Volvo 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

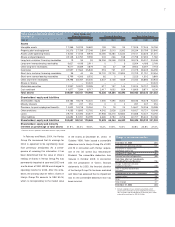

Net sales per market Trucks

SEKM 2001 2002 2003

Western Europe 60,841 61,406 63,097

Eastern Europe 5,526 6,424 7,004

North America 33,630 33,721 28,151

South America 3,993 3,277 3,464

Asia 4,659 5,919 9,206

Other markets 7,919 8,005 6,047

Total 116,568 118,752 116,969

Number of trucks produced Trucks

2001 2002 2003

Volvo

Volvo FH 28,920 31,880 33,720

Volvo VN and VHD 112,860 14,300 17,080

Volvo FM9, 10, and 12 14,580 15,300 17,480

Volvo FL 6,690 5,640 4,820

Volvo NL and NH 2,400 1,490 1,940

Volvo VM – – 400

Total 65,450 68,610 75,440

Mack

Mack CH 7,298 7,540 1,744

Mack CL 984 288 64

Mack Vision 2,122 2,523 4,811

Mack Granite 1,099 4,592 6,217

Mack DM 703 528 458

Mack DMM 111 47 —

Mack LE 1,393 1,084 964

Mack MR 3,015 1,668 2,034

Mack RB 488 103 130

Mack RD6 4,532 2,298 921

Mack RD8 86 35 54

Other – – 1,122

Total 21,831 20,706 18,519

Renault

Renault Mascott 11,528 11,446 9,797

Renault Kerax 7,967 7,677 6,674

Renault Midlum 12,764 12,545 12,801

Renault Premium 17,918 16,150 15,567

Renault Magnum 7,027 7,848 7,516

SISU – – 45

Total 57,204 55,666 52,400

1Includes other truck models produced in the United States.

segments for both vocational trucks and eco-

nomic haul trucks. Mack has been able to

retain its leadership position in its core seg-

ments of construction and refuse.

In Brazil, Volvo’s market share declined to

24.6% (31.0).

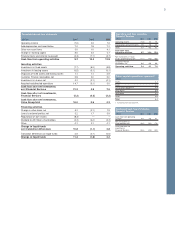

Financial performance

Net sales of Volvo’s truck operations

amounted to SEK 116,969 M in 2003.

Adjusted for currency effects, sales in-

creased by 5% compared with 2002.

Operating income in 2003 amounted to

SEK 3,951 M (1,189). The improvement

across the three truck brands, Mack, Renault

and Volvo, is largely related to increased

margins due to cost rationalization. The

strong customer values in the new Volvo

range, increased market shares and

increased efficiency has contributed to the

improved earnings in 2003. These positive

effects were partly offset by negative curren-

cy effects and higher costs for research and

development. Earnings improved in North

America, where profitability developed favor-

ably for both Volvo and Mack despite

adverse market conditions. In Europe, Volvo

Trucks’ strong performance continued and

both Renault Trucks and Volvo Trucks report-

ed improved earnings.

Production and investments

Production of trucks in 2003 amounted to

75,440 Volvo trucks (68,610), 52,400

Renault trucks (55,666) and 18,519 Mack

trucks (20,706).

On June 9, Volvo Trucks signed a joint

venture agreement with China National

Heavy Truck Corporation, CNHTC, for pro-

duction of trucks. Production will start during

the first quarter of 2004 in CNHTC’s prem-

ises in Jinan, in the Shandong Province. The

initial capacity will be 2,000 trucks per year.

Volvo’s product range in China will comprise

the Volvo FL, Volvo FM9 and Volvo FM12.

The ambition is to increase volumes to

10,000 trucks per year by 2010 with a high

level of local integration.

The transfer of production of Mack high-

way trucks from Winnsboro to New River

Valley was completed on May 1, 2003.

On July 11, all conditions for Volvo’s

acquisition of Bilia’s trucks and construction

equipment operations, Kommersiella Fordon

Europa AB (KFAB), were met. KFAB is a

leading service supplier and dealer of Volvo

trucks and construction equipment, with

operations in the Nordic countries and in

several other countries in Europe. The acqui-

sition of the strong KFAB dealerships and

workshop network will significantly strength-

en Volvo Trucks’ European distribution system.

Ambitions for 2004

The ambition in 2004 is to continue the

development of the distribution networks in

Europe and North America, including the

integration of the acquired former Bilia dis-

tribution network in Europe. In 2004, the

unique brand identities and product ranges

of the three strong brand names Volvo,

Renault and Mack will be developed further.