Volvo 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Board of Directors’ report

Corporate registration number 556012-5790.

In 2003, the truck and construction equipment operations of Bilia

were acquired through the exchange of Volvo’s 41% holding in Bilia

for 98% of the shares in the acquired operations, Kommersiella

Fordon Europa AB.

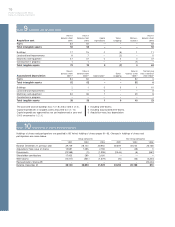

Income from investments in Group companies includes dividends

in the amount of 4,368 (770; 24,814), write-down of shares of

1,579 (531; 12,217) and transfer pricing adjustments and group

contributions delivered totaling 406 (3,835; 3,450). Income from

other shares and participations includes a write-down of shares in

Scania AB and Henlys Group Plc amounting to 3,901 and 429

respectively as well as a dividend from Scania AB of 501 (319; 637).

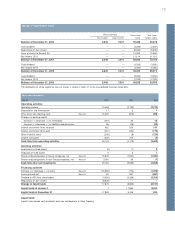

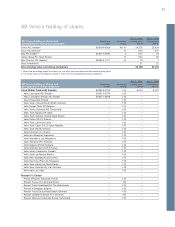

The carrying value of shares and participations in Group companies

amounted to 41,329 (38,950; 38,140), of which 40,060 (38,537;

37,725) pertained to shares in wholly owned subsidiaries. The corre-

sponding shareholders’ equity in the subsidiaries (including equity in

untaxed reserves but excluding minority interests) amounted to

51,395 (49,657; 39,752).

Shares and participations in non-Group companies included 1

(628; 659) in associated companies that are reported in accordance

with the equity method in the consolidated accounts. The portion of

shareholders’ equity in associated companies accruing to AB Volvo

totaled 98 (861; 844). Shares and participations in non-Group com-

panies included listed shares in Deutz AG, Henlys Group Plc and

Bilia AB with a carrying value of 790. The market value of these

holdings amounted to 339 at year-end. Based upon information pub-

lished by Henlys Group in February and March 2004, it was deter-

mined that Volvo’s holding in Henlys Group Plc was permanently

impaired at December 31, 2003. A write-down of 429 was charged

to income for the year, after which the carrying value of Volvo’s

shares in Henlys Group Plc amounted to 95, corresponding to the

market value of these shares at year-end 2003. No write-down has

been made of the holding in Deutz since the fair value of the invest-

ment is considered to be higher than the quoted market price of this

investment.

At year-end 2003, shares in Scania AB with a carrying value of

20,424 was accounted for among current assets, and a write-down

of 3,901 was charged to income. The carrying value of the holding of

Scania B shares was determined based upon the consideration

received when Volvo divested those shares to Deutsche Bank on

March 4, 2004. The carrying value of the holding of Scania A shares

was determined based upon the closing share price of SEK 202 on

December 31, 2003. In March, 2004, AB Volvo’s Board of Directors

proposed that the Annual General Meeting approve a dividend to AB

Volvo’s shareholders of 99% of the shares in Ainax AB, a wholly

owned subsidiary, which at the time of the distribution would hold

Volvo’s entire holding of Scania A shares. Further information regard-

ing the holding in Scania is provided in Note 10.

Financial net debt amounted to 3,606 (assets 3,281; assets

12,207).

AB Volvo’s risk capital (shareholders’ equity plus untaxed

reserves) amounted to 62,296 corresponding to 89% of total assets.

The comparable figure at year-end 2002 was 85%.

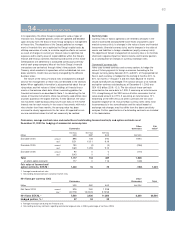

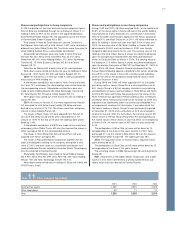

Income statements

SEK M 2001 2002 2003

Net sales 500 441 458

Cost of sales (500) (441) (458)

Gross income ———

Administrative expenses Note 1 (424) (560) (498)

Other operating income and expenses 0 16 52

Income from investments in Group companies Note 2 9,599 (3,599) 1,812

Income from investments in associated companies Note 3 22 54 283

Income from other investments Note 4 1,258 326 (3,822)

Operating income (loss) 10,455 (3,763) (2,173)

Interest income and similar credits Note 5 455 503 139

Interest expenses and similar charges Note 5 (467) (261) (196)

Other financial income and expenses Note 6 (163) (34) (117)

Income (loss) after financial items 10,280 (3,555) (2,347)

Allocations Note 7 2—0

Income taxes Note 8 832 1,070 158

Net income (loss) 11,114 (2,485) (2,189)

Parent Company