Volvo 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

estate companies in Sweden, Norway,

Finland, Germany and France that are being

reported through Danafjord. The occupancy

rate at the end of the year was 99.8% (99.9),

and 61% (59) of the total leasing was for

tenants outside the Volvo Group. 76% (77)

of the leases run for five years or more.

Volume and assets

The total volume of new retail financing in

2003 amounted to SEK 26.8 billion, which

was SEK 0.5 billion higher than 2002. For

the year, Volvo Trucks accounted for 54%

(51) of the volume, Construction Equipment

for 17% (16), Renault Trucks for 15% (13),

Buses for 5% (9) and Mack Trucks for 8%

(9). The remaining 1% (2%) is mainly related

to Volvo Aero and Volvo Penta.

In the markets where financial services are

offered, the average penetration during the

year was 33% for Volvo Trucks, 33% for

Construction Equipment, 17% for Buses,

15% for Renault Trucks and 12% for Mack

Trucks. Expressed as an average, Volvo

Financial Services financed 24% of the

Group’s products sold in the markets where

financing is offered, an increase of 5 per-

centage points from 2002.

To t al assets as of December 31, 2003

amounted to SEK 67 billion (69), of which

SEK 60 billion (61) was in the net credit

portfolio. Adjusted for the effects of foreign

exchange movements, the credit portfolio

grew by 7% during the year, compared with

a growth of 8% during 2002. The credit port-

folio consists of 54% Volvo Trucks, 16%

Construction Equipment, 10% Buses, 12%

Renault Trucks and 6% Mack Trucks. The

remaining 2% is mainly related to Volvo Aero

and Volvo Penta. From a currency perspec-

tive, 39% of the portfolio was denominated

in EUR, 33% in USD, 12% in GBP and 5%

CAD. The remaining 11% is a mix of other

European and Latin American currencies.

Financial performance

Year-end operating income amounted to

SEK 926 M (490). Return on equity was

9.8% (4.8) with a year-end equity ratio of

12.0% (10.8).

Write-offs in 2003 totaled SEK 848 M

resulting in an annualized write-off ratio for

the year of 1.37% (1.39). Total credit

reserves amounted to SEK 1.3 billion at the

end of December, and the credit reserve

ratio at year-end was 2.14%.

During 2003, VFS built on its foundation

of controlled growth and improved profitabil-

ity. Emphasis on prudent underwriting and

competitive pricing has led to a more stable

portfolio. Delinquencies are trending down-

ward and were at their lowest level in nearly

three years. Furthermore, the 2003 expenses

and operational efficiency statistics demon-

strate VFS was successful in streamlining

daily operations.

Ambitions for 2004

A stabilizing global economy, rebound in

capital spending and a comprehensive line-

up of new Volvo Group products should

serve as a catalyst for improved asset growth

and quality. As competition increases, VFS

will look to protect its share of the market

while maintaining return goals.

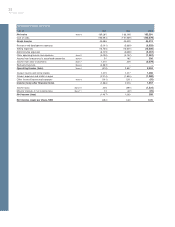

Condensed income statement

SEKM 2001 2002 2003

Net sales 9,495 9,925 9,153

Income after

financial items 325 490 926

Income taxes 10 (134) (170)

Net income 335 356 756

Distribution of credit portfolio, net

%2001 2002 2003

Operational leasing 23 22 22

Financial leasing 27 25 26

Installment contracts 36 37 37

Dealer financing 14 16 13

Other customer credits 0 0 2

Operational excellence initiatives will be

pursued aggressively in 2004 to further

improve efficiency and ability to care for cus-

tomers. VFS also needs to continue

strengthening the processes at both the

front and back-ends of the operations. The

approach will be conservative when moving

into emergin markets. A close watch on the

capital markets is essential so that financial

risks can be managed.

With the know-how of its 1,000 employ-

ees, VFS has the ambition to become a

benchmark in the finance industry. In the

meantime, VFS is on the path of reaching

another of its goals, becoming a solid and

dependable contributor to the Volvo

Group’s earnings.