Volvo 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

The Volvo Group year 2003

The Volvo Share

Shareholders

Due to the increase in international cross-

border trading of shares, Volvo has concen-

trated the trading of Volvo shares to the

stock exchanges in Stockholm, London and

New York (NASDAQ). In the fourth quarter of

2003, Volvo decided to apply for delisting of

its shares from the German stock exchanges

in Frankfurt, Hamburg and Düsseldorf. The

delisting is planned to be effective in the

latter part of 2004.

The dialogue with shareholders is of great

importance to Volvo. In addition to the

Annual General Meeting in April, a large

number of activities took place in 2003

aimed at the professional investment

community and Volvo’s private shareholders.

The Investors website on the Internet

(www.volvo.com) is an important tool that

makes it possible for all shareholders to

obtain relevant and timely information about

Volvo. In 2003, a new subscription service

was launched at the website, that enables all

shareholders to receive tailor-made informa-

tion from Volvo.

The Volvo share in 2003

The year 2003 was characterized by recov-

ering share prices on stock markets world-

wide. In the US, the Dow Jones Industrial

Average rose by 25% and NASDAQ

Composite closed 50% higher. In Sweden,

the Stockholmsbörsen All Share Index

increased by 30%.

At the end of 2003 Volvo’s market value

amounted to SEK 91 billion, seventh in size

on Stockholmsbörsen. The Volvo Series B

share rose by 55% in 2003, compared with

an increase of 27% on the MSCI Europe

Machinery Index. In 2003, the effective return

on the Volvo B share was 61%. Income per

share amounted to SEK 0.70 (3.30). Exclu-

ding write-down of shares, income per share

more than tripled to SEK 10.30 in 2003.

A total of 436 million Volvo shares were

traded on Stockholmsbörsen, which accounts

for the largest percentage of turnover, with

an average of 1.8 million Volvo shares traded

each day. During 2003, Volvo was the

eleventh most actively traded share in terms

of value on Stockholmsbörsen.

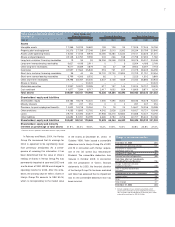

99 00 01 03

12.4 11.2 3.1 10.3

Net income* and cash dividend per share

Net income*,

SEK per share

Dividend,

SEK per share

7.0 8.0 8.0 8.0

02

3.3

8.0

99 00 01 03

3.2 5.1 4.5 3.6

02

5.6

Direct return*, %

* Dividend as percentage

of share price

*excluding divested

operations, restruc-

turing costs and

write-down of

shares.

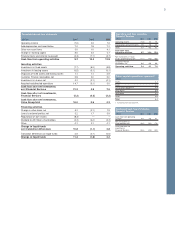

Ownership, categories*, %

Non-Swedish owners, (52)

Savings funds, (10)

Private share-

holdings, (12)

Pension funds and insur-

ance companies (14)

Others, (12)

Ownership by country*, %

Sweden, (48.0)

France, (20.3)

US, (17.3)

UK, (6.0)

Switzerland, (2.2)

Others, (6.2)

* of capital, registered shares

* of capital, registered shares