Volvo 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

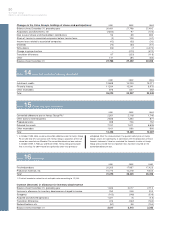

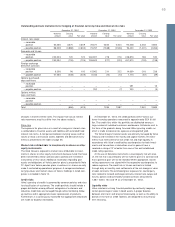

Note 28 Cash flow

Other items not affecting cash pertain to risk provisions and losses

related to doubtful receivables and customer-financing receivables

1,079 (1,306; 1,541), deficit in the Swedish pension fund – (807; –),

capital gains on the sale of subsidiaries and other business units 85

(–; 829), write-down of shares in Scania AB and Henlys Group Plc

amounting to 4,030 (–; –) and other negative 95 (negative 158;

negative 173).

Net investments in customer-financing receivables resulted in

2003 in a negative cash flow of SEK 4.3 billion (5.7; 3.7). In this

respect, liquid funds were reduced by SEK 15.6 billion (14.9; 16.6)

pertaining to new investments in financial leasing contracts and

installment contracts.

Investments in shares and participations, net in 2003 and in 2002

amounted to SEK 0.1 billion. Divestments of shares and participa-

tions, net in 2001 amounted to SEK 3.9 billion, mainly related to the

sale of Volvo’s holding in Mitsubishi Motors Corporation.

Acquired and divested subsidiaries and other business units, net

in 2003 amounted to SEK 0.0 billion and in 2002 to a negative

SEK 0.1 billion. Acquired and divested subsidiaries and other business

units, net in 2001 amounted to SEK 13.0 billion mainly pertained to

the final payment of SEK 12.1 billion from the sale of Volvo Cars,

divestment of the insurance operation in Volvia and acquired liquid

funds within Mack and Renault V.I.

During 2003, 2002 and 2001 net installments of loans to exter-

nal parties contributed SEK 0.9 billion, SEK 1.7 billion and SEK 0.2

billion, respectively to liquid funds.

The change during the year in bonds and other loans increased

liquid funds by SEK 1.9 billion (decrease 0.1; increase 6.2). New

borrowing during the year, mainly the issue of bond loans and a

commercial paper program, provided SEK 25.4 billion (33.1; 31.4).

Amortization during the year amounted to SEK 23.5 billion (33.2; 25.2).

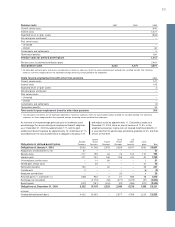

Note 27 Contingent liabilities

2001 2002 2003

Credit guarantees

– issued for associated companies 67 219 154

– issued for customers and others 5,557 3,337 3,508

Tax claims 1,151 982 1,098

Other contingent liabilities 3,666 4,796 4,851

Total 10,441 9,334 9,611

The reported amounts for contingent liabilities reflect the Volvo

Group’s risk exposure on a gross basis. The reported amounts have

thus not been reduced because of counter guarantees received or

other collaterals in cases where a legal offsetting right does not

exist. At December 31, 2003, the estimated value of counter guaran-

tees received and other collaterals, for example the estimated net

selling price of used products, amounted to 5,149.

Recourse obligations pertain to receivables that have been trans-

ferred, less reduction for recognized credit risks. Tax claims pertain to

charges against the Volvo Group for which provisions are not consid-

ered necessary.

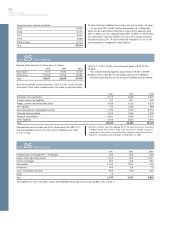

Legal proceedings

In March 1999, an FH 12 Volvo truck was involved in a fire in the

Mont Blanc tunnel. The tunnel suffered considerable damage from

the fire, which continued for 50 hours. 39 people lost their lives in

the fire, and 34 vehicles were trapped in the tunnel. It is still unclear

what caused the fire. The Mont Blanc tunnel was re-opened for

traffic in 2002. An expert group was appointed by the Commercial

Court in Nanterre, France, to investigate the cause of the fire and

the losses it caused. At present, it is not possible to anticipate the

result of this on-going investigation or the result of other French

legal actions in progress regarding the fire. The investigating magis-

trate appointed to investigate potential criminal liability for the fire

issued its final order and all parties previously placed under investi-

gation, including Volvo Truck Corporation, have been sent to trial for

unintentional manslaughter. It is expected that the trial will take place

in 2005.

A claim was filed with the Commercial Court in Nanterre by the

insurance company employed by the French tunnel operating com-

pany against certain Volvo Group companies and the trailor manu-

facturer in which compensation for the losses claimed to have been

incurred by the tunnel operating company was demanded. The

claimant requested that the Court postpone its decision until the

expert group has submitted its report. The Court of Nanterre has

since then declined jurisdiction in favour of the civil Court of Bonne-

ville before which several other claims had been filed in connection

with this matter. As a result, the Court of Bonneville is likely ultimately

to rule on all civil liability claims filed in France against Volvo Group

companies in connection with the Mont-Blanc tunnel fire. Volvo

Group companies are also involved in proceedings regarding this

matter before courts in Aosta, Italy and Brussels, Belgium. Volvo is

unable to determine the ultimate outcome of the litigation referred to

above.

AB Volvo and Renault SA have a dispute regarding the final value

of acquired assets and liabilities in Renault V.I. and Mack. This

process could result in an adjustment in the value of the transfer.

Any such adjustment will affect the amount of acquired liquid funds

and Volvo’s reported goodwill amount. The outcome of this dispute

cannot be determined with certainty. However, Volvo believes that

the outcome will not lead to an increase in goodwill.

Volvo is involved in a number of other legal proceedings incidental

to the normal conduct of its businesses. Volvo does not believe that

any liabilities related to such proceedings are likely to be, in the

aggregate, material to the financial condition of the Group.