Volvo 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

The Volvo Group year 2003

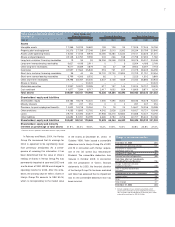

Net sales by market area

SEKM 2001 2002 2003 %1

Western Europe 93,147 92,331 95,775 4

Eastern Europe 6,383 7,437 8,344 12

North America 54,630 50,206 42,043 (16)

South America 6,018 4,667 4,727 1

Asia 10,862 12,644 15,754 25

Other markets 9,575 9,795 8,125 (17)

Volvo Group 180,615 177,080 174,768 (1)

1 Percentage change pertains to 2003/ 2002.

Net sales by business area

SEKM 2001 2002 2003 %1

Trucks 116,568 118,752 116,969 (2)

Buses 16,675 14,035 11,978 (15)

Construction

Equipment 21,135 21,012 23,154 10

Volvo Penta 7,380 7,669 7,596 (1)

Volvo Aero 11,784 8,837 8,030 (9)

Other 7,073 6,775 7,041 4

Volvo Group2180,615 177,080 174,768 (1)

1 Percentage change pertains to 2003/ 2002.

2 Adjusted for changes in currency rates, net sales increased

by 6%

Operating margin 1

%2001 2002 2003

Trucks 0.9 1.0 3.4

Buses (3.1) (0.7) (3.0)

Construction Equipment 4.2 1.9 3.9

Volvo Penta 8.9 8.4 9.1

Volvo Aero 5.5 0.1 (0.5)

Volvo Group11.8 1.6 3.7

Volvo Group (0.4) 1.6 1.4

1Excluding restructuring costs and write-down of shares in

Scania AB and Henlys Group Plc.

Operating income (loss) by business area

SEKM 2001 2002 2003

Trucks 1,040 1,189 3,951

Buses (524) (94) (361)

Construction

Equipment 891 406 908

Volvo Penta 658 647 695

Volvo Aero 653 5 (44)

Financial Services 325 490 926

Other 143 194 459

Operating income13,186 2,837 6,534

Restructuring costs (3,862) – –

Write-down of shares – – (4,030)

Operating income

(loss) (676) 2,837 2,504

1 Excluding restructuring costs and write-down of shares in

Scania AB and Henlys Group Plc.

Financial

performance

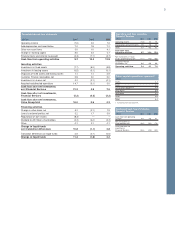

Net sales

Net sales in 2003 amounted to SEK

174,768 M (177,080), a decrease of 1%

compared with the preceding year. Adjusted

for changes in currency exchange rates, net

sales increased by 6%.

Net sales of Volvo’s truck operations

amounted to SEK 116,969 M, an increase of

5% adjusted for changes in currency

exchange rates. The increase in sales related

mainly to higher deliveries in Asia and

Eastern Europe. In North America, deliveries

of trucks were down by 5% and in Western

Europe the Volvo Group's deliveries of trucks

were 4% lower than in the preceding year.

In Buses, net sales decreased 15% com-

pared with 2002. The decline was partly

attributable to currency movements. Ad-

justed for these effects, net sales decreased

8%, pertaining mainly to lower deliveries in

North and South America, partially offset by

favorable volumes in China and the Nordic

countries. In an increasing world market, net

sales of Construction Equipment rose 18%,

adjusted for changes in currency rates, driv-

en by a wider product range and improved

market shares. In Volvo Penta, a weakening

total market was compensated by increased

market shares, and net sales increased by

8%, excluding the impact of currency trans-

lation. Volvo Aero’s net sales rose by 4%,

adjusted for changes in currency rates,

despite the crisis in the airline industry.

The Group’s net sales in Western Europe

increased by 4%. Net sales in North America

were down 16% due to lower USD

exchange rates and lower deliveries of Mack

trucks. Sales in Eastern Europe and Asia

grew by 12% and 25% respectively while

sales in South America increased 1%. The

distribution of net sales by market is further

specified in the adjoining table.

Operating income

Operating income, excluding write-down of

shares, more than doubled in 2003 and

amounted to SEK 6,534 M, compared with

an operating income of SEK 2,837 M in the

preceding year. The improvement was main-

ly attributable to higher margins on newly

introduced products and cost rationalization.

A detailed analysis of changes in the Group's

operating income compared with 2002 is

shown in the table on page 5.

Trucks’ operating income in 2003 amount-

ed to SEK 3,951 M (1,189). The improve-

ment across the three truck brands, Mack,

Renault and Volvo, is largely related to

increased margins due to price realization

and cost rationalization. Earnings improved

in North America, where profitability devel-

oped favorably for both Volvo and Mack

despite adverse market conditions. In

Europe, Volvo Trucks’ strong performance

continued and both Renault Trucks and Volvo

Trucks reported improved earnings.

The operating loss during 2003 in Buses,

excluding write-down of shares, amounted to

SEK 361 M compared with a loss of SEK 94

M in the preceding year. The weaker result

was largely related to lower volumes, contin-

ued price pressure and currency effects.

Construction Equipment reported operating

income of SEK 908 M compared with SEK

406 M in 2002. The improved earnings were

primarily related to increased volumes due to

recently launched products and further

improved market shares partly offset by

strongly negative currency effects.

Operating income in 2003 for Volvo Penta

amounted to SEK 695 M (647). The strong

financial performance of Volvo Penta mainly

related to higher sales and improved gross

margins. In Volvo Aero, operating income