Volvo 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

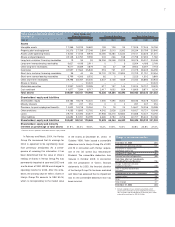

200320022001

0

50

100

150

200

250

Volvo B

Affärsvärldens Generalindex

MSCI-Europe - Machinery Index

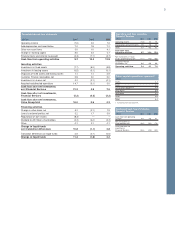

lenders. The financial ratios are set to meet

long-term A-rated requirements, and the tar-

geted levels were met at year-end 2003.

Volvo held meetings with rating agencies

during the past year to review operations and

to discuss their views of the company.

Moody's Investors Service confirmed the

long-term A3 rating and short term at P-2.

Standard & Poor's confirmed the short-term

rating at A2. To utilize local funding opportu-

nities, and to meet with legal requirements,

Volvo is rated nationally in Canada and Japan

at A-level and short-term in Australia and

Sweden.

Dow Jones Sustainability Index

As of 2002, the Volvo share is part of the

newly launched Dow Jones STOXX

Sustainability Indexes. Launched in 1999,

the Dow Jones Sustainability World Index is

the first global index tracking the perform-

ance of the leading sustainability-driven com-

panies worldwide. It covers the top 10% of

the largest 2,500 companies in the Dow

Jones Global Index in terms of economic,

environmental and social criteria.

Dividend

Volvo’s dividend policy states that the effec-

tive return (the dividend combined with the

change in share price over the long term)

should exceed the average for the industry.

For fiscal year 2003, the Board of Directors

proposes that the shareholders at the Annual

General Meeting approve a cash dividend of

SEK 8.00 per share, a total of approximately

SEK 3,556 M, corresponding to a direct

return of 3.6%, calculated at the year-end

rate of SEK 220. In addition, the Board pro-

poses to distribute 99% of the shares in the

wholly owned company, Ainax to the share-

holders. The value of the Ainax shares corre-

sponds to SEK 14.40 per Volvo share, based

on the Scania A closing price of SEK 223.50

at March 12, 2004.

Credit rating

Volvo’s capital structure aims at balancing the

expectations of the stock market and the

financial market. Volvo annually meets with

credit rating agencies to discuss the views of

the lenders and to evaluate the capability to

repay loans at maturity. The group aims to be

a stable long-term A-rated company to attract

The largest shareholders in

AB Volvo, December 31, 20031

Share capital, % 2

Renault SA 20.0

Franklin Templeton funds 5.9

Capital Group funds 2.6

Robur aktiefonder (savings funds) 2.5

SHB 1.8

1Following the repurchase of its own shares, AB Volvo held 5%

of the Company’s shares on Dec. 31, 2003.

2 Based on all registered shares.

Share capital, December 31, 2003

Registered number of shares 1441,520,885

of which, Series A shares 2138,604,945

of which, Series B shares 3302,915,940

Par value, SEK 6

Share capital, SEK M 2,649

Number of shareholders 208,540

Private persons 199,488

Legal entities 9,052

1Following the repurchase of the Group’s own shares, the num-

ber of outstanding shares was 419,444,842.

2Series A shares carry one vote each.

3Series B shares carry one tenth of a vote each.

Price Trend, Volvo series B shares SEK

See further on page 90 for more detailed

information.