Volvo 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

The Volvo Group

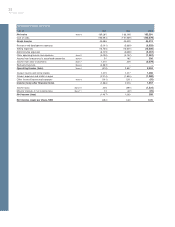

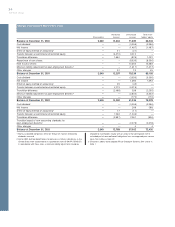

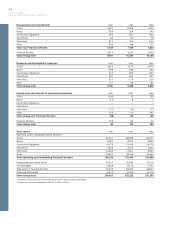

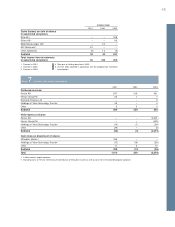

Notes to consolidated financial statements

Disclosure and Presentation, which conforms to a large extent with

IAS 32 issued by the IASC. The adoption of RR 27 has affected the

balance sheet presentation of certain derivative instruments that are

used to manage financial risks related to financial assets and liabil-

ities. In accordance with RR 27, derivative instruments with unreal-

ized gains are to be presented as assets and derivative instruments

with unrealized losses are to be presented as liabilities. In accord-

ance with Volvo’s earlier accounting principles, derivative instruments

used for management of financial assets were reported as assets

and derivative instruments used for management of financial liabilities

were reported as liabilities. As a consquence of adoption of the pres-

entation principles in RR 27, the Volvo Group’s assets at December

31, 2003, increased by SEK 3.6 billion and the Group’s liabilities

increased by the corresponding amount. In accordance with the tran-

sition rules of RR 27, no restatement has been made of figures for

prior years.

As of 2003, Volvo has also adopted RR 22 Presentation of

Financial Statements, RR 24 Investment Property, RR 25 Segment

Reporting — Sectors and Geographical Areas, RR 26 Events after

the Balance Sheet Date and RR 28 Government Grants. Certain

changes have been made in the structure and content of the finan-

cial information in this annual report as a result of these new stan-

dards. However, the standards listed above have not resulted in any

changes of the measurement of the Group’s financial performance

or position.

Future changes of accounting principles

Effective in 2005 Volvo will adopt International Financial Reporting

Standards (IFRS) in its financial reporting. The transition from

Swedish GAAP to IFRS is being made to implement a regulation

applicable to all listed companies within the European Union as of

2005. Because revised IFRS’s are expected to be issued during

2004, the total effect of this change of accounting principles cannot

be determined with certainty. Volvo considers, however, that the most

significant effects will pertain to the accounting for financial instru-

ments and goodwill. Restatement of figures for prior years will be

made in accordance with the requirements of the transition rules.

During 2003 Volvo has started a number of projects aimed at adapt-

ing the internal reporting routines to the new regulation. More

detailed information about the IFRS transition effects will be

presented in connection with the publication of the 2004 financial

reports.

Consolidated financial statements

The consolidated financial statements comprise the Parent Company,

subsidiaries, joint ventures and associated companies. Subsidiaries

are defined as companies in which Volvo holds more than 50% of

the voting rights or in which Volvo otherwise has a controlling influ-

ence. However, subsidiaries in which Volvo’s holding is temporary are

not consolidated. Joint ventures are companies over which Volvo has

joint control together with one or more external parties. Associated

companies are companies in which Volvo has a significant influence,

which is normally when Volvo’s holding equals to at least 20% but

less than 50% of the voting rights.

The consolidated financial statement have been prepared in

General information

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the two preceding years; the first figure is for 2002

and the second for 2001.

Note 1Accounting principles

The consolidated financial statements for AB Volvo (the Parent

Company) and its subsidiaries have been prepared in accordance

with generally accepted accounting principles in Sweden (Swedish

GAAP). Accounting standards and interpretations issued by the

Swedish Financial Accounting Standards Council have thereby been

applied. Swedish GAAP differs in significant respects from US

GAAP, see further in Note 35.

In the preparation of these financial statements, the company

management has made certain estimates and assumptions that

affect the value of assets and liabilities as well as contingent liabilities

at the balance sheet date. Reported amounts for income and

expenses in the reporting period are also affected. The actual future

outcome of certain transactions may differ from the estimated out-

come when these financial statements were issued. Any such differ-

ences will affect the financial statements for future fiscal periods.

Changes of accounting principles in 2003

RR 29 Employee benefits

As of 2003, Volvo has adopted RR 29 Employee Benefits in its

financial reporting. RR 29 Employee Benefits, which was issued by

the Swedish Financial Accounting Standards Council in December

2002, conforms in all significant respects with IAS 19 Employee

Benefits issued earlier by the International Accounting Standards

Committee (IASC). By applying RR 29, defined-benefit pension plans

and health-care benefit plans in all the Group’s subsidiaries are

accounted for by use of consistent principles. In Volvo’s financial

reporting up to 2002, such plans have been accounted for by apply-

ing the local rules and directives in each country. In accordance with

the transition rules of the new standard, a transitional liability was

established as at January 1, 2003, determined in accordance with

RR 29. This transitional liability exceeded the liability recognized as

per December 31, 2002, in accordance with earlier principles by

approximately SEK 2.3 billion. The excess liability consequently was

recognized as at January 1, 2003, as an increase in provisions for

pensions and other post-employment benefits and a corresponding

decrease in shareholders’ equity. No additional deferred tax asset

was recognized in the Group’s balance sheet as at January 1, 2003,

attributable to the transition liability. In accordance with the transition

rules of the new standard, Volvo has not restated figures for earlier

years in accordance with the new accounting standard. Because the

Group’s subsidiaries up to 2002 have been applying local rules in

each country, the impact of adopting RR 29 as of 2003 differs for

different countries of operations. Compared with earlier accounting

principles in Sweden, the adoption of RR 29 has mainly had the

effect that plan assets invested in Volvo’s Swedish pension founda-

tion as from 2003 are accounted for at a long-term expected return

instead of being revalued each closing date to fair value. For Volvo’s

subsidiaries in the US, differences relate to accounting for past serv-

ice costs and the fact that RR 29 does not include rules about mini-

mum liability adjustments.

RR 27 Financial instruments: Disclosure and presentation

Effective in 2003, Volvo has adopted RR 27 Financial Instruments: