Volvo 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

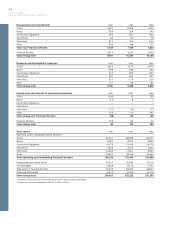

The market values of Volvo’s holdings of shares and participations in

listed companies as of December 31, 2003 are shown in the table

below. When the carrying value of an investment exceeds its market

value, it has been assessed that the fair value of the investment is

higher than the quoted market price of this investment.

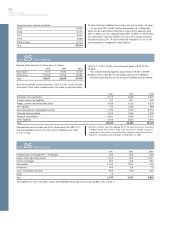

Carrying value Market value

Scania AB 20,424 18,459

Deutz AG 670 190

Henlys Group Plc 95 95

Bilia AB 28 54

Total holdings

in listed companies 21,217 18,798

Holdings in non-

listed companies 989 –

Total shares and

participations 22,206

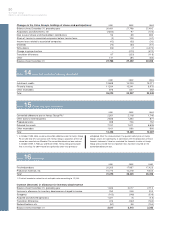

Scania AB

During 1999 and 2000, Volvo acquired 45.5% of the capital and

30.6% of the voting rights in Scania AB, one of the world’s leading

manufacturers of trucks and buses. As a concession in connection

with the European Commission’s approval of Volvo’s acquisition of

Renault V.I. and Mack Trucks Inc. in 2001, Volvo undertook to divest

its holding in Scania not later than April, 2004. At year-end 2003,

the carrying value of Volvo’s holding in Scania AB was determined to

SEK 20.4 billion, and a write-down of SEK 3.6 billion was thereby

charged to operating income for the year. The carrying value of the

holding of the 63.8 million Scania B shares was determined based

upon the consideration received when Volvo divested those shares

to Deutsche Bank on March 4, 2004. The carrying value of the hold-

ing of 27.3 million Scania A shares was determined based upon the

closing share price of SEK 202 on December 31, 2003. In March,

2004, AB Volvo’s Board of Directors proposed that the Annual

General Meeting approve a dividend to AB Volvo’s shareholders of

99% of the shares in Ainax AB, a wholly owned subsidiary, which at

the time of the distribution would hold Volvo’s entire holding of

Scania A shares.

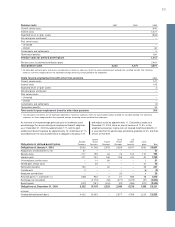

Henlys Group Plc

During 1998 and 1999, Volvo acquired 9.9% of the capital and vot-

ing rights in Henlys Group Plc at a total acquisition cost of 524.

Henlys Group is a british company involved in manufacturing and

distribution of buses and bus bodies in Great Britain and North

America. Volvo and Henlys Group jointly own the shares of the North

American bus operations Prévost and Nova Bus. In February and

March 2004, Henlys announced that its earnings for 2004 was

expected to be significantly lower than previously anticipated. As a

consequence of receiving this information, it was determined that

Volvo’s holding in Henlys Group Plc was permanently impaired at

December 31, 2003, and a write-down of 429 was charged to

income for the year. After this write-down, the carrying value of

Volvo’s shares in Henlys Group amounted to 95, corresponding to

the market value of these shares at year-end 2003. In the beginning

of March 2004, the market value of Volvo’s shares amounted to 24.

Bilia AB

In 2003, Volvo exchanged 41% of the shares in Bilia for 98% of the

shares in Kommersiella Fordon Europa AB. The capital gain was 188.

Effero AB

In 2003, Volvo divested its entire holding in Effero with a capital gain

of 59.

Shanghai Sunwin Bus Corp

As of 2003, Shanghai Sunwin Bus is reported in the Volvo Group

according to the proportionate method of consolidation.

Xian Silver Bus Corp

As of 2003, Xian Silver Bus is reported in the Volvo Group according

to the proportionate method of consolidation.

Eddo Restauranger AB

In 2002, Volvo divested its entire holding in Eddo with a capital gain

of 32.

Mitsubishi Motors Corporation (MMC)

In 2001, Volvo divested its holding and all rights and obligations

relating to MMC, which resulted in a capital gain of 574, net of ter-

mination costs of 194.

AB Volvofinans

In 2001, Volvo divested its entire holding in Volvofinans for a total

purchase price of 871 and with a capital gain of 61.

Arrow Truck Sales

In 2001, Volvo increased its holding to 100% and Arrow thereby

became a subsidiary of Volvo.

SM Motors Pte Ltd

In 2001, Volvo divested its entire holding in SM Motors with a capital

loss of 13.

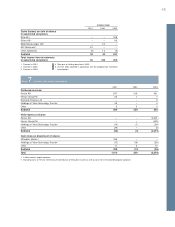

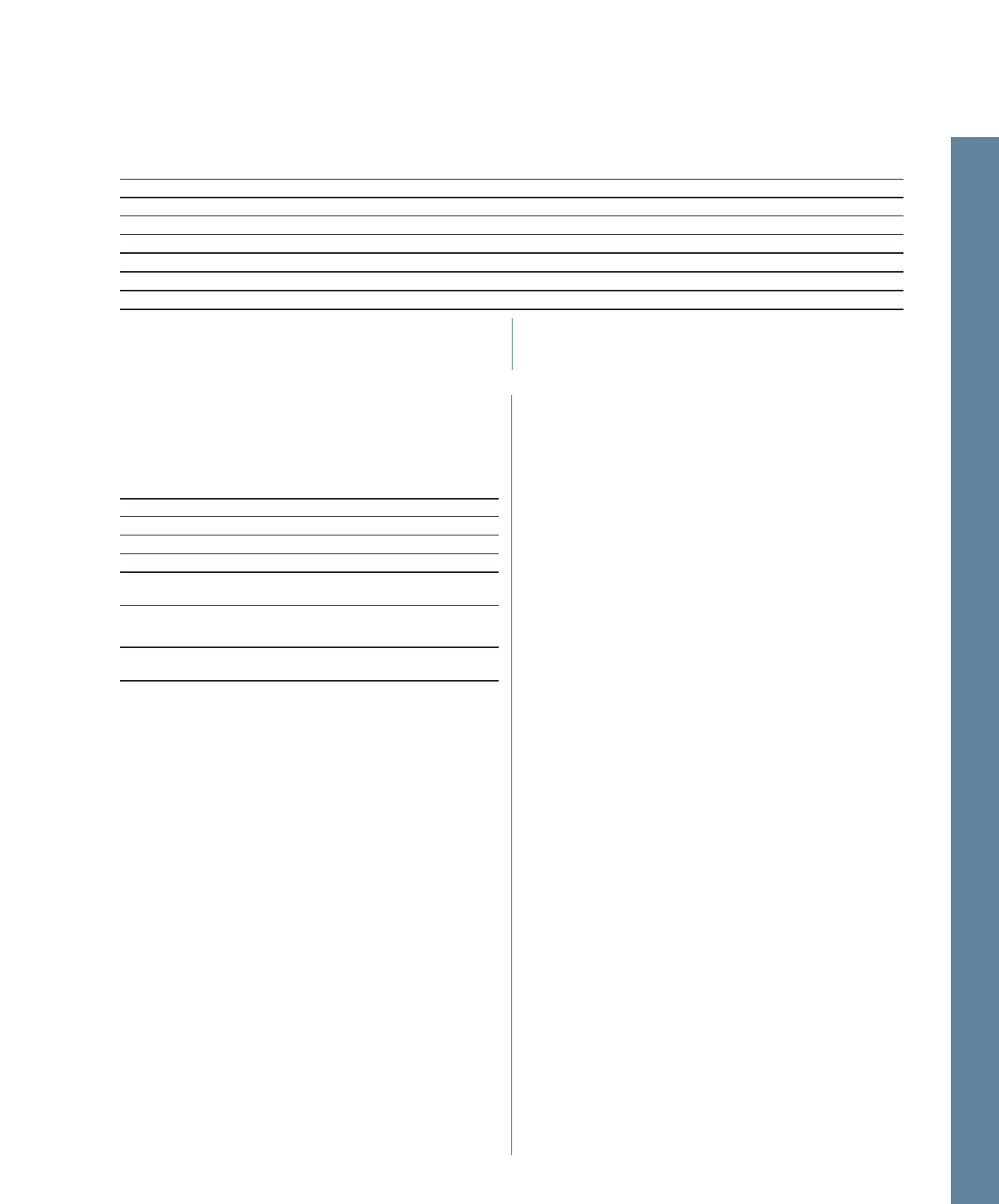

Dec 31, 2002 Dec 31, 2003

Registration Percentage Carrying value Carrying value

Shares and participations in other companies number holding 1SEK M 2SEK M 2

Scania AB, Sweden 556184-8564 46/ 31 24,026 20,424

Deutz AG, Germany – 11 670 670

Henlys Group Plc, Great Britain – 10 524 95

Bilia AB, Sweden 556112-5690 2 – 28

Other holdings 615 626

Total shares and participations in other companies 25,835 21,843

Carrying value in accordance with Group balance sheet 27,492 22,206

1Where two percentage figures are shown, the first refers to share capital

and the second to voting rights.

2 Associated companies are reported in accordance with the equity method.

Other companies are reported at cost.

3From 2003 reported according to the proportionate method of consolidation.

4Volvo’s share of shareholders’ equity in associated companies (incl. equity in

untaxed reserves) amounted to 363 (1,629; 1,951). Excess values amount-

ed to 0 (28; 16).