Volvo 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP

FINANCIAL REPORT

2003

The Volvo Group’s positive

trend continued in 2003 and

earnings, excluding write-down of

shares, more than

doubled. The improved

performance from the truck

operations in North America, a

strong earnings trend in Volvo

CE and another impressive result

from Volvo Penta contributed

to the improved

earnings. Cash flow

improved sharply. Income per

share increased to

SEK 10.30, excluding write-down

of shares.

Table of contents

-

Page 1

...GROUP FINANCIAL REPORT 2003 The Volvo Group's positive trend continued in 2003 and earnings, excluding write-down of shares, more than doubled. The improved performance from the truck operations in North America, a strong earnings trend in Volvo CE and another impressive result from Volvo Penta... -

Page 2

... 30 The year 2003 The Volvo share Financial performance Financial position Cash-flow statement Financial targets Trucks Buses Construction Equipment Volvo Penta Volvo Aero Financial Services Managing Values Corporate governance Group Management Board of Directors and Auditors Financial Information... -

Page 3

... exchange of the predominant part of Volvo's holding in Bilia for 98% of the shares in the acquired operations, Kommersiella Fordon Europa AB (KFAB). KFAB is a leading service supplier and reseller of Volvo trucks and construction equipment in Europe. Volvo Aero is partner in General Electric's new... -

Page 4

... in 2003 The year 2003 was characterized by recovering share prices on stock markets worldwide. In the US, the Dow Jones Industrial Average rose by 25% and NASDAQ Composite closed 50% higher. In Sweden, the Stockholmsbörsen All Share Index increased by 30%. At the end of 2003 Volvo's market value... -

Page 5

... long term) should exceed the average for the industry. For fiscal year 2003, the Board of Directors proposes that the shareholders at the Annual General Meeting approve a cash dividend of SEK 8.00 per share, a total of approximately SEK 3,556 M, corresponding to a direct return of 3.6%, calculated... -

Page 6

... increased by 4%. Net sales in North America were down 16% due to lower USD exchange rates and lower deliveries of Mack trucks. Sales in Eastern Europe and Asia grew by 12% and 25% respectively while sales in South America increased 1%. The Trucks Buses Construction Equipment Volvo Penta Volvo Aero... -

Page 7

... affected by provisions of SEK 807 M relating to a deficit within the Volvo Group's Swedish pension foundation. Operating margin during 2003, excluding write-down of shares, was 3.7%, compared with 1.6% in 2002. Impact of exchange rates on operating income The effect of changes in currency... -

Page 8

...was mainly explained by lower yield on financial assets and higher average net financial debt during 2003, in part due to higher provisions for post-employment benefits and the acquisition of Bilia's truck and construction equipment operations, KFAB. Financial position Balance sheet The Volvo Group... -

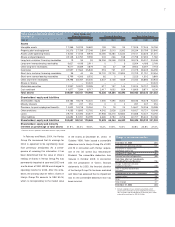

Page 9

... sheets, December 31 SEK M Volvo Group, excl Financial Services 1 2001 2002 Financial Services 2001 2002 Total Volvo Group 2001 2002 2003 2003 2003 Assets Intangible assets Property, plant and equipment Assets under operating leases Shares and participations Long-term customer-financing... -

Page 10

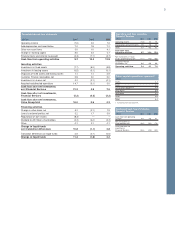

8 The Volvo Group year 2003 Self-financing ratio, excluding Financial Services, % Cash-flow statement Cash flow Cash flow after net investments, excluding Financial Services, amounted to SEK 7.5 billion. Operating cash flow (excluding the billion and in Volvo Aero at SEK 0.3 billion, decreased in... -

Page 11

... 1 SEK bn Trucks Buses Construction Equipment Volvo Penta Volvo Aero Other 4.7 0.2 0.9 0.0 0.1 0.5 6.4 Cash flow after net investments excl Financial Services Cash flow after net investments, Financial Services Cash flow after net investments, Volvo Group total Financing activities Change in... -

Page 12

... ratio for Financial Services was 12.0%. 0 * Excluding divested operations ers, Volvo has set a number of Group-wide 99 6.4 00 01 02 03 financial targets covering growth, operating margin, return on equity and capital structure. These financial targets are set and evaluated over a business cycle... -

Page 13

... and new forms of financing. The three truck brands - Mack, Renault and Volvo - have highly competitive products and worldwide market coverage. Total deliveries from the Group's truck operations amounted to 155,989 trucks in 2003, a decline of 1% compared with the year-earlier period. In Europe, 92... -

Page 14

... for the new Volvo VN. Mack's share of the market fell to 10.4% (12.9) in 2003, an effect of a general decline in the The total market for heavy trucks in Western Europe was unchanged during 2003, compared with the preceding year. The markets Western Europe North America in Germany and in the UK... -

Page 15

.... Operating income in 2003 amounted to SEK 3,951 M (1,189). The improvement across the three truck brands, Mack, Renault and Volvo, is largely related to increased margins due to cost rationalization. The strong customer values in the new Volvo range, increased market shares and increased efficiency... -

Page 16

... bus market is the second largest in Europe and the cooperation with Renault Trucks gives Volvo Buses access to an extensive dealer network for repair, service and spare parts. 0 224 440 (524) (94) (361) *excluding restructuring costs and write-down of shares Operating Margin*, % Total market... -

Page 17

...Net sales per market SEK M 2001 2002 Buses 2003 Western Europe Eastern Europe North America South America Asia Other markets 6,263 373 6,847 757 1,839 596 6,695 409 3,838 366 2,022 705 6,153 381 2,984 329 1,447 684 Total 16,675 14,035 11,978 Production and investments During the year Volvo... -

Page 18

...areas the market shares were higher compared with a year earlier, mainly due to recently launched products equipped with new fuel-efficient and environmentally friendly Volvo engines. The market in Europe continued to be the largest single market, with 53% of sales, while North America accounted for... -

Page 19

...machines a year. In addition, the dealer network expanded and in the beginning of 2004, there were 19 dealer partners supporting Volvo CE in China. Net sales per market Construction Equipment SEK M 2001 2002 2003 Western Europe Eastern Europe North America South America Asia Other markets 10,326... -

Page 20

...leisure boats and commercial boats Total market The world market for marine and industrial engines was relativeley stable during 2003, although the situation varied considerably in different parts of the world. The demand in Europe has been relatively strong, while the total demand in North America... -

Page 21

... Volvo Penta's single largest market for industrial engines. Production and investments All of Volvo Penta's production facilities - the diesel engine factories in Vara, Sweden, and in Wuxi, China, and the gasoline engine factory in Lexington, Tennessee, USA - were operated at full capacity in 2003... -

Page 22

... provides aftermarket services for gasturbine engines and systems. The company's operations are based on close cooperation with partners and on selective specialization. In 2003, overhaul 0 Business environment Aircraft deliveries decreased in 2003 for the second consecutive year and the production... -

Page 23

... Volvo Aero will deliver a number of key components for the new environmentally friendly gas turbine. The total value of the contracts is expected to be USD 800 M over a 20-year period. Net sales per market SEK M 2001 Volvo Aero 2002 2003 Western Europe Eastern Europe North America South America... -

Page 24

...499 490 Return on shareholders´equity, % 99 00 01 02 03 financing services. For much of the year, VFS concentrated on developing new business opportunities with creditworthy customers. These relation- 12.0 14.1 4.2 4.8 9.8 Market penetration Volvo Trucks, % ships and good margins are key... -

Page 25

... the year was 33% for Volvo Trucks, 33% for Construction Equipment, 17% for Buses, 15% for Renault Trucks and 12% for Mack Trucks. Expressed as an average, Volvo Financial Services financed 24% of the Group's products sold in the markets where financing is offered, an increase of 5 percentage points... -

Page 26

... agenda for the entire Volvo Group, and objectives for the coming tree-year period were developed. Fuel efficiency is the main interest of all our customers, with its direct link to the operating costs of the business. Improved total fuel efficiency is also the most rewarding way to decrease carbon... -

Page 27

... sources. The development of the second generation heavy duty DME vehicle technology has continued successfully and a prototype truck will be presented by Volvo during 2004. The focused environmental agenda defines far-reaching objectives for energy efficiency also in the production processes. The... -

Page 28

... of new operations, and matters related to investments in product renewal and product development in the Group's business areas. Nomination Committee In April 2003, the Annual General Meeting resolved to authorize the Board Chairman to appoint a Nomination Committee comprising three members from... -

Page 29

... and it is proposed to the Annual General Meeting that it is replaced by a share-based program. The employment contracts of the Group Executive Committee and certain other senior executives contain provisions for severance payments, equal to the employee's monthly salary for a period of 12-24... -

Page 30

28 Group Management Group Management Leif Johansson M ichel Gigou Staffan Jufors Stefan Johnsson Lennart Jeansson Paul Vik ner Fred Bodin Per Löjdquist Jorm a Halonen Håk an Karlsson Salvatore L M auro Eva Persson ... -

Page 31

...Science in Accounting. President of Volvo Financial Services since 2001. President of Volvo Car Finance Europe 1999-2001. Member of Group Executive Committee since 2001. With Volvo since 1985. Holdings: 1,003 American Depositary Receipts (ADRs) of AB Volvo and 25,000 employee stock options. HÃ¥k an... -

Page 32

... Born 1951, Master of Engineering. President of AB Volvo and Chief Executive Officer of the Volvo Group. Member of Volvo Board since 1997. Holdings: 36,724 Volvo shares, including 30,000 Series B shares. 13,866 call options and 63,600 employee stock options. Board m em bers designated by em ployee... -

Page 33

31 Secretary to the Board Eva Persson Born 1953. Master of Laws. Senior Vice President of AB Volvo and General Counsel of the Volvo Group. Secretary to Volvo Board since 1997. Holdings: 418 Volvo shares, including 200 Series B shares. 2,323 call options and 31,800 employee stock options. A uditors... -

Page 34

... Volvo Group Consolidated income statements SEK M 2001 Note 4 2002 2003 Net sales Cost of sales 189...development expenses Selling expenses Administrative expenses Other operating income and expenses Income from investments in associated companies Income from other investments Restructuring costs... -

Page 35

...2003 Assets Non-current assets Intangible assets Tangible assets Property, plant and equipment Assets under operating leases Financial assets Shares and participations Long-term customer-financing receivables Other long-term receivables Total non-current assets Current assets Inventories Short-term... -

Page 36

...Total shareholders' equity Balance at December 31, 2000 Cash dividend Net income Effect of equity method of accounting 1 Transfer between unrestricted and restricted equity Translation difference Repurchase of own shares New issue of shares Minimum liability adjustment for post-employment benefits... -

Page 37

...Cash flow from operating activities Investing activities Investments in fixed assets Investments in leasing assets Disposals of fixed assets and leasing assets Customer-financing receivables, net Shares and participations, net Acquired and divested subsidiaries and other business units, net Note 28... -

Page 38

... mainly had the effect that plan assets invested in Volvo's Swedish pension foundation as from 2003 are accounted for at a long-term expected return instead of being revalued each closing date to fair value. For Volvo's subsidiaries in the US, differences relate to accounting for past service costs... -

Page 39

... Interest-rate contracts and forward exchange rate contracts are used to change the underlying financial asset and debt structure and are reported as hedges against such assets and debts. Interest-rate contracts used as part of the management of the Group's short-term investments are valued together... -

Page 40

... to Renault Trucks, Mack Trucks, Volvo Construction Equipment, Champion Road Machinery, Volvo Aero Services, Prévost, Nova BUS, Volvo Bus de Mexico, Volvo Construction Equipment Korea, Volvo Aero Norge and Kommersiella Fordon Europa are being amortized over 20 years due to the holdings' longterm... -

Page 41

... the acquired operations, the L.B. Smith distribution business has not been consolidated in the Volvo Group's financial statements during 2003. Acrivia AB (former OmniNova Technology AB) In April 2001, Volvo Buses acquired 65% of Acrivia AB, an engineering company that develops production processes... -

Page 42

...' income statements Net sales Restructuring costs Operating income Income after financial items Total shareholders' equity and liabilities 2002 2003 3,026 2,266 1,882 2001 1,047 (348) (261) (272) 2,724 - 74 10 1,832 - 51 19 At the end of 2003 no guarantees were issued for the benefit of... -

Page 43

... such as dealers, the truck brands are reported as one business segment. Reporting by business segment The Volvo Group's operations are organized in eight business areas: Volvo Trucks, Renault Trucks, Mack Trucks, Buses, Construction Equipment, Volvo Penta, Volvo Aero and Financial Services. In... -

Page 44

... companies Trucks Buses Construction Equipment Volvo Penta Volvo Aero Other 5,391 2001 5,869 2002 6,829 2003 (130) (11) - - (72) 125 15 8 - - (70) 173 (55) 1 - - (77) 297 Volvo Group excl Financial Services Financial Services (88) 138 126 56 166 34 Volvo Group total Total assets Operating... -

Page 45

...384 161 525 362 262 528 Volvo Group excl Financial Services Financial Services 8,364 5,775 6,776 5,461 6,222 5,459 Volvo Group total Reporting by geographical segment Net sales Europe North America South America Asia Other markets 14,139 12,237 11,681 2001 2002 2003 104,500 57,724 6,469... -

Page 46

... 2003 2001 Dividends received 2002 2003 Petro Stopping Centers Holding LP Aviation Lease Finance Other companies (73) 24 (79) (57) 51 77 (73) 30 15 - - 8 - - 20 - - - Holdings no longer reported as equity method investments Bilia AB 4 Turbec AB 3 Xian Silver Bus Corp 5 Shanghai Sunwin Bus... -

Page 47

...200 4 Main part of holding divested in 2003. 5 As from 2003 reported in accordance with the proportionate method of consolidation. Note 7 Income from other investments 2001 2002 2003 Dividends received Scania AB Henlys Group Plc Diamond Finance, Ltd Holdings of Volvo Technology Transfer 1 Other... -

Page 48

... of Mack Trucks and Renault Trucks in order to secure coordination gains made possible through the acquisition. The integration measures included reduction of the North American production capacity through a decision to close Mack's Winnsboro plant and transfer of production to Volvo's New River... -

Page 49

... in shareholders' equity consisted mainly of the minority interests in Volvo Aero Norge AS (22%) and in Volvo Aero Services LP (5%). The Henlys Group's holding (49%) in Prévost Holding BV was reported as minority inter- Note 12 Intangible and tangible assets Value in balance sheet 2001 Value in... -

Page 50

...31, 2003 Carrying value SEK M 2 Group holdings of shares and participations in non-Group companies Shares in associated companies, equity method of accounting Aviation Lease Finance USA Blue Chip Jet H B, Sweden Arbustum Invest AB, Sweden Merakvim Metal Works Ltd, Israel Euromation AB, Sweden Petro... -

Page 51

... Deutsche Bank on March 4, 2004. The carrying value of the holding of 27.3 million Scania A shares was determined based upon the closing share price of SEK 202 on December 31, 2003. In March, 2004, AB Volvo's Board of Directors proposed that the Annual General Meeting approve a dividend to AB Volvo... -

Page 52

...financial statements Changes in the Volvo Group's holdings of shares and participations: Balance sheet, December 31, preceding year Acquisitions and divestments, net New issue of shares and shareholders' contributions Share of income in associated companies, before income taxes Income taxes related... -

Page 53

...1,079 932 Note 19 Marketable securities Marketable securities consist mainly of interest-bearing securities, distributed as shown below: 2001 2002 2003 Government securities Banks and financial institutions Corporate institutions Real estate financial institutions Other Total 1,399 436 3,968... -

Page 54

...par value was 2,649 and is based on 441,520,885 registered shares. The average number of outstanding shares was 419,444,842 in 2003. Note 22 Provisions for post-employment benefits Assumptions applied for actuarial calculations Sweden Discount rate Expected return on plan assets 1 Expected salary... -

Page 55

... average remaining service period of the employees. Costs for post-employment benefits other than pensions Current service costs Interest costs Expected return on plan assets Actuarial gains and losses 1 Past service costs - Unvested - Vested Curtailments and settlements Termination benefits 2003... -

Page 56

... The Volvo Group Notes to consolidated financial statements Fair value of plan assets in funded plans Plan assets at January 1, 2003 Acquisitions and divestments, net Actual return on plan assets Employer contributions Employee contributions Exchange rate translation Benefits paid Sweden Pensions... -

Page 57

..., 2003. Volvo hedges foreign-exchange and interest-rate risks using derivative instruments. See Note 34. 2001 2002 The listing below shows the Group's non-current liabilities in which the largest loans are distributed by currency. Most are issued by Volvo Treasury AB and Volvo Group Finance Europe... -

Page 58

...of long-term loans, 2001 2002 2003 Advances from customers Current income tax liabilities Wages, salaries and withholding taxes VAT liabilities Accrued expenses and prepaid income 1 Deferred leasing income Residual value liability Other liabilities Total Secured bank loans at year-end 2003 amounted... -

Page 59

...to new investments in financial leasing contracts and installment contracts. Investments in shares and participations, net in 2003 and in 2002 amounted to SEK 0.1 billion. Divestments of shares and participations, net in 2001 amounted to SEK 3.9 billion, mainly related to the sale of Volvo's holding... -

Page 60

... sales were mainly from Renault Trucks to Renault S.A. and consisted of components and spare parts. The purchases were mainly made by Renault Trucks from Renault S.A. and consisted mainly of light trucks. On May 2 2003, Volvo CE North America acquired assets associated with the distribution business... -

Page 61

...70% of his pensionable salary. For the period after reaching the age of 65 he will receive a pension amounting to 50% of his pensionable salary. The pensionable salary is the sum of 12 times the current monthly salary, Volvo's internal value for company car, and a five-year rolling annual average of... -

Page 62

... in part in relation to how large part of the vesting period the holder has been employed. If the holder retires during the vesting period, he or she may exercise the full number of options. New stock-based incentive program The Board of Directors has proposed to the Annual General Meeting to... -

Page 63

... Europe Eastern Europe North America South America Asia Other countries Group total 72,031 15 70,546 16 73,156 2003 16 Board members and chief officers AB Volvo Board members Presidents and other senior executives Number at year-end of which women, % 13 15 15 7 Volvo Group Board members... -

Page 64

62 The Volvo Group Notes to consolidated financial statements Wages, salaries and other remunerations, SEK M AB Volvo Sweden 2001 Board and Presidents1 of which variable salaries Other employees Board and Presidents1 2002 of which variable salaries Other employees Board and Presidents1 2003 of ... -

Page 65

... fair values of Volvo's holdings of financial instruments at the balance sheet date. Volvo's accounting policies for financial instruments are described in Note 1. In calculating the fair values of financial instruments, Volvo has primarily used official rates or prices quoted on the capital markets... -

Page 66

..., 2003, the average interest rate on liquid funds was 3.3%. Volvo's interest bearing liabilities, apart from loans designated to funding of the customer financing portfolio, consisted on the same date mainly of provisions for post-employment benefits and loans. Of such loans outstanding at year-end... -

Page 67

... Volvo's pension plans, investments in shares are only made if motivated by operational purposes. A comparison between carrying values and market values of Volvo's holdings in listed companies is included in Note 13. Credit risks Volvo's granting of credits is governed by common policies and rules... -

Page 68

... securities (C) Restructuring costs (D) Post-employment benefits (E) Alecta surplus funds (F) Software development (G) Product development (H) Entrance fees, aircraft engine programs (I) Other (J) Income taxes on above US GAAP adjustments (K) Net increase (decrease) in net income 2001 2002 2003... -

Page 69

...and equity securities (C) Restructuring costs (D) Post-employment benefits (E) Alecta surplus funds (F) Software development (G) Product development (H) Entrance fees, aircraft engine programs (I) Other (J) Income taxes on above US GAAP adjustments (K) Net increase (decrease) in shareholders' equity... -

Page 70

... Group Notes to consolidated financial statements Net income Shareholders' equity 2003 2001 2002 2003 Goodwill Goodwill in accordance with Swedish GAAP Items affecting reporting of goodwill: Acquisition of Renault V.I. and Mack Trucks Inc. Acquisition of Volvo Construction Equipment Corporation... -

Page 71

... for Post-retirement Benefits Other than Pensions". The differences between Volvo's accounting principles and US GAAP pertain to different transition dates, recognition of past service costs and minimum liability adjustments. 2001 2002 2003 Net periodical costs for post-employment benefits Net... -

Page 72

... costs, leasing, stock option plans and guarantees. In accordance with US GAAP, interest expense incurred in connection with the financing of the construction of property and other qualifying assets is capitalized and amortized over the useful life of the related assets. In Volvo's consolidated... -

Page 73

... Parent Company Corporate registration number 556012-5790. Board of Directors' report In 2003, the truck and construction equipment operations of Bilia were acquired through the exchange of Volvo's 41% holding in Bilia for 98% of the shares in the acquired operations, Kommersiella Fordon Europa AB... -

Page 74

... in Group companies Other shares and participations Other long-term receivables Total non-current assets Current assets Short-term receivables from Group companies Other short-term receivables Shares in Scania AB Short-term investments in Group companies Cash and bank accounts Total current assets... -

Page 75

73 Changes in Shareholders' equity Restricted equity Share capital Legal reserves Unrestricted equity Total shareholders' equity Balance at December 31, 2000 Cash dividend Repurchase of own shares Issue of shares to Renault SA Net income 2001 2,649 - - - - 7,241 - - - - 52,486 (3,356) (8,336... -

Page 76

...with a statement issued by a special committee of the Swedish Financial Accounting Standards Council. Group contributions are reported among Income from investments in Group companies. As of 2003, the Volvo Group has adopted "RR 29 Employee Benefits" in its financial reporting. The parent company is... -

Page 77

... expenses include exchange rate differences on loans, guarantee commissions from subsidiaries, unrealized gains (losses) pertaining to a hedge for a program of employee stock options, costs for confirmed credit facilities as well as costs of having Note 7 Allocations 2001 2002 2003 Allocation to... -

Page 78

76 Parent Company AB Volvo Notes to financial statements Note 9 Intangible and tangible assets Value in balance sheet 2001 Value in balance sheet 2002 Capital expenditures Sales/ scrapping Reclassifications Value in balance sheet 2003 Acquisition cost Rights 52 52 - - - 52 Total ... -

Page 79

... The shares in Mack Trucks Inc were acquired from Renault V.I. for 3,225 and newly issued shares were subscribed for in the amount of 1,490. At the end of the year the holdings were written down by 1,490. A shareholder contribution of 8,678 was made to the newly formed company Volvo Global Trucks AB... -

Page 80

.... AB Volvo's pension costs in 2003 amounted to 85 (168; 93). The accumulated benefit obligation of all AB Volvo's pension obligations at year-end 2003 amounted to 804, which has been secured in part through provisions for pensions and in part through funds in pension foundations. Net asset value in... -

Page 81

... (815) 288 Shares and participations in Group companies, net Investments Disposals Net investments in shares and participations in Group companies Renault V.I. was transferred Group-internal 2001 for 10,700. Proceeds received from the sale of Volvo Personvagnar Holding AB resulted in a positive... -

Page 82

... sixth month. Volvo's accounting policies for financial instruments are described in Note 1 and Note 34 to the consolidated financial statements. Hedging transactions in AB Volvo are carried out through Volvo Treasury AB. In 2003, the Parent Company has used interest-rate Outstanding derivative... -

Page 83

... market value of the holdings is shown in Note 13 to the consolidated financial statements. 26,168 21,237 Dec 31, 2002 Dec 31, 2003 Carrying value, SEK M AB Volvo's holding of shares and participations in Group companies Volvo Global Trucks AB, Sweden Volvo Volvo Volvo Volvo Volvo Volvo Volvo... -

Page 84

...CV, Mexico Trucks Australia Pty Ltd., Australia Volvo Bussar AB, Sweden Säffle Karosseri AB, Sweden Acrivia AB, Sweden Carrus Oy, Finland Volvo Busse Deutschland GmbH, Germany Prévost Holding BV, Canada 2 Shanghai Sunwin Bus Co, China 2 XIAN Silver Bus Co, China 2 Volvo Construction Equipment NV... -

Page 85

...Group Finance Europe BV, The Netherlands Volvo Construction Equipment Korea Co Ltd, South Korea Volvo Financial Services AB, Sweden Kommersiella Fordon Europa AB, Sweden Volvo China Investment Co Ltd, China Volvo Truck & Bus Ltd, Great Britain 1 Volvo Holding Mexico, Mexico Volvo Technology Transfer... -

Page 86

... to restricted equity. AB Volvo Retained earnings Net income 2003 Total SEK M 53,067 (2,189) 50.878 The Board of Directors and the President propose that the above sum be disposed of as follows: SEK M To the shareholders, a dividend of SEK 8.00 per share To the shareholders, a dividend of 27... -

Page 87

... the general meeting of shareholders that the income statements and balance sheets of the Parent Company and the Group be adopted, that the profit of the Parent Company be dealt with in accordance with the proposal in the Board of Directors' Report, and that the members of the Board of Directors and... -

Page 88

... 1 In 1995 write-down of goodwill pertaining to Volvo Construction Equipment. Consolidated income statements with Financial Services reported in accordance with the equity method SEK M 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Net sales Cost of sales 109,978 154,668 166,541 150,425... -

Page 89

...for post employment benefits 6,139 Shareholders' equity ...balance sheets excluding Financial Services 1 SEK M 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Intangible assets Property, plant and equipment Assets under operating leases Shares and participations Inventories Customer financing... -

Page 90

... Financial items and income tax Cash flow from operating activities Investments in fixed assets Investments in leasing assets Disposals of fixed assets and leasing assets Customer financing receivables, net Shares and participations, net Acquired and divested subsidiaries and other business units... -

Page 91

... from 1997 Financial Services is accounted by the equity method. 3 As of 1999, Volvo's cash-flow statement is presented in accordance with the Swedish Financial Accounting Standards Council's recommendation, Reporting of Cash Flow, RR 7. Values in prior years are adjusted in accordance with the new... -

Page 92

... of shares. 6 Dividend divided by income per share. 7 Shareholders' equity divided by number of shares outstanding at year-end. 8 Plus one share of Swedish Match per Volvo share, price of SEK 21.74 (weighted average first ten trading days following listing). 9 Proposed by the Board of Directors. In... -

Page 93

... in the Volvo Group as of July 1995. Net sales for the Construction Equipment business area in the years 1993 through 1995, calculated using the average exchange rate for the US dollar in each year, amounted to 9,665,12,084 and 13,684. Effective in 1997, the Volvo Group's accounting per market area... -

Page 94

...M relating to excess value in Volvo Trucks, which was estimated to arise in connection with exchange of shares with Renault. 10 Refers to Volvo Trucks for 1993-2000. Operating margin % 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Trucks Buses Construction Equipment Volvo Penta Volvo Aero... -

Page 95

... per market area reflects geographical definitions based on an ISO standard. The accounting for the years 1993-1996 has been adjusted to conform with the new principle. Environmental performance of Volvo production plants Absolute values related to net sales 1999 2000 2001 2002 2003 Energy... -

Page 96

... leases. Investments in fixed assets included in the Group's cash flow statement include only capital expenditures that have reduced the Group's liquid funds during the year. Equity ratio Shareholders' equity divided by total assets. Income per share Net income divided by the weighted average number... -

Page 97

...as members of the Board of Directors and as auditors. The Committee also proposes the amount of the fees to be paid to the holders of these positions. Publication dates Volvo Annual Report 2003 Form 20-F US GAAP 2003 Three months ended March 31, 2004 Six months ended June 30, 2004 Nine months ended... -

Page 98

AB Volvo (publ) SE-405 08 Göteborg, Suède Téléphone + 46-31 66 00 00 www.volvo.com AB Volvo, Investor Relations, 635 2804