Tyson Foods 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

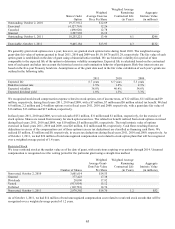

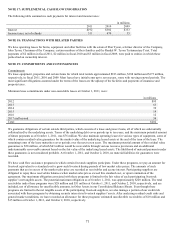

Additionally, we enter into future purchase commitments for various items, such as grains, livestock contracts and fixed grower fees.

At October 1, 2011, these commitments totaled:

in millions

2012

$886

2013

63

2014

18

2015

16

2016

15

2017 and beyond

61

Total

$1,059

Contingencies

We are involved in various claims and legal proceedings. We routinely assess the likelihood of adverse judgments or outcomes to

those matters, as well as ranges of probable losses, to the extent losses are reasonably estimable. We record accruals for such matters

to the extent that we conclude a loss is probable and the financial impact, should an adverse outcome occur, is reasonably estimable.

Such accruals are reflected in the Company’s Consolidated Financial Statements. In our opinion, we have made appropriate and

adequate accruals for these matters and believe the probability of a material loss beyond the amounts accrued to be remote; however,

the ultimate liability for these matters is uncertain, and if accruals are not adequate, an adverse outcome could have a material effect

on the consolidated financial condition or results of operations. Listed below are certain claims made against the Company and/or our

subsidiaries for which the potential exposure is considered material to the Company’s Consolidated Financial Statements. We believe

we have substantial defenses to the claims made and intend to vigorously defend these matters.

Several private lawsuits are pending against us alleging that we failed to compensate poultry plant employees for all hours worked,

including overtime compensation, in violation of the Federal Labor Standards Act (FLSA). These lawsuits include DeAsencio v.

Tyson Foods, Inc. (DeAsencio), filed on August 22, 2000, in the U.S. District Court for the Eastern District of Pennsylvania. This

matter involves similar allegations that employees should be paid for the time it takes to engage in pre- and post-shift activities such as

changing into and out of protective and sanitary clothing, obtaining clothing and walking to and from the changing area, work areas

and break areas. They seek back wages, liquidated damages, pre- and post-judgment interest, and attorneys’ fees. Plaintiffs appealed a

jury verdict and final judgment entered in our favor on June 22, 2006, in the U.S. District Court for the Eastern District of

Pennsylvania. On September 7, 2007, the U.S. Court of Appeals for the Third Circuit reversed the jury verdict and remanded the case

to the District Court for further proceedings. We sought rehearing en banc, which was denied by the Court of Appeals on October 5,

2007. The United States Supreme Court denied our petition for a writ of certiorari on June 9, 2008. The new trial date has not been set.

The other private lawsuits referred to above are Sheila Ackles, et al. v. Tyson Foods, Inc. (N. Dist. Alabama, October 23, 2006);

McCluster, et al. v. Tyson Foods, Inc. (M. Dist. Georgia, December 11, 2006); Dobbins, et al. v. Tyson Chicken, Inc., et al. (N.D.

Alabama, December 21, 2006); Buchanan, et al. v. Tyson Chicken, Inc., et al. and Potter, et al. v. Tyson Chicken, Inc., et al. (N.D.

Alabama, December 22, 2006); Jones, et al. v. Tyson Foods, Inc., et al., Walton, et al. v. Tyson Foods, Inc., et al. and Williams, et al.

v. Tyson Foods, Inc., et al. (S.D. Mississippi, February 9, 2007); Balch, et al. v. Tyson Foods, Inc. (E.D. Oklahoma, March 1, 2007);

Adams, et al. v. Tyson Foods, Inc. (W.D. Arkansas, March 2, 2007); Atkins, et al. v. Tyson Foods, Inc. (M.D. Georgia, March 5,

2007); Laney, et al. v. Tyson Foods, Inc. and Williams, et al. v. Tyson Foods, Inc. (M.D. Georgia, May 23, 2007) (the Williams Case).

Similar to DeAsencio, each of these matters involves allegations that employees should be paid for the time it takes to engage in pre-

and post-shift activities such as changing into and out of protective and sanitary clothing, obtaining clothing and walking to and from

the changing area, work areas and break areas. The plaintiffs in each of these lawsuits seek or have sought to act as class

representatives on behalf of all current and former employees who were allegedly not paid for time worked and seek back wages,

liquidated damages, pre- and post-judgment interest, and attorneys’ fees. On April 6, 2007, we filed a motion for transfer of the above

named actions for coordinated pretrial proceedings before the Judicial Panel on Multidistrict Litigation, which was granted on

August 17, 2007. These cases and five other cases subsequently filed involving the same allegations (i.e., Armstrong, et al. v. Tyson

Foods, Inc. (W.D. Tennessee, January 30, 2008); Maldonado, et al. v. Tyson Foods, Inc. (E.D. Tennessee, January 31, 2008); White,

et al. v. Tyson Foods, Inc. (E.D. Texas, February 1, 2008); Meyer, et al. v. Tyson Foods, Inc. (W.D. Missouri, February 2, 2008); and

Leak, et al. v. Tyson Foods, Inc. (W.D. North Carolina, February 6, 2008)), were transferred to the U.S. District Court in the Middle

District of Georgia, In re: Tyson Foods, Inc., Fair Labor Standards Act Litigation (MDL Proceedings). On September 2, 2011, the

parties executed a settlement agreement and filed a joint motion with the court seeking its approval of the settlement. The court

approved the settlement on September 15, 2011, and Tyson will pay at least $12.25 million but no more than $17.5 million in back

pay and damages to eligible class members. The settlement agreement provides a process for identifying and certifying eligible class

members, which includes a 75-day notice period for certain class members to become eligible for payment under the settlement. In

addition, the settlement agreement provides that plaintiffs’ attorneys must file an application for fees with the court but that no more

than $14.5 million in attorneys’ fees and costs will be paid. Plaintiffs’ attorneys filed their fee application on October 11, 2011.