Tyson Foods 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

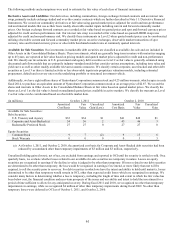

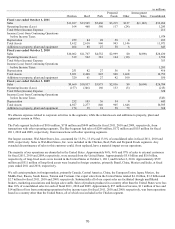

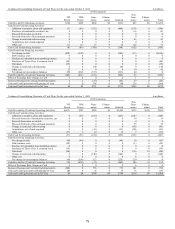

NOTE 17: SUPPLEMENTAL CASH FLOW INFORMATION

The following table summarizes cash payments for interest and income taxes:

in millions

2011

2010

2009

Interest

$192

$302

$333

Income taxes, net of refunds

311

470

35

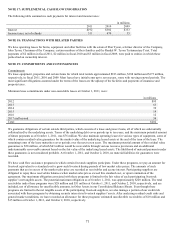

NOTE 18: TRANSACTIONS WITH RELATED PARTIES

We have operating leases for farms, equipment and other facilities with the estate of Don Tyson, a former director of the Company,

John Tyson, Chairman of the Company, certain members of their families and the Randal W. Tyson Testamentary Trust. Total

payments of $2 million in fiscal 2011, $2 million in fiscal 2010 and $3 million in fiscal 2009, were paid to entities in which these

parties had an ownership interest.

NOTE 19: COMMITMENTS AND CONTINGENCIES

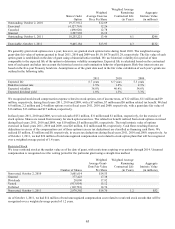

Commitments

We lease equipment, properties and certain farms for which total rentals approximated $183 million, $188 million and $175 million,

respectively, in fiscal 2011, 2010 and 2009. Most leases have initial terms up to seven years, some with varying renewal periods. The

most significant obligations assumed under the terms of the leases are the upkeep of the facilities and payments of insurance and

property taxes.

Minimum lease commitments under non-cancelable leases at October 1, 2011, were:

in millions

2012

$95

2013

63

2014

39

2015

19

2016

12

2017 and beyond

54

Total

$282

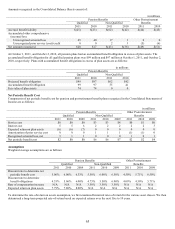

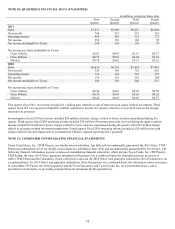

We guarantee obligations of certain outside third parties, which consists of a lease and grower loans, all of which are substantially

collateralized by the underlying assets. Terms of the underlying debt cover periods up to ten years, and the maximum potential amount

of future payments as of October 1, 2011, was $76 million. We also maintain operating leases for various types of equipment, some of

which contain residual value guarantees for the market value of the underlying leased assets at the end of the term of the lease. The

remaining terms of the lease maturities cover periods over the next seven years. The maximum potential amount of the residual value

guarantees is $50 million, of which $43 million would be recoverable through various recourse provisions and an additional

undeterminable recoverable amount based on the fair value of the underlying leased assets. The likelihood of material payments under

these guarantees is not considered probable. At October 1, 2011, and October 2, 2010, no material liabilities for guarantees were

recorded.

We have cash flow assistance programs in which certain livestock suppliers participate. Under these programs, we pay an amount for

livestock equivalent to a standard cost to grow such livestock during periods of low market sales prices. The amounts of such

payments that are in excess of the market sales price are recorded as receivables and accrue interest. Participating suppliers are

obligated to repay these receivables balances when market sales prices exceed this standard cost, or upon termination of the

agreement. Our maximum obligation associated with these programs is limited to the fair value of each participating livestock

supplier’s net tangible assets. The potential maximum obligation as of October 1, 2011, was approximately $220 million. The total

receivables under these programs were $28 million and $51 million at October 1, 2011, and October 2, 2010, respectively, and are

included, net of allowance for uncollectible amounts, in Other Assets in our Consolidated Balance Sheets. Even though these

programs are limited to the net tangible assets of the participating livestock suppliers, we also manage a portion of our credit risk

associated with these programs by obtaining security interests in livestock suppliers' assets. After analyzing residual credit risks and

general market conditions, we have recorded an allowance for these programs' estimated uncollectible receivables of $10 million and

$15 million at October 1, 2011, and October 2, 2010, respectively.