Tyson Foods 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

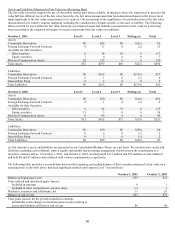

Deferred Compensation Assets: We maintain non-qualified deferred compensation plans for certain executives and other highly

compensated employees. Investments are maintained within a trust and include money market funds, mutual funds and life insurance

policies. The cash surrender value of the life insurance policies is invested primarily in mutual funds. The investments are recorded at

fair value based on quoted market prices and are included in Other Assets in the Consolidated Balance Sheets. We classify the

investments which have observable market prices in active markets in Level 1 as these are generally publicly-traded mutual funds. The

remaining deferred compensation assets are classified in Level 2, as fair value can be corroborated based on observable market data.

Realized and unrealized gains (losses) on deferred compensation are included in earnings.

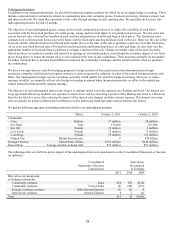

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

In addition to assets and liabilities that are recorded at fair value on a recurring basis, we record assets and liabilities at fair value on a

nonrecurring basis. Generally, assets are recorded at fair value on a nonrecurring basis as a result of impairment charges. During fiscal

2010, we recorded a $29 million charge to fully impair an immaterial Chicken segment reporting unit’s goodwill. We utilized a

discounted cash flow analysis that incorporated unobservable Level 3 inputs. We did not have any other significant measurements of

assets or liabilities at fair value on a nonrecurring basis subsequent to their initial recognition.

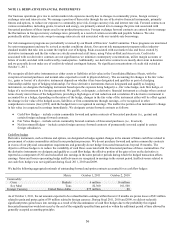

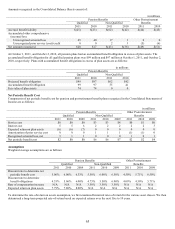

Other Financial Instruments

Fair values for debt are based on quoted market prices or published forward interest rate curves. Fair value and carrying value for our

debt were as follows (in millions):

October 1, 2011

October 2, 2010

Fair

Value

Carrying

Value

Fair

Value

Carrying

Value

Total Debt

$2,334

$2,182

$2,770

$2,536

For all of our other financial instruments, the estimated fair value approximated the carrying value at October 1, 2011, and October 2,

2010. The carrying value of our other financial instruments, not otherwise disclosed herein, included notes receivable, which

approximated fair value at October 1, 2011, and October 2, 2010. Notes receivable were recorded in Other Current Assets in the

Consolidated Balance Sheets and totaled $0 and $49 million at October 1, 2011, and October 2, 2010, respectively. The fair values

were determined using pricing models for which the assumptions utilize management’s estimates of market participant assumptions.

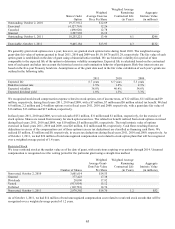

Concentrations of Credit Risk

Our financial instruments exposed to concentrations of credit risk consist primarily of cash and cash equivalents and accounts

receivable. Our cash equivalents are in high quality securities placed with major banks and financial institutions. Concentrations of

credit risk with respect to receivables are limited due to the large number of customers and their dispersion across geographic areas.

We perform periodic credit evaluations of our customers’ financial condition and generally do not require collateral. At October 1,

2011, and October 2, 2010, 16.5% and 15.3%, respectively, of our net accounts receivable balance was due from Wal-Mart Stores,

Inc. No other single customer or customer group represented greater than 10% of net accounts receivable.

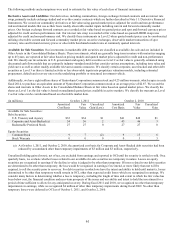

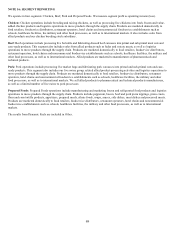

NOTE 13: STOCK-BASED COMPENSATION

We issue shares under our stock-based compensation plans by issuing Class A stock from treasury. The total number of shares

available for future grant under the Tyson Foods, Inc. 2000 Stock Incentive Plan (Incentive Plan) was 15,102,409 at October 1, 2011.

Stock Options

Shareholders approved the Incentive Plan in January 2001. The Incentive Plan is administered by the Compensation Committee of the

Board of Directors (Compensation Committee). The Incentive Plan includes provisions for granting incentive stock options for shares

of Class A stock at a price not less than the fair value at the date of grant. Nonqualified stock options may be granted at a price equal

to, less than or more than the fair value of Class A stock on the date the option is granted. Stock options under the Incentive Plan

generally become exercisable ratably over two to five years from the date of grant and must be exercised within 10 years from the date

of grant. Our policy is to recognize compensation expense on a straight-line basis over the requisite service period for the entire

award.