Tyson Foods 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Revolving Credit Facility

S&P’s corporate credit rating for Tyson Foods, Inc. is “BBB-.” Moody’s corporate credit rating for Tyson Foods, Inc. is “Ba1.” If

Moody’s were to upgrade our credit rating to “Baa2” or higher while our S&P credit rating remained at “BBB-”, or S&P were to

upgrade our credit rating to “BBB” or higher while Moody’s upgraded our credit rating to “Baa3” or higher, our letter of credit fees

would decrease by 0.25% and fees paid on the unused portion of the facility would decrease by 0.075%.

If S&P were to downgrade our corporate credit rating to “BB+” or Moody’s were to downgrade our corporate credit rating to “Ba2”,

our letter of credit fees would increase by 0.25% and fees paid on the unused portion of the facility would increase by 0.025%.

Debt Covenants

Our revolving credit facility contains affirmative and negative covenants that, among other things, may limit or restrict our ability to:

create liens and encumbrances; incur debt; merge, dissolve, liquidate or consolidate; make acquisitions and investments; dispose of or

transfer assets; pay dividends or make other payments in respect of our capital stock; amend material documents; change the nature of

our business; make certain payments of debt; engage in certain transactions with affiliates; and enter into sale/leaseback or hedging

transactions, in each case, subject to certain qualifications and exceptions. In addition, we are required to maintain minimum interest

expense coverage and maximum leverage ratios.

Our 2014 Notes also contain affirmative and negative covenants that, among other things, may limit or restrict our ability to: incur

additional debt and issue preferred stock; make certain investments and restricted payments; create liens; create restrictions on

distributions from subsidiaries; engage in specified sales of assets and subsidiary stock; enter into transactions with affiliates; enter

new lines of business; engage in consolidation, mergers and acquisitions; and engage in certain sale/leaseback transactions.

We were in compliance with all debt covenants at October 1, 2011.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements material to our financial position or results of operations. The off-balance sheet

arrangements we have are guarantees of debt of outside third parties, including a lease and grower loans, and residual value guarantees

covering certain operating leases for various types of equipment. See Note 19: Commitments and Contingencies of the Notes to

Consolidated Financial Statements for further discussion.

CONTRACTUAL OBLIGATIONS

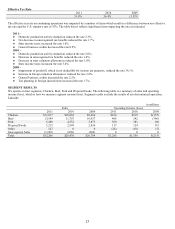

The following table summarizes our contractual obligations as of October 1, 2011:

in millions

Payments Due by Period

2012

2013-2014

2015-2016

2017 and

thereafter

Total

Debt and capital lease obligations:

Principal payments (1)

$70

$1,296

$650

$242

$2,258

Interest payments (2)

165

272

116

46

599

Guarantees (3)

26

61

22

17

126

Operating lease obligations (4)

95

102

31

54

282

Purchase obligations (5)

886

81

31

61

1,059

Capital expenditures (6)

412

15

0

0

427

Other long-term liabilities (7)

12

5

4

29

50

Total contractual commitments

$1,666

$1,832

$854

$449

$4,801

(1)

In the event of a default on payment, acceleration of the principal payments could occur.

(2)

Interest payments include interest on all outstanding debt. Payments are estimated for variable rate and variable term debt based on

effective rates at October 1, 2011, and expected payment dates.

(3)

Amounts include guarantees of debt of outside third parties, which consist of a lease and grower loans, all of which are substantially

collateralized by the underlying assets, as well as residual value guarantees covering certain operating leases for various types of

equipment. The amounts included are the maximum potential amount of future payments.

(4)

Amounts include minimum lease payments under lease agreements.

(5)

Amounts include agreements to purchase goods or services that are enforceable and legally binding and specify all significant terms,

including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the

transaction. The purchase obligations amount included items, such as future purchase commitments for grains, livestock contracts and

fixed grower fees that provide terms that meet the above criteria. We have excluded future purchase commitments for contracts that do

not meet these criteria. Purchase orders have not been included in the table, as a purchase order is an authorization to purchase and may

not be considered an enforceable and legally binding contract. Contracts for goods or services that contain termination clauses without

penalty have also been excluded.

(6)

Amounts include estimated amounts to complete buildings and equipment under construction as of October 1, 2011.

(7)

Amounts include items that meet the definition of a purchase obligation and are recorded in the Consolidated Balance Sheets.