Tyson Foods 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

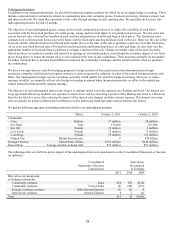

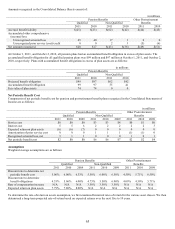

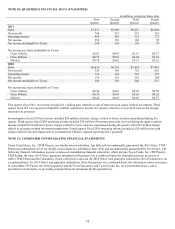

NOTE 15: COMPREHENSIVE INCOME (LOSS)

The components of accumulated other comprehensive income (loss) are as follows:

in millions

2011

2010

Accumulated other comprehensive income (loss):

Unrealized net hedging gains (losses), net of taxes

$(7)

$10

Unrealized net gain on investments, net of taxes

1

9

Currency translation adjustment

(35)

6

Postretirement benefits reserve adjustments

(38)

(25)

Total accumulated other comprehensive income (loss)

$(79)

$0

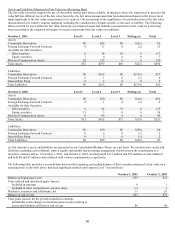

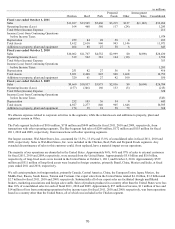

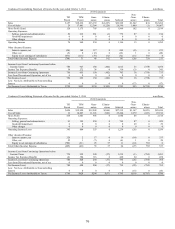

The components of other comprehensive income (loss) are as follows:

in millions

Before Tax

Income Tax

After Tax

Fiscal 2011:

Net hedging gain reclassified to earnings

$(25)

$10

$(15)

Net hedging unrealized gain (loss)

4

(6)

(2)

Unrealized loss on investments

(12)

4

(8)

Currency translation adjustment

(42)

1

(41)

Net change in postretirement liabilities

(21)

8

(13)

Other comprehensive income (loss) – 2011

$(96)

$17

$(79)

Fiscal 2010:

Net hedging loss reclassified to earnings

$7

$(1)

$6

Net hedging unrealized gain

7

(1)

6

Currency translation adjustment

27

0

27

Net change in postretirement liabilities

(6)

1

(5)

Other comprehensive income (loss) – 2010

$35

$(1)

$34

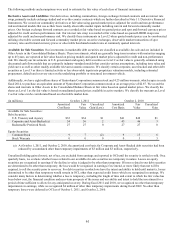

Fiscal 2009:

Net hedging loss reclassified to earnings

$61

$(25)

$36

Net hedging unrealized loss

(53)

23

(30)

Loss on investments reclassified to other income

4

(1)

3

Unrealized gain on investments

12

(5)

7

Currency translation adjustment gain reclassified to loss from discontinued

operation

(41)

0

(41)

Currency translation adjustment

(43)

3

(40)

Net change in postretirement liabilities

(11)

1

(10)

Other comprehensive income (loss) – 2009

$(71)

$(4)

$(75)