Tyson Foods 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

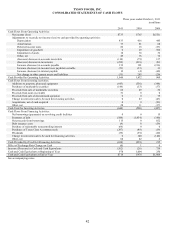

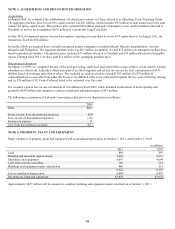

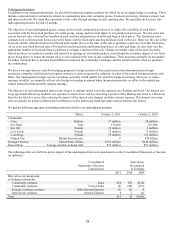

NOTE 7: DEBT

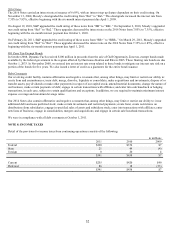

The major components of debt are as follows (in millions):

2011

2010

Revolving credit facility

$0

$0

Senior notes:

8.25% Notes due October 2011 (2011 Notes)

0

315

3.25% Convertible senior notes due October 2013 (2013 Notes)

458

458

10.50% Senior notes due March 2014 (2014 Notes)

810

810

6.85% Senior notes due April 2016 (2016 Notes)

638

701

7.00% Notes due May 2018

120

122

7.00% Notes due January 2028

18

18

Discount on senior notes

(76)

(105)

GO Zone tax-exempt bonds due October 2033 (0.14% at 10/1/2011)

100

100

Other

114

117

Total debt

2,182

2,536

Less current debt

70

401

Total long-term debt

$2,112

$2,135

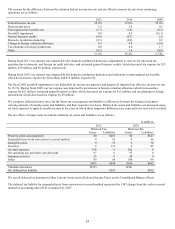

Annual maturities of debt for the five fiscal years subsequent to October 1, 2011, are: 2012 - $70 million; 2013 - $17 million; 2014 -

$1,279 million; 2015 - $7 million; 2016 - $643 million.

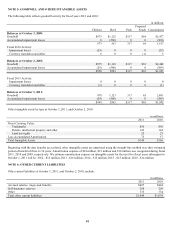

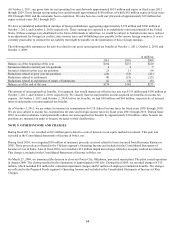

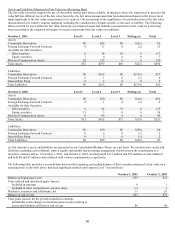

Revolving Credit Facility

In February 2011, we amended and extended our $1.0 billion revolving credit facility that supports short-term funding needs and

letters of credit. The facility will mature and the commitments thereunder will terminate in February 2016, provided that (a) at any

time during the six-month period ending November 29, 2013, we have corporate credit ratings not lower than BBB- and Baa3 from

Standard & Poor’s (S&P) and Moody’s Investor Services, Inc. (Moody’s), respectively, in each case with stable outlook or better, (b)

on or prior to November 29, 2013, we have refinanced, purchased, or defeased the 2014 Notes, or (c) we have irrevocably deposited

cash in an amount not less than the aggregate principal amount of the outstanding 2014 Notes on or prior to November 29, 2013, in a

blocked cash collateral account. In the event none of the foregoing events have occurred, the loans made under this facility will mature

and the commitments thereunder will terminate on November 29, 2013. As of October 1, 2011, none of the foregoing events have

occurred.

After reducing the amount available by outstanding letters of credit issued under this facility, the amount available for borrowing

under this facility at October 1, 2011, was $842 million. At October 1, 2011, we had outstanding letters of credit issued under this

facility totaling $158 million, none of which were drawn upon. Our letters of credit are issued primarily in support of workers’

compensation insurance programs, derivative activities and Dynamic Fuels’ Gulf Opportunity Zone tax-exempt bonds. We had an

additional $50 million of bilateral letters of credit not issued under this facility, none of which were drawn upon.

This facility is fully and unconditionally guaranteed by substantially all of our domestic subsidiaries. The guarantors’ cash, accounts

receivable, inventory and proceeds received related to these items previously secured our obligations under this facility. Because we

satisfied certain credit rating requirements provided for in the facility, we requested the release of the liens securing the facility. As of

October 1, 2011, all liens securing our obligations under this facility were released, while the facility remains fully and

unconditionally guaranteed by substantially all of our domestic subsidiaries.

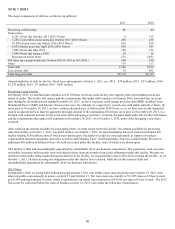

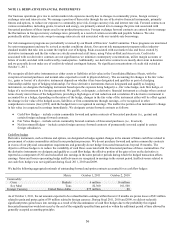

2013 Notes

In September 2008, we issued $458 million principal amount 3.25% convertible senior unsecured notes due October 15, 2013, with

interest payable semi-annually in arrears on April 15 and October 15. The conversion rate initially is 59.1935 shares of Class A stock

per $1,000 principal amount of notes, which is equivalent to an initial conversion price of $16.89 per share of Class A stock. The 2013

Notes may be converted before the close of business on July 12, 2013, only under the following circumstances: