Tyson Foods 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

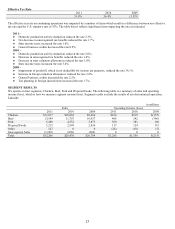

in millions, except per share data

2011

2010

2009

Net income (loss) attributable to Tyson

$750

$780

$(547)

Net income (loss) attributable to Tyson – per diluted share

1.97

2.06

(1.47)

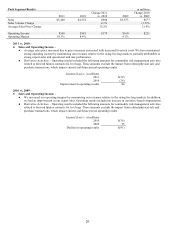

2011 – Net income included the following items:

●

$11 million gain related to a sale of interests in an equity method investment; and

●

$21 million reduction to income tax expense related to a reversal of reserves for foreign uncertain tax positions.

2010 – Net income included the following items:

●

$61 million in charges related to losses on notes repurchased during fiscal 2010;

●

$29 million non-cash, non-tax deductible charge related to a full goodwill impairment in an immaterial Chicken segment

reporting unit;

●

$12 million non-cash, non-tax deductible charge related to the impairment of an equity method investment; and

●

$38 million gain from insurance proceeds.

2009 – Net loss included the following items:

●

$560 million non-cash, non-tax deductible charge related to a goodwill impairment in our Beef segment; and

●

$15 million charge related to the closing of our Ponca City, Oklahoma, processed meats plant.

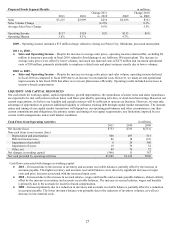

FISCAL 2012 OUTLOOK

USDA data indicates overall domestic protein (chicken, beef, pork and turkey) production is expected to decrease in fiscal 2012.

Because exports are likely to remain strong, we forecast total domestic availability of protein to be down 2-3% compared to fiscal

2011, which should continue to support improved pricing. The following is a summary of the fiscal 2012 outlook for each of our

segments, as well as an outlook on sales, capital expenditures, net interest expense, debt and liquidity and share repurchases:

●

Chicken – For fiscal 2012, we expect industry production will decrease approximately 4% from fiscal 2011, which should

gradually improve market pricing conditions. Current futures prices indicate higher grain costs in fiscal 2012 compared to

fiscal 2011. We expect to offset the increased grain costs with operational, pricing and mix improvements. Our Chicken

segment is currently profitable and we expect it to strengthen throughout the year.

●

Beef – We expect to see a gradual reduction in fed cattle supplies of 1-2% in fiscal 2012 as well as exports to remain strong as

compared to fiscal 2011. Despite reduced domestic availability, we expect adequate supplies in the regions we operate our

plants. Although current weak industry fundamentals are challenging our Beef business, we expect it to be profitable in the first

quarter. We anticipate the fundamentals will strengthen throughout the year and our Beef segment will be in our normalized

range for fiscal 2012.

●

Pork – We expect hog supplies in fiscal 2012 to be comparable to fiscal 2011 and to be adequate in the regions in which we

operate

. Additionally, we expect pork exports to remain strong in fiscal 2012. Based on these factors, we expect strong

fundamentals in our Pork business to continue in fiscal 2012.

●

Prepared Foods – We expect operational improvements and increased pricing to offset an anticipated increase in raw material

costs. Because many of our sales contracts are formula based or shorter-term in nature, we are typically able to offset rising

input costs through increased pricing. However, there is a lag time for price increases to take effect. We expect improved

Prepared Foods profitability for fiscal 2012 primarily due to improvements in our lunchmeats business.

●

Sales – We expect 2012 sales to exceed $34 billion mostly resulting from price increases related to decreases in domestic

availability of protein and rising raw material costs.

●

Capital Expenditures – Our preliminary capital expenditures plan for fiscal 2012 is approximately $800-$850 million. We will

continue to make significant investments in our production facilities for high return operational efficiencies, other profit

improvement projects and development of our foreign operations.

●

Net Interest Expense – We expect fiscal 2012 net interest expense will be approximately $185 million, down $46 million

compared to fiscal 2011.

●

Debt and Liquidity – We do not have any significant maturities of debt coming due over the next two fiscal years and will

continue to use our available cash to repurchase notes when available at attractive rates. We plan to maintain total liquidity in

excess of $1.2 billion.

●

Share Repurchases – We expect to continue repurchasing shares under our previously announced share repurchase plan. In

fiscal 2011, we repurchased 9.7 million shares for approximately $170 million. As of October 1, 2011, 12.8 million shares

remain authorized for repurchases. The timing and extent to which we repurchase shares will depend upon, among other things,

market conditions, liquidity targets, our debt obligations and regulatory requirements.