Tyson Foods 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

We have issued and outstanding two classes of capital stock, Class A stock and Class B stock. Holders of Class B stock may convert

such stock into Class A stock on a share-for-share basis. Holders of Class B stock are entitled to 10 votes per share while holders of

Class A stock are entitled to one vote per share on matters submitted to shareholders for approval. As of October 29, 2011, there were

approximately 29,000 holders of record of our Class A stock and 9 holders of record of our Class B stock, excluding holders in the

security position listings held by nominees.

DIVIDENDS

Cash dividends cannot be paid to holders of Class B stock unless they are simultaneously paid to holders of Class A stock. The per

share amount of the cash dividend paid to holders of Class B stock cannot exceed 90% of the cash dividend simultaneously paid to

holders of Class A stock. We have paid uninterrupted quarterly dividends on common stock each year since 1977 and expect to

continue our cash dividend policy during fiscal 2012. In both fiscal 2011 and 2010, the annual dividend rate for Class A stock was

$0.16 per share and the annual dividend rate for Class B stock was $0.144 per share.

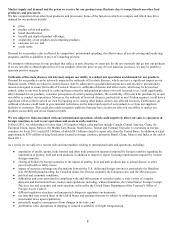

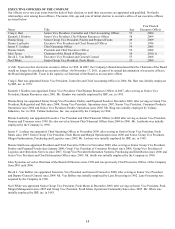

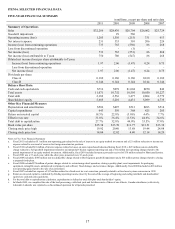

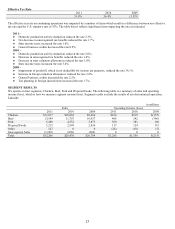

MARKET INFORMATION

Our Class A stock is traded on the New York Stock Exchange under the symbol “TSN.” No public trading market currently exists for

our Class B stock. The high and low closing sales prices of our Class A stock for each quarter of fiscal 2011 and 2010 are represented

in the table below.

Fiscal 2011

Fiscal 2010

High

Low

High

Low

First Quarter

$17.74

$14.84

$13.19

$12.02

Second Quarter

19.82

16.25

19.50

12.24

Third Quarter

19.92

17.12

20.40

16.25

Fourth Quarter

19.24

15.68

18.06

15.22

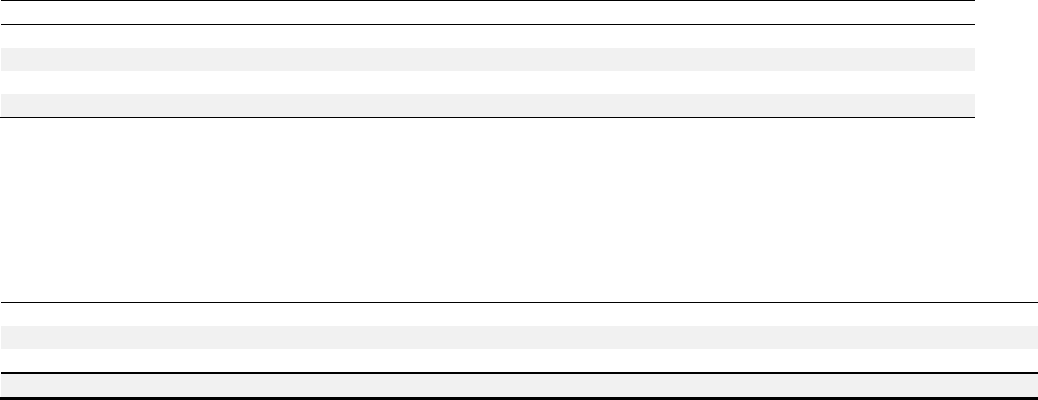

ISSUER PURCHASES OF EQUITY SECURITIES

The table below provides information regarding our purchases of Class A stock during the periods indicated.

Period

Total

Number of

Shares

Purchased

Average

Price Paid

per Share

Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs

Maximum Number of

Shares that May Yet Be

Purchased Under the Plans

or Programs (1)

July 3 to July 30, 2011

191,102

$18.98

-

18,071,095

July 31 to Sept. 3, 2011

2,919,607

16.97

2,807,479

15,263,616

Sept. 4 to Oct. 1, 2011

2,524,152

17.16

2,469,800

12,793,816

Total

(2)

5,634,861

$17.12

(3) 5,277,279

12,793,816

(1) On February 7, 2003, we announced our Board of Directors approved a plan to repurchase up to 25 million shares of Class A

common stock from time to time in open market or privately negotiated transactions. The plan has no fixed or scheduled

termination date. On May 11, 2011, the Board of Directors reactivated the program, effective immediately, to repurchase up

to the remaining 22.5 million shares of the Company’s Class A common stock.

(2) We purchased 357,582 shares during the period that were not made pursuant to our previously announced stock repurchase

plan, but were purchased to fund certain Company obligations under our equity compensation plans. These transactions

included 325,835 shares purchased in open market transactions and 31,747 shares withheld to cover required tax

withholdings on the vesting of restricted stock.

(3) We purchased 5,277,279 shares during the period pursuant to our previously announced stock repurchase plan of

approximately 25 million shares.