Tyson Foods 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

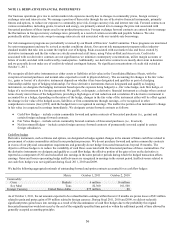

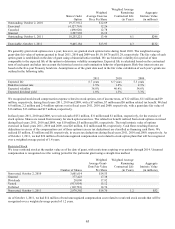

The following methods and assumptions were used to estimate the fair value of each class of financial instrument:

Derivative Assets and Liabilities: Our derivatives, including commodities, foreign exchange forward contracts and an interest rate

swap, primarily include exchange-traded and over-the-counter contracts which are further described in Note 11: Derivative Financial

Instruments. We record our commodity derivatives at fair value using quoted market prices adjusted for credit and non-performance

risk and internal models that use as their basis readily observable market inputs including current and forward commodity market

prices. Our foreign exchange forward contracts are recorded at fair value based on quoted prices and spot and forward currency prices

adjusted for credit and non-performance risk. Our interest rate swap is recorded at fair value based on quoted LIBOR swap rates

adjusted for credit and non-performance risk. We classify these instruments in Level 2 when quoted market prices can be corroborated

utilizing observable current and forward commodity market prices on active exchanges, observable market transactions of spot

currency rates and forward currency prices or observable benchmark market rates at commonly quoted intervals.

Available for Sale Securities: Our investments in marketable debt securities are classified as available-for-sale and are included in

Other Assets in the Consolidated Balance Sheets. These investments, which are generally long-term in nature with maturities ranging

up to 45 years, are reported at fair value based on pricing models and quoted market prices adjusted for credit and non-performance

risk. We classify our investments in U.S. government and agency debt securities as Level 2 as fair value is generally estimated using

discounted cash flow models that are primarily industry-standard models that consider various assumptions, including time value and

yield curve as well as other readily available relevant economic measures. We classify certain corporate, asset-backed and other debt

securities as Level 3 as there is limited activity or less observable inputs into proprietary valuation models, including estimated

prepayment, default and recovery rates on the underlying portfolio or structured investment vehicle.

Additionally, we have eight million shares of Syntroleum Corporation common stock and 4.25 million warrants, which expire in early

fiscal 2014, to purchase an equivalent amount of Syntroleum Corporation common stock at an average price of $2.87. We record the

shares and warrants in Other Assets in the Consolidated Balance Sheets at fair value based on quoted market prices. We classify the

shares as Level 1 as the fair value is based on unadjusted quoted prices available in active markets. We classify the warrants as Level

2 as fair value can be corroborated based on observable market data.

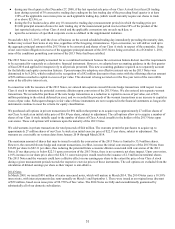

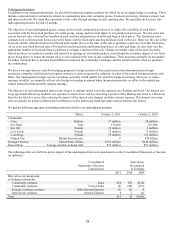

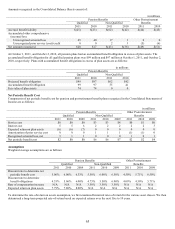

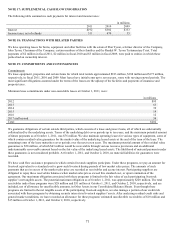

(in millions)

October 1, 2011

October 2, 2010

Amortized

Cost Basis

Fair

Value

Unrealized

Gain/(Loss)

Amortized

Cost Basis

Fair

Value

Unrealized

Gain

Available for Sale Securities:

Debt Securities:

U.S. Treasury and Agency

$33

$34

$1

$41

$42

$1

Corporate and Asset-Backed (a)

54

56

2

43

46

3

Redeemable Preferred Stock

27

27

0

27

27

0

Equity Securities:

Common Stock

9

7

(2)

9

15

6

Stock Warrants

0

0

0

0

3

3

(a) At October 1, 2011, and October 2, 2010, the amortized cost basis for Corporate and Asset-Backed debt securities had been

reduced by accumulated other than temporary impairments of $3 million and $3 million, respectively.

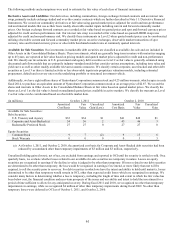

Unrealized holding gains (losses), net of tax, are excluded from earnings and reported in OCI until the security is settled or sold. On a

quarterly basis, we evaluate whether losses related to our available-for-sale securities are temporary in nature. Losses on equity

securities are recognized in earnings if the decline in value is judged to be other than temporary. If losses related to our debt securities

are determined to be other than temporary, the loss would be recognized in earnings if we intend, or more likely than not will be

required, to sell the security prior to recovery. For debt securities in which we have the intent and ability to hold until maturity, losses

determined to be other than temporary would remain in OCI, other than expected credit losses which are recognized in earnings. We

consider many factors in determining whether a loss is temporary, including the length of time and extent to which the fair value has

been below cost, the financial condition and near-term prospects of the issuer and our ability and intent to hold the investment for a

period of time sufficient to allow for any anticipated recovery. During fiscal 2011 and 2010, we recognized no other than temporary

impairments in earnings, while we recognized $4 million of other than temporary impairments during fiscal 2009. No other than

temporary losses were deferred in OCI as of October 1, 2011, and October 2, 2010.