Tyson Foods 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

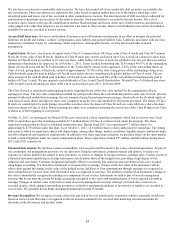

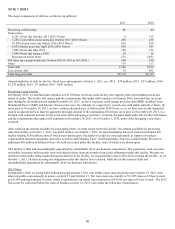

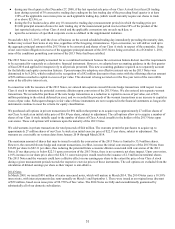

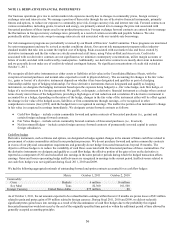

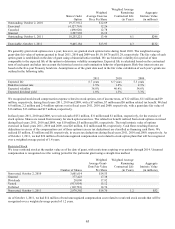

NOTE 10: EARNINGS (LOSS) PER SHARE

The earnings and weighted average common shares used in the computation of basic and diluted earnings (loss) per share are as

follows:

in millions, except per share data

2011

2010

2009

Numerator:

Income (loss) from continuing operations

$733

$765

$(550)

Less: Net loss attributable to noncontrolling interest

(17)

(15)

(4)

Income (loss) from continuing operations attributable to Tyson

750

780

(546)

Less Dividends:

Class A ($0.16/share)

49

49

50

Class B ($0.144/share)

10

10

10

Undistributed earnings (losses)

$691

$721

$(606)

Class A undistributed earnings (losses)

$572

$597

$(501)

Class B undistributed earnings (losses)

119

124

(105)

Total undistributed earnings (losses)

$691

$721

$(606)

Denominator:

Denominator for basic earnings (loss) per share:

Class A weighted average shares

303

303

302

Class B weighted average shares, and shares under if-converted

method for diluted earnings per share

70

70

70

Effect of dilutive securities:

Stock options and restricted stock

6

6

0

Convertible 2013 Notes

1

0

0

Denominator for diluted earnings (loss) per share – adjusted

weighted average shares and assumed conversions

380

379

372

Net Income (Loss) Per Share from Continuing Operations

Attributable to Tyson:

Class A Basic

$2.04

$2.13

$(1.49)

Class B Basic

$1.84

$1.91

$(1.35)

Diluted

$1.97

$2.06

$(1.47)

Net Income (Loss) Per Share Attributable to Tyson:

Class A Basic

$2.04

$2.13

$(1.49)

Class B Basic

$1.84

$1.91

$(1.35)

Diluted

$1.97

$2.06

$(1.47)

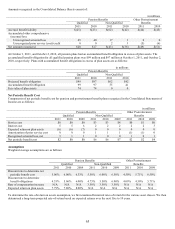

Approximately 4 million, 5 million and 24 million in fiscal years 2011, 2010 and 2009, respectively, of our stock-based compensation

shares were antidilutive and were not included in the dilutive earnings per share calculation.

We have two classes of capital stock, Class A stock and Class B stock. Cash dividends cannot be paid to holders of Class B stock

unless they are simultaneously paid to holders of Class A stock. The per share amount of cash dividends paid to holders of Class B

stock cannot exceed 90% of the cash dividends paid to holders of Class A stock.

We allocate undistributed earnings (losses) based upon a 1 to 0.9 ratio per share to Class A stock and Class B stock, respectively. We

allocate undistributed earnings (losses) based on this ratio due to historical dividend patterns, voting control of Class B shareholders

and contractual limitations of dividends to Class B stock.