Tyson Foods 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

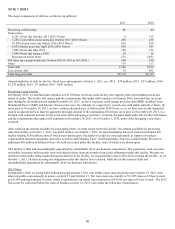

2016 Notes

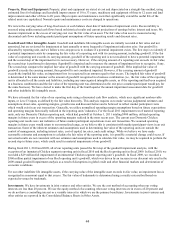

The 2016 Notes carried an interest rate at issuance of 6.60%, with an interest step up feature dependent on their credit rating. On

November 13, 2008, Moody’s downgraded the credit rating from “Ba1” to “Ba3.” This downgrade increased the interest rate from

7.35% to 7.85%, effective beginning with the six-month interest payment due April 1, 2009.

On August 19, 2010, S&P upgraded the credit rating of these notes from “BB” to “BB+.” On September 2, 2010, Moody’s upgraded

our credit rating from “Ba3” to “Ba2.” These upgrades decreased the interest rate on the 2016 Notes from 7.85% to 7.35%, effective

beginning with the six-month interest payment due October 1, 2010.

On February 24, 2011, S&P upgraded the credit rating of these notes from “BB+” to “BBB-.” On March 29, 2011, Moody’s upgraded

our credit rating from “Ba2” to “Ba1”. These upgrades decreased the interest rate on the 2016 Notes from 7.35% to 6.85%, effective

beginning with the six-month interest payment due April 1, 2011.

GO Zone Tax-Exempt Bonds

In October 2008, Dynamic Fuels received $100 million in proceeds from the sale of Gulf Opportunity Zone tax-exempt bonds made

available by the federal government to the regions affected by Hurricanes Katrina and Rita in 2005. These floating rate bonds are due

October 1, 2033. In November 2008, we entered into an interest rate swap related to these bonds to mitigate our interest rate risk on a

portion of the bonds for five years. We also issued a letter of credit as a guarantee for the entire bond issuance.

Debt Covenants

Our revolving credit facility contains affirmative and negative covenants that, among other things, may limit or restrict our ability to:

create liens and encumbrances; incur debt; merge, dissolve, liquidate or consolidate; make acquisitions and investments; dispose of or

transfer assets; pay dividends or make other payments in respect of our capital stock; amend material documents; change the nature of

our business; make certain payments of debt; engage in certain transactions with affiliates; and enter into sale/leaseback or hedging

transactions, in each case, subject to certain qualifications and exceptions. In addition, we are required to maintain minimum interest

expense coverage and maximum leverage ratios.

Our 2014 Notes also contain affirmative and negative covenants that, among other things, may limit or restrict our ability to: incur

additional debt and issue preferred stock; make certain investments and restricted payments; create liens; create restrictions on

distributions from subsidiaries; engage in specified sales of assets and subsidiary stock; enter into transactions with affiliates; enter

new lines of business; engage in consolidation, mergers and acquisitions; and engage in certain sale/leaseback transactions.

We were in compliance with all debt covenants at October 1, 2011.

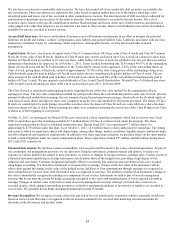

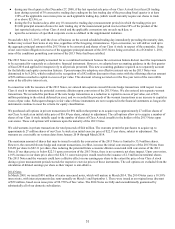

NOTE 8: INCOME TAXES

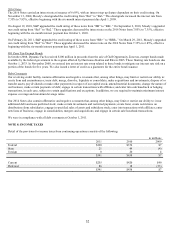

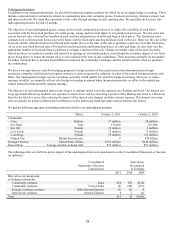

Detail of the provision for income taxes from continuing operations consists of the following:

in millions

2011

2010

2009

Federal

$320

$374

$7

State

21

44

(4)

Foreign

0

20

4

$341

$438

$7

Current

$255

$420

$40

Deferred

86

18

(33)

$341

$438

$7