Tyson Foods 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

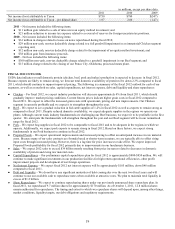

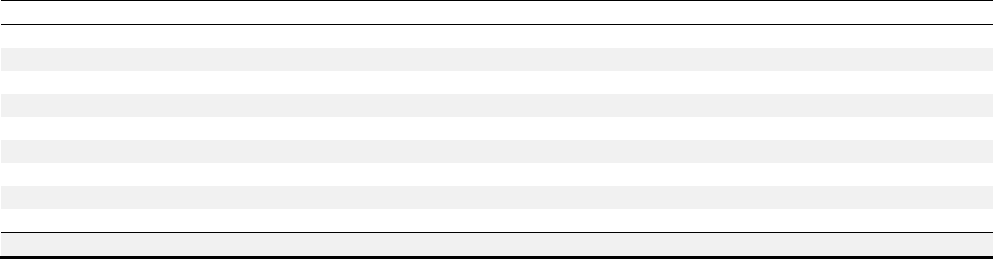

Cash Flows from Financing Activities

in millions

2011

2010

2009

Net borrowings (payments) on revolving credit facilities

$0

$0

$15

Payments on debt

(500)

(1,034)

(380)

Net proceeds from borrowings

115

0

852

Debt issuance costs

(9)

0

(59)

Purchase of redeemable noncontrolling interest

(66)

0

0

Purchases of Tyson Class A common stock

(207)

(48)

(19)

Dividends

(59)

(59)

(60)

Change in restricted cash to be used for financing activities

0

140

(140)

Other, net

68

42

6

Net cash provided by (used for) financing activities

$(658)

$(959)

$215

●

Net borrowings (payments) on revolving credit facilities primarily include activity related to the accounts receivable

securitization facility. With the entry into a new revolving credit facility and issuance of the 2014 Notes in March 2009, we

repaid all outstanding borrowings under our accounts receivable securitization facility and terminated the facility.

●

Payments on debt include –

●

2011 – $315 million of 2011 Notes; $63 million of 2016 Notes; $2 million of 7.0% Notes due May 2018; and $103

million related to borrowings at our foreign operations.

●

2010 – $524 million of 2011 Notes; $222 million of 2016 Notes; $140 million of 7.95% Notes due February 2010

(2010 Notes) (using the restricted cash held in a blocked cash collateral account for the retirement of these notes); $52

million of 7.0% Notes due May 2018; and $61 million related to the premiums on notes repurchased during the year.

●

2009 – $161 million of 2011 Notes; $94 million of 2010 Notes (using the restricted cash held in a blocked cash

collateral account for the repurchase of these notes); and $38 million of 2016 Notes.

●

Net proceeds from borrowings include –

●

In fiscal 2011, our foreign operations received proceeds of $106 million from borrowings. Total debt related to our

foreign operations was $98 million at October 1, 2011 ($58 million current, $40 million long-term). Additionally,

Dynamic Fuels received $9 million in proceeds from short term notes in fiscal 2011.

●

In fiscal 2009, we issued $810 million of 2014 Notes. After the original issue discount of $59 million, based on an

issue price of 92.756% of face value, we received net proceeds of $751 million. We used the net proceeds towards the

repayment of our borrowings under our accounts receivable securitization facility and for other general corporate

purposes.

●

In fiscal 2009, Dynamic Fuels received $100 million in proceeds from the sale of Gulf Opportunity Zone tax-exempt

bonds made available by the Federal government to the regions affected by Hurricanes Katrina and Rita in 2005. These

floating rate bonds are due October 1, 2033.

●

In conjunction with the entry into our credit facility and the issuance of the 2014 Notes during fiscal 2009, we paid $48

million for debt issuance costs.

●

In fiscal 2011, the minority interest partner in our 60%-owned Shandong Tyson Xinchang Foods joint ventures in China

exercised put option

s requiring us to purchase its entire 40% equity interest. The transaction closed in fis

cal 2011 for cash

consideration totaling $66 million.

●

In fiscal 2011, we announced our Board of Directors reactivated a share repurchase program, which had no activity since

fiscal 2005, to repurchase up to the remaining available 22.5 million shares of Class A common stock under the program.

The share repurchase program has no fixed or scheduled termination date. During fiscal 2011, we repurchased 9.7 million

shares for approximately $170 million under this plan. As of October 1, 2011, 12.8 million shares remain authorized for

repurchase. The timing and extent to which we repurchase shares will depend upon, among other things, market

conditions, liquidity targets, limitations under our debt obligations and regulatory requirements. In addition to the share

repurchase program, we purchase shares on the open market to fund certain obligations under our equity compensation

plans. These repurchases totaled $37 million, $48 million and $19 million in fiscal 2011, 2010 and 2009, respectively.