Tyson Foods 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

At October 1, 2011, our gross state tax net operating loss carryforwards approximated $635 million and expire in fiscal years 2012

through 2029. Gross foreign net operating loss carryforwards approximated $160 million, of which $63 million expire in fiscal years

2012 through 2020, and the remainder has no expiration. We also have tax credit carryforwards of approximately $19 million that

expire in fiscal years 2012 through 2025.

We have accumulated undistributed earnings of foreign subsidiaries aggregating approximately $339 million and $260 million at

October 1, 2011, and October 2, 2010, respectively. These earnings are expected to be indefinitely reinvested outside of the United

States. If those earnings were distributed in the form of dividends or otherwise, we would be subject to federal income taxes (subject

to an adjustment for foreign tax credits), state income taxes and withholding taxes payable to the various foreign countries. It is not

currently practicable to estimate the tax liability that might be payable on the repatriation of these foreign earnings.

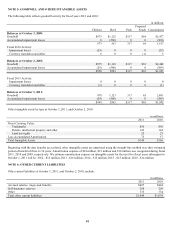

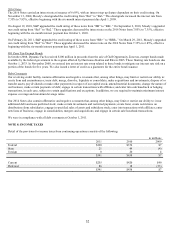

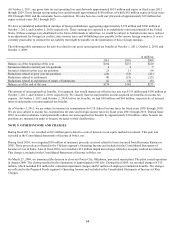

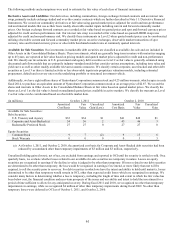

The following table summarizes the activity related to our gross unrecognized tax benefits at October 1, 2011, October 2, 2010, and

October 3, 2009:

in millions

2011

2010

2009

Balance as of the beginning of the year

$184

$233

$220

Increases related to current year tax positions

4

4

7

Increases related to prior year tax positions

21

11

60

Reductions related to prior year tax positions

(24)

(35)

(21)

Reductions related to settlements

(9)

(25)

(25)

Reductions related to expirations of statute of limitations

(2)

(4)

(8)

Balance as of the end of the year

$174

$184

$233

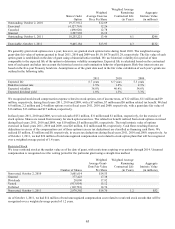

The amount of unrecognized tax benefits, if recognized, that would impact our effective tax rate was $155 million and $150 million at

October 1, 2011, and October 2, 2010, respectively. We classify interest and penalties on unrecognized tax benefits as income tax

expense. At October 1, 2011, and October 2, 2010, before tax benefits, we had $58 million and $64 million, respectively, of accrued

interest and penalties on unrecognized tax benefits.

As of October 1, 2011, we are subject to income tax examinations for U.S. federal income taxes for fiscal years 2003 through 2010.

We are also subject to income tax examinations for state and foreign income taxes for fiscal years 2001 through 2010. During fiscal

2012, tax audit resolutions could potentially reduce our unrecognized tax benefits by approximately $10 million, either because tax

positions are sustained on audit or because we agree to their disallowance.

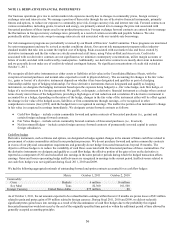

NOTE 9: OTHER INCOME AND CHARGES

During fiscal 2011, we recorded an $11 million gain related to a sale of interests in an equity method investment. This gain was

recorded in the Consolidated Statements of Income in Other, net.

During fiscal 2010, we recognized $38 million of insurance proceeds received related to losses incurred from Hurricane Katrina in

2005. These proceeds are reflected in the Chicken segment’s Operating Income and included in the Consolidated Statements of

Income in Cost of Sales. Also in fiscal 2010, we recorded a $12 million impairment charge related to an equity method investment.

This charge is included in the Consolidated Statements of Income in Other, net.

On March 27, 2009, we announced the decision to close our Ponca City, Oklahoma, processed meats plant. The plant ceased operation

in August 2009. The closing resulted in the elimination of approximately 600 jobs. During fiscal 2009, we recorded charges of $15

million, which included $14 million for estimated impairment charges and $1 million of employee termination benefits. The charges

are reflected in the Prepared Foods segment’s Operating Income and included in the Consolidated Statements of Income in Other

Charges.