Tyson Foods 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

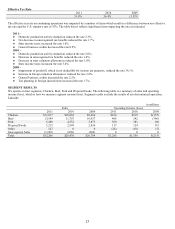

Beef Segment Results

in millions

2011

2010

Change 2011

vs. 2010

2009

Change 2010

vs. 2009

Sales

$13,549

$11,707

$1,842

$10,937

$770

Sales Volume Change

(1.0)%

(1.9)%

Average Sales Price Change

16.9%

9.1%

Operating Income (Loss)

$468

$542

$(74)

$(346)

$888

Operating Margin

3.5%

4.6%

(3.2)%

2009 – Operating loss included a $560 million non-cash charge related to the partial impairment of goodwill.

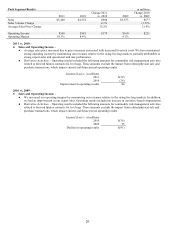

2011 vs. 2010 –

●

Sales and Operating Income –

●

Average sales price increased due to price increases associated with increased livestock costs. We have maintained

strong operating income by maximizing our revenues relative to the rising live cattle markets, partially attributable to

strong export sales. This was offset by an increase in operating costs, primarily attributable to employee related costs.

●

Derivative Activities – Operating results included the following amounts for commodity risk management activities

related to forward futures contracts for live cattle. These amounts exclude the impact from related physical sale and

purchase transactions, which impact current and future period operating results.

Income/(Loss) – in millions

2011

$(41)

2010

(15)

Decline in operating results

$(26)

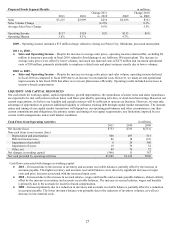

2010 vs. 2009 –

●

Sales and Operating Income (Loss) –

●

We increased our operating margins by maximizing our revenues relative to the rising live cattle markets, as well as

improved our operating costs.

In addition, we had an improvement in our export sales.

Operating results included an

increase in incentive-based compensation.

●

Derivative Activities – Operating results included the following amounts for commodity risk management activities

related to forward futures contracts for live cattle. These amounts exclude the impact from related physical sale and

purchase transactions, which impact current and future period operating results.

Income/(Loss) – in millions

2010

$(15)

2009

102

Decline in operating results

$(117)