Tyson Foods 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

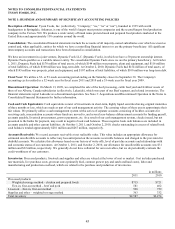

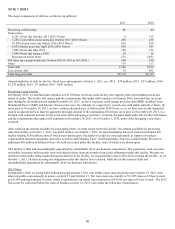

In May 2008, the FASB issued guidance which specifies issuers of convertible debt instruments that may be settled in cash upon

conversion (including partial cash settlement) should separately account for the liability and equity components in a manner that will

reflect the entity’s nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. The amount allocated to

the equity component represents a discount to the debt, which is amortized into interest expense using the effective interest method

over the life of the debt. We adopted this guidance in the first quarter of fiscal 2010 and applied it retrospectively. Upon retrospective

adoption, our effective interest rate on our 3.25% Convertible Senior Notes due 2013 issued in September 2008 was determined to be

8.26%, which resulted in the recognition of a $92 million discount to these notes with the offsetting after tax amount of $56 million

recorded to capital in excess of par value. This discount is being accreted over the five-year term of the convertible notes at the

effective interest rate.

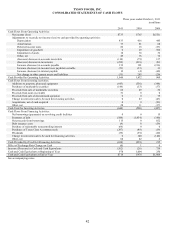

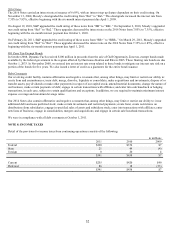

The following table presents the effects of the retrospective application of new accounting guidance on our consolidated financial

statements (in millions, except per share data):

Adjustments:

Adjustments:

Previously

Convertible

Noncontrolling

As

Reported

Debt

Interest

Adjusted

October 3, 2009 – Income Statement:

Interest Expense

$310

$17

$0

$327

Income (Loss) from Continuing Operations before Income Taxes

(526)

(17)

0

(543)

Income Tax Expense

14

(7)

0

7

Income (Loss) from Continuing Operations

(540)

(10)

0

(550)

Minority Interest

(4)

0

4

0

Net Income (Loss)

(537)

(10)

(4)

(551)

Less: Net Loss Attributable to Noncontrolling Interest

0

0

(4)

(4)

Net Income (Loss) Attributable to Tyson

0

0

0

(547)

Net Income (Loss) Per Share from Continuing Operations

Attributable to Tyson:

Class A Basic

$(1.47)

$(0.02)

$0.00

$(1.49)

Class B Basic

$(1.32)

$(0.03)

$0.00

$(1.35)

Diluted

$(1.44)

$(0.03)

$0.00

$(1.47)

Net Income (Loss) Per Share Attributable to Tyson:

Class A Basic

$(1.47)

$(0.02)

$0.00

$(1.49)

Class B Basic

$(1.32)

$(0.03)

$0.00

$(1.35)

Diluted

$(1.44)

$(0.03)

$0.00

$(1.47)

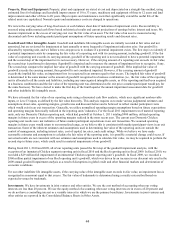

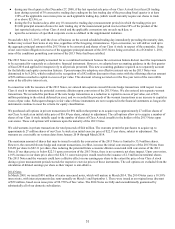

In December 2008, the FASB issued guidance requiring additional disclosures about assets held in an employer’s defined benefit

pension or other postretirement plan. This guidance is effective for fiscal years ending after December 15, 2009, with early adoption

permitted. We adopted the disclosure requirements in fiscal 2010. See Note 14: Pensions and Other Postretirement Benefits for

required disclosures.

In June 2009, the FASB issued guidance removing the concept of a qualifying special-purpose entity. This guidance also clarifies the

requirements for isolation and limitations on portions of financial assets eligible for sale accounting. This guidance is effective for

fiscal years beginning after November 15, 2009. We adopted this guidance at the beginning of fiscal year 2011. The adoption did not

have a significant impact on our consolidated financial statements.

In June 2009 and December 2009, the FASB issued guidance requiring an analysis to determine whether a variable interest gives the

entity a controlling financial interest in a variable interest entity. This guidance requires an ongoing assessment and eliminates the

quantitative approach previously required for determining whether an entity is the primary beneficiary. This guidance is effective for

fiscal years beginning after November 15, 2009. We adopted this guidance at the beginning of fiscal year 2011. The adoption did not

have a significant impact on our consolidated financial statements.