Tyson Foods 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

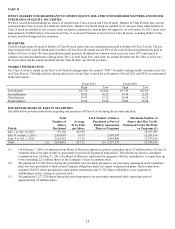

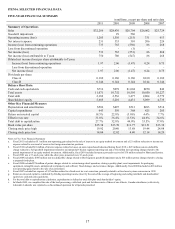

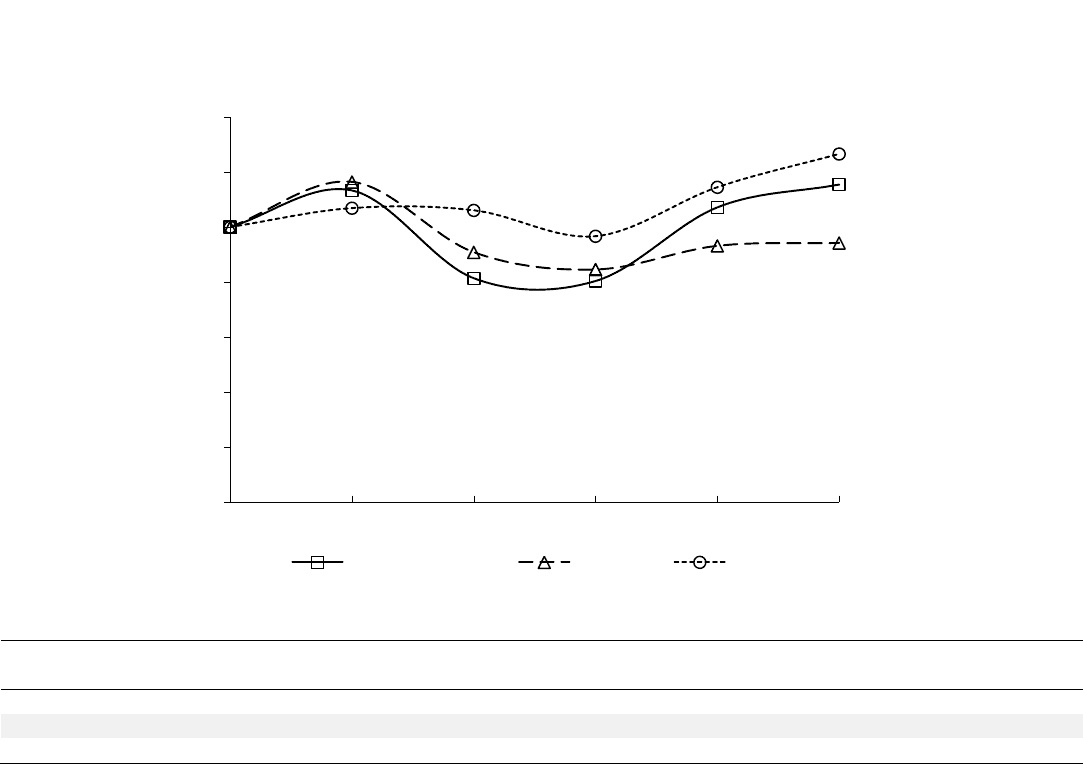

PERFORMANCE GRAPH

The following graph shows a five-year comparison of cumulative total returns for our Class A stock, the Standard & Poor’s (S&P) 500

Index and a group of peer companies described below.

Years Ending

Base Period

9/30/06

9/29/07

9/27/08

10/3/09

10/2/10

10/1/11

Tyson Foods, Inc.

100

113.35

81.41

80.40

107.22

115.51

S&P 500 Index

100

116.44

90.85

84.58

93.17

94.24

Peer Group

100

106.89

106.09

96.68

114.50

126.61

The total cumulative return on investment (change in the year-end stock price plus reinvested dividends), which is based on the stock

price or composite index at the end of fiscal 2006, is presented for each of the periods for the Company, the S&P 500 Index and a peer

group. The peer group includes: Campbell Soup Company, ConAgra Foods, Inc., General Mills, Inc., H.J. Heinz Co., Hershey Foods

Corp., Hormel Foods Corp., Kellogg Co., McCormick & Co., Pilgrim’s Pride Corporation, Sara Lee Corp. and Smithfield Foods, Inc.

The graph compares the performance of the Company with that of the S&P 500 Index and peer group, with the investment weighted

on market capitalization.

$0

$20

$40

$60

$80

$100

$120

$140

9/30/06

9/29/07

9/27/08

10/3/09

10/2/10

10/1/11

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Tyson Foods, Inc., the S&P 500 Index

and a Peer Group

Tyson Foods, Inc.

S&P 500

Peer Group