Tyson Foods 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

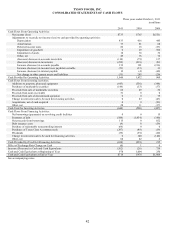

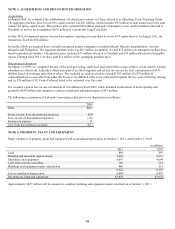

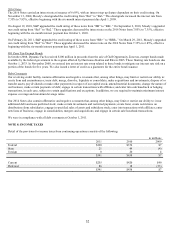

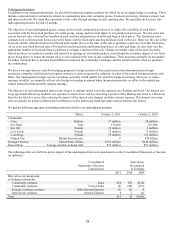

NOTE 5: GOODWILL AND OTHER INTANGIBLE ASSETS

The following table reflects goodwill activity for fiscal years 2011 and 2010:

in millions

Chicken

Beef

Pork

Prepared

Foods

Consolidated

Balances at October 3, 2009:

Goodwill

$973

$1,123

$317

$64

$2,477

Accumulated impairment losses

0

(560)

0

0

(560)

973

563

317

64

1,917

Fiscal 2010 Activity:

Impairment losses

(29)

0

0

0

(29)

Currency translation and other

6

0

0

(1)

5

Balances at October 2, 2010:

Goodwill

$979

$1,123

$317

$63

$2,482

Accumulated impairment losses

(29)

(560)

0

0

(589)

$950

$563

$317

$63

$1,893

Fiscal 2011 Activity:

Impairment losses

0

0

0

0

0

Currency translation and other

(1)

0

0

0

(1)

Balances at October 1, 2011:

Goodwill

978

1,123

317

63

2,481

Accumulated impairment losses

(29)

(560)

0

0

(589)

$949

$563

$317

$63

$1,892

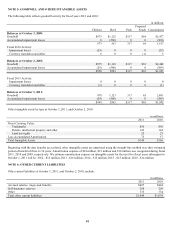

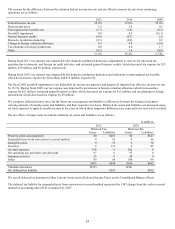

Other intangible assets by type at October 1, 2011, and October 2, 2010:

in millions

2011

2010

Gross Carrying Value:

Trademarks

$56

$56

Patents, intellectual property and other

143

144

Land use rights

25

23

Less Accumulated Amortization

75

57

Total Intangible Assets

$149

$166

Beginning with the date benefits are realized, other intangible assets are amortized using the straight-line method over their estimated

period of benefit of three to 30 years. Amortization expense of $18 million, $19 million and $10 million was recognized during fiscal

2011, 2010 and 2009, respectively. We estimate amortization expense on intangible assets for the next five fiscal years subsequent to

October 1, 2011 will be: 2012 - $16 million; 2013 - $16 million; 2014 - $15 million; 2015 - $15 million; 2016 - $14 million.

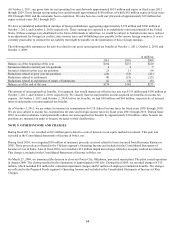

NOTE 6: OTHER CURRENT LIABILITIES

Other current liabilities at October 1, 2011, and October 2, 2010, include:

in millions

2011

2010

Accrued salaries, wages and benefits

$407

$444

Self-insurance reserves

298

256

Other

335

334

Total other current liabilities

$1,040

$1,034