Tyson Foods 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

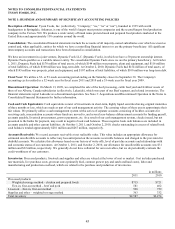

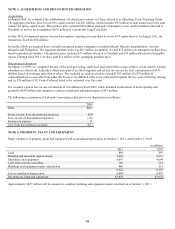

NOTE 3: ACQUISITIONS AND DISCONTINUED OPERATION

Acquisitions

In August 2009, we completed the establishment of related joint ventures in China referred to as Shandong Tyson Xinchang Foods.

The aggregate purchase price for our 60% equity interest was $21 million, which excludes $93 million of cash transferred to the joint

venture for future capital needs. The purchase price included $29 million allocated to Intangible Assets and $19 million allocated to

Goodwill, as well as the assumption of $76 million of Current and Long-Term Debt.

In May 2011, the minority partner exercised put options requiring us to purchase its entire 40% equity interest. In August 2011, the

transaction closed for $66 million.

In October 2008, we acquired three vertically integrated poultry companies in southern Brazil: Macedo Agroindustrial, Avicola

Itaiopolis and Frangobras. The aggregate purchase price was $67 million. In addition, we had $15 million of contingent purchase price

based on production volumes. The purchase price included $23 million allocated to Goodwill and $19 million allocated to Intangible

Assets. Through fiscal 2011, we have paid $11 million of the contingent purchase price.

Discontinued Operation

On March 13, 2009, we completed the sale of the beef processing, cattle feed yard and fertilizer assets of three of our Alberta, Canada

subsidiaries (collectively, Lakeside), which were part of our Beef segment, and related inventories for total consideration of $145

million, based on exchange rates then in effect. This included (a) cash received at closing of $43 million, (b) $78 million of

collateralized notes receivable from either XL Foods or an affiliated entity to be collected throughout the two years following closing,

and (c) $24 million of XL Foods Preferred Stock to be redeemed over five years.

We recorded a pretax loss on sale of Lakeside of $10 million in fiscal 2009, which included an allocation of beef reporting unit

goodwill of $59 million and cumulative currency translation adjustment gains of $41 million.

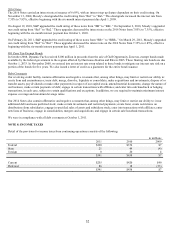

The following is a summary of Lakeside’s operating results prior to its disposition (in millions):

2009

Sales

$461

Pretax income from discontinued operation

$20

Loss on sale of discontinued operation

(10)

Income tax expense

11

Loss from discontinued operation

$(1)

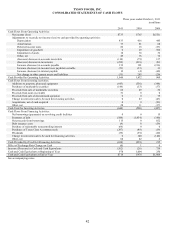

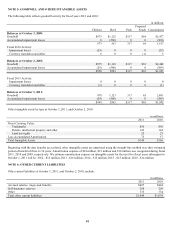

NOTE 4: PROPERTY, PLANT AND EQUIPMENT

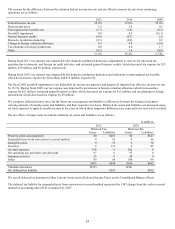

Major categories of property, plant and equipment and accumulated depreciation at October 1, 2011, and October 2, 2010:

in millions

2011

2010

Land

$95

$97

Building and leasehold improvements

2,698

2,617

Machinery and equipment

4,897

4,694

Land improvements and other

386

232

Buildings and equipment under construction

446

513

8,522

8,153

Less accumulated depreciation

4,699

4,479

Net property, plant and equipment

$3,823

$3,674

Approximately $427 million will be required to complete buildings and equipment under construction at October 1, 2011.