Tyson Foods 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

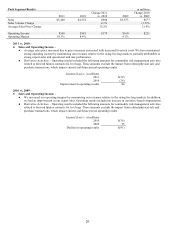

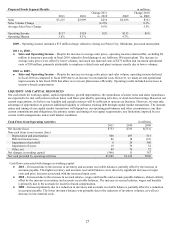

Cash Flows from Investing Activities

in millions

2011

2010

2009

Additions to property, plant and equipment

$(643)

$(550)

$(368)

Proceeds from sale (purchases) of marketable securities, net

(80)

(4)

19

Proceeds from notes receivable

51

0

0

Proceeds from sale of discontinued operation

0

0

75

Change in restricted cash to be used for investing activities

0

43

(43)

Acquisitions, net of cash acquired

0

0

(93)

Other, net

28

11

(17)

Net cash used for investing activities

$(644)

$(500)

$(427)

●

Additions to property, plant and equipment include acquiring new equipment and upgrading our facilities to maintain

competitive standing and position us for future opportunities. In fiscal 2011, our capital spending was primarily for

production efficiencies in our operations and for ongoing development of foreign operations. In fiscal 2010, our capital

spending was primarily related to production efficiencies in our operations, construction of Dynamic Fuels’ facility and

development of our foreign operations. In fiscal 2009, our capital spending was for improvements made in our prepared

foods operations to increase efficiencies, construction of Dynamic Fuels’ facility and development of our foreign

operations.

●

Capital spending for fiscal 2012 is expected to be approximately $800-$850 million, and includes spending on our

operations for production and labor efficiencies, yield improvements and sales channel flexibility, as well as

expansion of our foreign operations.

●

Purchases of marketable securities included funding for our deferred compensation plans.

●

Proceeds from notes receivable totaling $51 million in fiscal 2011 related to the collection of notes receivable received in

conjunction with the sale of a business operation in fiscal 2009.

●

Change in restricted cash – In fiscal 2009, Dynamic Fuels received $100 million in proceeds from the sale of Gulf

Opportunity Zone tax

-exempt bonds made available by the federal government to the regions affected by Hurricanes

Katrin

a and Rita in 2005. The cash received from these bonds was restricted and could only be used towards the

construction of the Dynamic Fuels’ facility.

●

Acquisitions – In fiscal 2009, we acquired three vertically integrated poultry companies in southern Brazil. The aggregate

purchase price was $67 million. In addition, we had $15 million of contingent purchase price based on production

volumes. The joint ventures in China called Shandong Tyson Xinchang Foods received the necessary government

approvals during fiscal 2009. The aggregate purchase price for our 60% equity interest was $21 million, which excludes

$93 million of cash transferred to the joint venture for future capital needs.