Tyson Foods 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

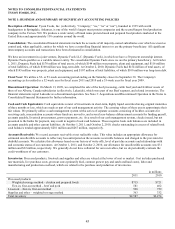

Interest Rate Risk: At October 1, 2011, we had variable rate debt of $211 million with a weighted average interest rate of 4.1%. A

hypothetical 10% increase in interest rates effective at October 1, 2011, and October 2, 2010, would have a minimal effect on interest

expense.

Additionally, changes in interest rates impact the fair value of our fixed-rate debt. At October 1, 2011, we had fixed-rate debt of $2.0

billion with a weighted average interest rate of 9.2%. Market risk for fixed-rate debt is estimated as the potential increase in fair value,

resulting from a hypothetical 10% decrease in interest rates. A hypothetical 10% decrease in interest rates would have increased the

fair value of our fixed-rate debt by approximately $5 million at October 1, 2011, and $9 million at October 2, 2010. The fair values of

our debt were estimated based on quoted market prices and/or published interest rates.

Foreign Currency Risk: We have foreign exchange gain/loss exposure from fluctuations in foreign currency exchange rates

primarily as a result of certain receivable and payable balances. The primary currency exchanges we have exposure to are the

Brazilian real, the British pound sterling, the Canadian dollar, the Chinese renminbi, the European euro, and the Mexican peso. We

periodically enter into foreign exchange forward and option contracts to hedge some portion of our foreign currency exposure. A

hypothetical 10% change in foreign exchange rates effective at October 1, 2011, and October 2, 2010, related to the foreign exchange

forward and option contracts would have an $18 million and $17 million impact, respectively, on pretax income. In the future, we may

enter into more foreign exchange forward and option contracts as a result of our international growth strategy.

Concentrations of Credit Risk: Our financial instruments exposed to concentrations of credit risk consist primarily of cash

equivalents and trade receivables. Our cash equivalents are in high quality securities placed with major banks and financial

institutions. Concentrations of credit risk with respect to receivables are limited due to our large number of customers and their

dispersion across geographic areas. We perform periodic credit evaluations of our customers’ financial condition and generally do not

require collateral. At October 1, 2011, and October 2, 2010, 16.5% and 15.3%, respectively, of our net accounts receivable balance

was due from Wal-Mart Stores, Inc. No other single customer or customer group represented greater than 10% of net accounts

receivable.