Tyson Foods 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

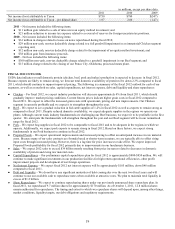

Interest Expense

in millions

2011

2010

2009

Cash interest expense

$195

$245

$270

Losses on notes repurchased

7

61

3

Non-cash interest expense

40

41

54

Total Interest Expense

$242

$347

$327

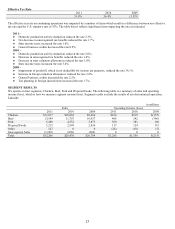

2011 vs. 2010 –

●

Cash interest expense included interest expense related to the coupon rates for senior notes and commitment/letter of

credit fees incurred on our revolving credit facilities. The decrease is due

primarily

to lower average weekly indebtedness

of approximately 15%.

●

Losses on notes repurchased during fiscal 2011 and 2010 included the amount paid exceeding the carrying value of the

notes repurchased, which primarily included the repurchases of the 8.25% Notes due October 2011 (2011 Notes) and the

6.85% Senior notes due April 2016 (2016 Notes).

●

Non-cash interest expense primarily included interest related to the amortization of debt issuance costs and

discounts/premiums on note issuances. This included debt issuance costs incurred on our revolving credit facility, the

10.50% Senior Notes due 2014 (2014 Notes) issued in March 2009, as well as the accretion of the debt discount on the

3.25% Convertible Senior Notes due 2013 (2013 Notes) and 2014 Notes.

2010 vs. 2009 –

●

Cash interest expense included interest expense related to the coupon rates for senior notes and commitment/letter of

credit fees incurred on our revolving credit facilities. The decrease is due to lower average weekly indebtedness of

approximately 11%, partially offset by an increase in the overall average borrowing rates.

●

Losses on notes repurchased during fiscal 2010 included the amount paid exceeding the carrying value of the notes

repurchased, which primarily included the repurchases of the 2011 Notes and the 2016 Notes.

●

Non-cash interest expense primarily included interest related to the amortization of debt issuance costs and

discounts/premiums on note issuances. This included debt issuance costs incurred on our revolving credit facility, the

2014 Notes, as well as the accretion of the debt discount on the 2013 Notes and 2014 Notes. Fiscal 2009 also includes

expenses related to amendment fees paid in December 2008 on our then existing credit agreements.

Other (Income) Expense, net

in millions

2011

2010

2009

$(20)

$20

$18

2011 – Included $11 million gain related to a sale of interests in an equity method investment.

2010 – Included $12 million charge related to the impairment of an equity method investment.

2009 – Included $24 million in foreign currency exchange loss.