Tyson Foods 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

If the Domestic Chicken reporting unit experienced a 15% or more decline in fair value at July 1, 2011, it would have caused the

carrying value of the reporting unit to be in excess of fair value, which would have required the second step to be performed.

Additionally, valuing the Domestic Chicken reporting unit utilizing projected operating margins averaging less than 4.0%, or a 0.9%

increase in the discount rate used in fiscal 2011, would have caused the carrying value of the Domestic Chicken reporting unit to be in

excess of fair value, which would have required the second step to be performed. The second step may have resulted in a material

goodwill impairment loss. All other material reporting units’ estimated fair value exceeded their carrying value by more than 20%.

Consequently, we do not consider any of our other material reporting units at significant risk of failing the first step of the annual

goodwill impairment test.

Our fiscal 2011 other indefinite life intangible asset impairment analysis did not result in a material impairment charge. A hypothetical

20% decrease in the fair value of intangible assets would not result in a material impairment.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

MARKET RISK

Market risk relating to our operations results primarily from changes in commodity prices, interest rates and foreign exchange rates, as

well as credit risk concentrations. To address certain of these risks, we enter into various derivative transactions as described below. If

a derivative instrument is accounted for as a hedge, depending on the nature of the hedge, changes in the fair value of the instrument

either will be offset against the change in fair value of the hedged assets, liabilities or firm commitments through earnings, or be

recognized in other comprehensive income (loss) until the hedged item is recognized in earnings. The ineffective portion of an

instrument’s change in fair value is recognized immediately. Additionally, we hold certain positions, primarily in grain and livestock

futures that either do not meet the criteria for hedge accounting or are not designated as hedges. With the exception of normal

purchases and normal sales that are expected to result in physical delivery, we record these positions at fair value, and the unrealized

gains and losses are reported in earnings at each reporting date. Changes in market value of derivatives used in our risk management

activities relating to forward sales contracts are recorded in sales. Changes in market value of derivatives used in our risk management

activities surrounding inventories on hand or anticipated purchases of inventories are recorded in cost of sales.

The sensitivity analyses presented below are the measures of potential losses of fair value resulting from hypothetical changes in

market prices related to commodities. Sensitivity analyses do not consider the actions we may take to mitigate our exposure to

changes, nor do they consider the effects such hypothetical adverse changes may have on overall economic activity. Actual changes in

market prices may differ from hypothetical changes.

Commodities Risk: We purchase certain commodities, such as grains and livestock, in the course of normal operations. As part of our

commodity risk management activities, we use derivative financial instruments, primarily futures and options, to reduce the effect of

changing prices and as a mechanism to procure the underlying commodity. However, as the commodities underlying our derivative

financial instruments can experience significant price fluctuations, any requirement to mark-to-market the positions that have not been

designated or do not qualify as hedges could result in volatility in our results of operations. Contract terms of a hedge instrument

closely mirror those of the hedged item providing a high degree of risk reduction and correlation. Contracts designated and highly

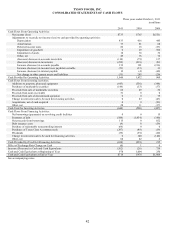

effective at meeting this risk reduction and correlation criteria are recorded using hedge accounting. The following table presents a

sensitivity analysis resulting from a hypothetical change of 10% in market prices as of October 1, 2011, and October 2, 2010, on the

fair value of open positions. The fair value of such positions is a summation of the fair values calculated for each commodity by

valuing each net position at quoted futures prices. The market risk exposure analysis includes hedge and non-hedge derivative

financial instruments.

Effect of 10% change in fair value

in millions

2011

2010

Livestock:

Cattle

$34

$39

Hogs

57

42

Grain

11

10