The Hartford 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255

|

|

83

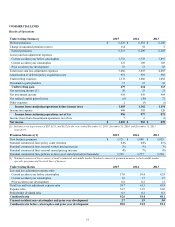

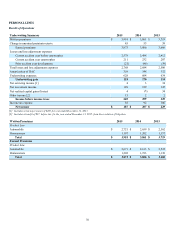

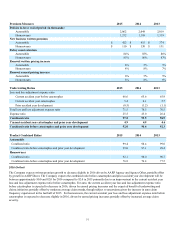

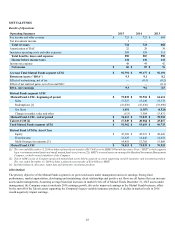

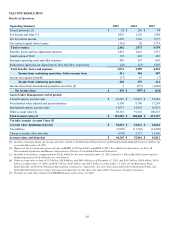

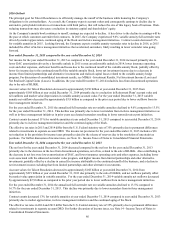

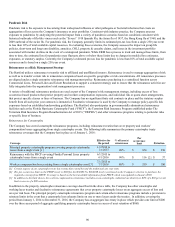

MUTUAL FUNDS

Results of Operations

Operating Summary 2015 2014 2013

Fee income and other revenue $ 723 $ 723 $ 668

Net investment income 1 — —

Total revenues 724 723 668

Amortization of DAC 22 28 39

Insurance operating costs and other expenses 568 559 511

Total benefits, losses and expenses 590 587 550

Income before income taxes 134 136 118

Income tax expense 48 49 42

Net income $ 86 $ 87 $ 76

Average Total Mutual Funds segment AUM $ 92,791 $ 95,177 $ 92,191

Return on Assets ("ROA") 9.3 9.1 8.2

Effect of restructuring, net of tax — (0.5) (0.2)

Effect of net realized gains, net of tax and DAC — — (0.1)

ROA, core earnings 9.3 9.6 8.5

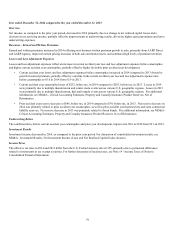

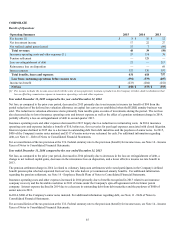

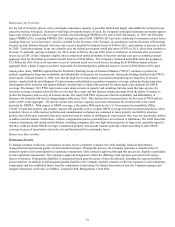

Mutual Funds segment AUM

Mutual Fund AUM - beginning of period $ 73,035 $ 70,918 $ 61,611

Sales 17,527 15,249 15,172

Redemptions [1] (16,036)(16,636) (19,696)

Net flows 1,491 (1,387) (4,524)

Change in market value and other (113) 3,504 13,831

Mutual Fund AUM - end of period $ 74,413 $ 73,035 $ 70,918

Talcott AUM [2] $ 17,549 $ 20,584 $ 25,817

Total Mutual Funds segment AUM $ 91,962 $ 93,619 $ 96,735

Mutual Fund AUM by Asset Class

Equity $ 47,369 $ 45,221 $ 42,426

Fixed Income 12,625 14,046 14,632

Multi-Strategy Investments [3] 14,419 13,768 13,860

Mutual Fund AUM $ 74,413 $ 73,035 $ 70,918

[1] The year ended December 31, 2014 includes a planned asset transfer of $0.7 billion to the HIMCO Variable Insurance Trust (“HVIT”) which supports

legacy retirement mutual funds and runoff mutual funds (see footnote [2]). HVIT's invested assets are managed by Hartford Investment Management

Company, a wholly-owned subsidiary of the Company.

[2] Talcott AUM consist of Company-sponsored mutual fund assets held in separate accounts supporting variable insurance and investment products.

The year ended December 31, 2014 includes a planned asset transfer of $2.0 billion to HVIT.

[3] Includes balanced, allocation, target date and alternative investment products.

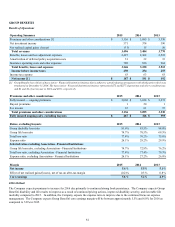

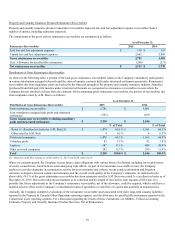

2016 Outlook

The primary objective of the Mutual Funds segment is to grow total assets under management and core earnings. Strong fund

performance, market appreciation, developing and maintaining client relationships and positive net flows are all factors that can increase

assets under management. Assuming average historical increases in market levels off of Mutual Funds December 31, 2015 assets under

management, the Company expects moderate 2016 earnings growth, driven by improved earnings in the Mutual Funds business, offset

by the run-off of the Talcott assets supporting the Company's legacy variable insurance products. A decline in market levels in 2016

would negatively impact earnings.