The Hartford 2015 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255

|

|

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

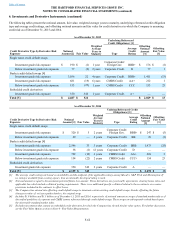

6. Investments and Derivative Instruments (continued)

F-59

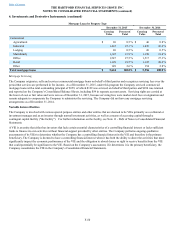

As of December 31, 2015, the before-tax deferred net gains on derivative instruments recorded in AOCI that are expected to be

reclassified to earnings during the next twelve months are $54. This expectation is based on the anticipated interest payments on hedged

investments in fixed maturity securities that will occur over the next twelve months, at which time the Company will recognize the

deferred net gains (losses) as an adjustment to net investment income over the term of the investment cash flows. The maximum term

over which the Company is hedging its exposure to the variability of future cash flows for forecasted transactions, excluding interest

payments on existing variable-rate financial instruments, is approximately three years.

During the years ended December 31, 2015, 2014, and 2013, the Company had no net reclassifications from AOCI to earnings resulting

from the discontinuance of cash-flow hedges due to forecasted transactions that were no longer probable of occurring.

Fair Value Hedges

For derivative instruments that are designated and qualify as fair value hedges, the gain or loss on the derivatives as well as the offsetting

loss or gain on the hedged items attributable to the hedged risk are recognized in current earnings. The Company includes the gain or

loss on the derivative in the same line item as the offsetting loss or gain on the hedged item. All components of each derivative’s gain or

loss were included in the assessment of hedge effectiveness.

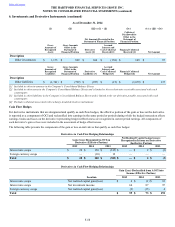

The Company recognized in income gains (losses) representing the ineffective portion of fair value hedges as follows:

Derivatives in Fair Value Hedging Relationships

Gain (Loss) Recognized in Income [1]

2015 2014 2013

Derivative Hedged Item Derivative Hedged Item Derivative Hedged Item

Interest rate swaps

Net realized capital gains (losses) $ — $ — $ (3) $ 1 $ 7 $ (12)

Foreign currency swaps

Net realized capital gains (losses) — — — — 1 (1)

Benefits, losses and loss adjustment expenses — — — — (2) 2

Total $ — $ — $ (3) $ 1 $ 6 $ (11)

[1] The amounts presented do not include the periodic net coupon settlements of the derivative or the coupon income (expense) related to the hedged

item. The net of the amounts presented represents the ineffective portion of the hedge.