The Hartford 2015 Annual Report Download - page 247

Download and view the complete annual report

Please find page 247 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

II-7

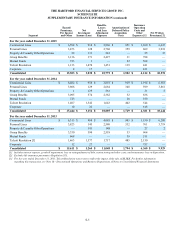

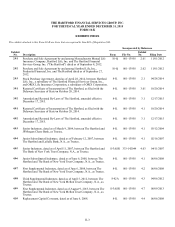

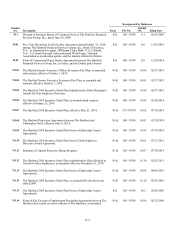

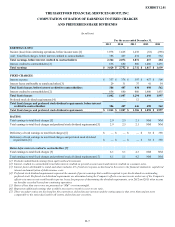

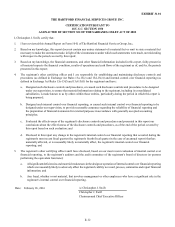

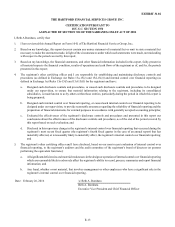

EXHIBIT 12.01

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

COMPUTATION OF RATIOS OF EARNINGS TO FIXED CHARGES

AND PREFERRED SHARE DIVIDENDS

(In millions)

For the years ended December 31,

2015 2014 2013 2012 2011

EARNINGS (LOSS):

Income (loss) from continuing operations, before income taxes [1] 1,978 1,665 1,438 (81) (358)

Add: Total fixed charges, before interest credited to contractholders 386 407 434 498 562

Total earnings, before interest credited to contractholders 2,364 2,072 1,872 417 204

Interest credited to contractholders [2] 656 680 860 1,400 1,435

Total earnings $ 3,020 $ 2,752 $ 2,732 $ 1,817 $ 1,639

FIXED CHARGES:

Interest expense $ 357 $ 376 $ 397 $ 457 $ 508

Interest factor attributable to rentals and other [3] 29 31 37 41 54

Total fixed charges, before interest credited to contractholders 386 407 434 498 562

Interest credited to contractholders [2] 656 680 860 1,400 1,435

Total fixed charges 1,042 1,087 1,294 1,898 1,997

Preferred stock dividend requirements [4] — — 12 — —

Total fixed charges and preferred stock dividend requirements, before interest

credited to contractholders 386 407 446 498 562

Total fixed charges and preferred stock dividend requirements $ 1,042 $ 1,087 $ 1,306 $ 1,898 $ 1,997

RATIOS:

Total earnings to total fixed charges [5] 2.9 2.5 2.1 NM NM

Total earnings to total fixed charges and preferred stock dividend requirements [5] 2.9 2.5 2.1 NM NM

Deficiency of total earnings to total fixed charges [6] $ — $ — $ — $ 81 $ 358

Deficiency of total earnings to total fixed charges and preferred stock dividend

requirements [6] $ — $ — $ — $ 81 $ 358

Ratios before interest credited to contractholders [7]

Total earnings to total fixed charges [5] 6.1 5.1 4.3 NM NM

Total earnings to total fixed charges and preferred stock dividend requirements [5] 6.1 5.1 4.2 NM NM

[1] Excludes undistributed earnings from equity method investments.

[2] Interest credited to contractholders includes interest credited on general account assets and interest credited on consumer notes.

[3] Interest factor attributable to rental and others includes 1/3 of total rent expense as disclosed in the notes to the financial statements, capitalized

interest and amortization of debt issuance costs.

[4] Preferred stock dividend requirements represent the amount of pre-tax earnings that would be required to pay the dividends on outstanding

preferred stock. Preferred stock dividend requirements are determined using the Company's effective income tax rate unless use of the Company's

effective income tax rate would result in pre-tax losses for purposes of determining the dividend requirements, as in 2012 and 2011 when income

tax benefits exceeded losses from continuing operations.

[5] Ratios of less than one-to-one are presented as “NM” or not meaningful.

[6] Represents additional earnings that would be necessary to result in a one-to-one ratio.

[7] These secondary ratios are disclosed for the convenience of fixed income investors and the rating agencies that serve them and are more

comparable to the ratios disclosed by all issuers of fixed income securities.