The Hartford 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255

|

|

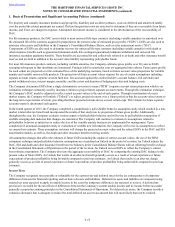

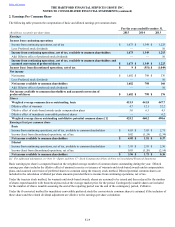

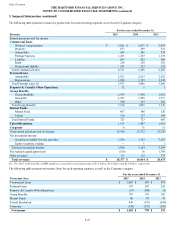

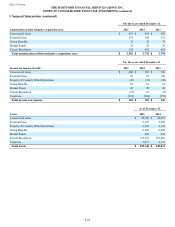

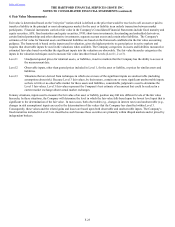

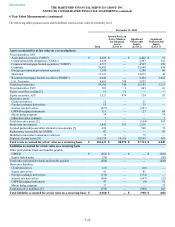

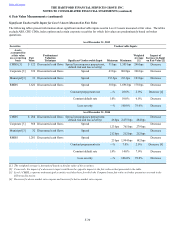

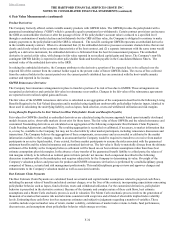

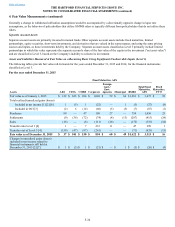

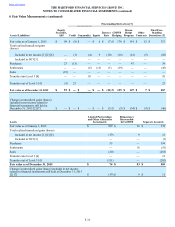

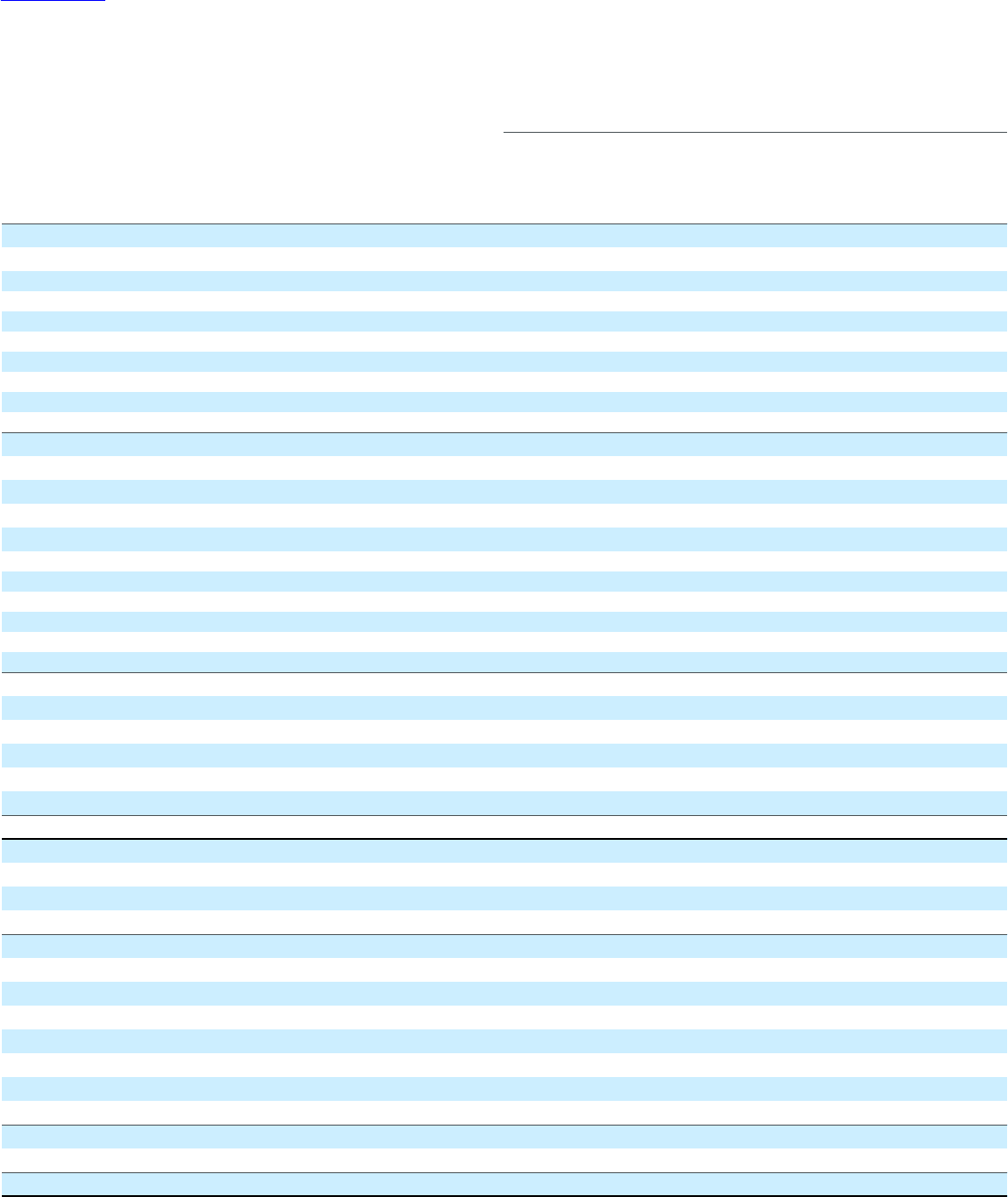

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

4. Fair Value Measurements (continued)

F-25

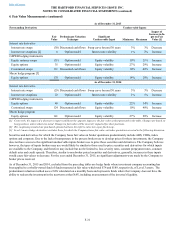

December 31, 2014

Total

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

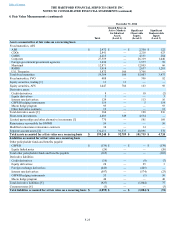

Assets accounted for at fair value on a recurring basis

Fixed maturities, AFS

ABS $ 2,472 $ — $ 2,350 $ 122

CDOs 2,841 — 2,218 623

CMBS 4,415 — 4,131 284

Corporate 27,359 — 26,319 1,040

Foreign government/government agencies 1,636 — 1,577 59

Municipal 12,871 — 12,805 66

RMBS 3,918 — 2,637 1,281

U.S. Treasuries 3,872 106 3,766 —

Total fixed maturities 59,384 106 55,803 3,475

Fixed maturities, FVO 488 — 396 92

Equity securities, trading [1] 11 11 — —

Equity securities, AFS 1,047 786 163 98

Derivative assets

Credit derivatives 8 — 10 (2)

Equity derivatives 3 — — 3

Interest rate derivatives 129 — 113 16

GMWB hedging instruments 119 — 5 114

Macro hedge program 93 — — 93

Other derivative contracts 12 — — 12

Total derivative assets [2] 364 — 128 236

Short-term investments 4,883 349 4,534 —

Limited partnerships and other alternative investments [3] 770 — 581 189

Reinsurance recoverable for GMWB 56 — — 56

Modified coinsurance reinsurance contracts 34 — 34 —

Separate account assets [4] 132,211 91,537 40,096 578

Total assets accounted for at fair value on a recurring basis $ 199,248 $ 92,789 $ 101,735 $ 4,724

Liabilities accounted for at fair value on a recurring basis

Other policyholder funds and benefits payable

GMWB $ (139) $ — $ — $ (139)

Equity linked notes (26) — — (26)

Total other policyholder funds and benefits payable (165) — — (165)

Derivative liabilities

Credit derivatives (16) — (9) (7)

Equity derivatives 28 — 25 3

Foreign exchange derivatives (445) — (445) —

Interest rate derivatives (597) — (574) (23)

GMWB hedging instruments 55 — (1) 56

Macro hedge program 48 — — 48

Total derivative liabilities [5] (927) — (1,004) 77

Consumer notes [6] (3) — — (3)

Total liabilities accounted for at fair value on a recurring basis $ (1,095) $ — $ (1,004) $ (91)