The Hartford 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

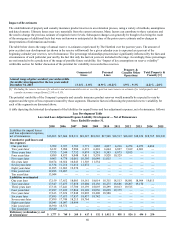

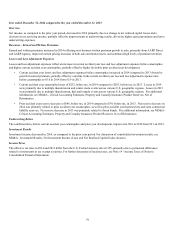

Loss and Loss Adjustment Expense Ratio

The loss and loss adjustment expense ratio is a measure of the cost of claims incurred in the calendar year divided by earned premium

and includes losses incurred for both the current and prior accident years, as well as the costs of mortality and morbidity and other

contractholder benefits to policyholders. Among other factors, the loss and loss adjustment expense ratio needed for the Company to

achieve its targeted return on equity fluctuates from year to year based on changes in the expected investment yield over the claim

settlement period, the timing of expected claim settlements and the targeted returns set by management based on the competitive

environment.

The loss and loss adjustment expense ratio is affected by claim frequency and claim severity, particularly for shorter-tail property lines

of business, where the emergence of claim frequency and severity is credible and likely indicative of ultimate losses. Claim frequency

represents the percentage change in the average number of reported claims per unit of exposure in the current accident year compared to

that of the previous accident year. Claim severity represents the percentage change in the estimated average cost per claim in the current

accident year compared to that of the previous accident year. As one of the factors used to determine pricing, the Company’s practice is

to first make an overall assumption about claim frequency and severity for a given line of business and then, as part of the ratemaking

process, adjust the assumption as appropriate for the particular state, product or coverage.

Loss Ratio, excluding Buyouts

The loss ratio is utilized for the Group Benefits segment and is expressed as a ratio of benefits, losses and loss adjustment expenses to

premiums and other considerations, excluding buyout premiums. Since Group Benefits occasionally buys a block of claims for a stated

premium amount, the Company excludes this buyout from the loss ratio used for evaluating the underwriting results of the business as

buyouts may distort the loss ratio. Buyout premiums represent takeover of open claim liabilities and other non-recurring premium

amounts.

Mutual Fund Assets

Mutual fund assets are owned by the shareholders of those funds and not by the Company and therefore are not reflected in the

Company’s consolidated financial statements. Mutual fund assets are a measure used by the Company because a significant portion of

the Company’s revenues are based upon asset values. These revenues increase or decrease with a rise or fall in AUM whether caused by

changes in the market or through net flows.

New Business Written Premium

New business written premium represents the amount of premiums charged for policies issued to customers who were not insured with

the Company in the previous policy term. New business written premium plus renewal policy written premium equals total written

premium.

Policies in Force

Policies in force represent the number of policies with coverage in effect as of the end of the period. The number of policies in force is a

growth measure used for Personal Lines and standard commercial lines within Commercial Lines and is affected by both new business

growth and policy count retention.

Policy Count Retention

Policy count retention represents the ratio of the number of policies renewed during the period divided by the number of policies

available to renew. The number of policies available to renew represents the number of policies, net of any cancellations, written in the

previous policy term. Policy count retention is affected by a number of factors, including the percentage of renewal policy quotes

accepted and decisions by the Company to non-renew policies because of specific policy underwriting concerns or because of a decision

to reduce premium writings in certain classes of business or states. Policy count retention is also affected by advertising and rate actions

taken by competitors.

Policyholder Dividend Ratio

The policyholder dividend ratio is the ratio of policyholder dividends to earned premium.

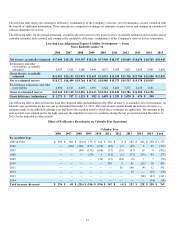

Prior Accident Year Loss and Loss Adjustment Expense Ratio

The prior accident year loss and loss adjustment expense ratio represents the increase (decrease) in the estimated cost of settling

catastrophe and non-catastrophe claims incurred in prior accident years as recorded in the current calendar year divided by earned

premiums.