The Hartford 2015 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

12. Commitments and Contingencies (continued)

F-74

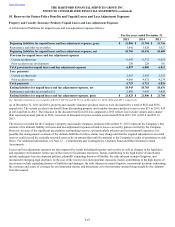

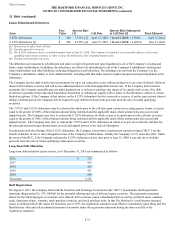

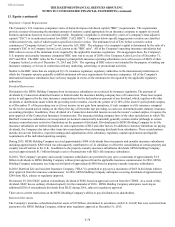

Asbestos and Environmental Claims

The Company continues to receive asbestos and environmental claims. Asbestos claims relate primarily to bodily injuries asserted by

people who came in contact with asbestos or products containing asbestos. Environmental claims relate primarily to pollution and

related clean-up costs.

The Company wrote several different categories of insurance contracts that may cover asbestos and environmental claims. First, the

Company wrote primary policies providing the first layer of coverage in an insured’s liability program. Second, the Company wrote

excess policies providing higher layers of coverage for losses that exhaust the limits of underlying coverage. Third, the Company acted

as a reinsurer assuming a portion of those risks assumed by other insurers writing primary, excess and reinsurance coverages. Fourth,

subsidiaries of the Company participated in the London Market, writing both direct insurance and assumed reinsurance business.

Significant uncertainty limits the ability of insurers and reinsurers to estimate the ultimate reserves necessary for unpaid losses and

expenses related to environmental and particularly asbestos claims. The degree of variability of reserve estimates for these exposures is

significantly greater than for other more traditional exposures.

In the case of the reserves for asbestos exposures, factors contributing to the high degree of uncertainty include inadequate loss

development patterns, plaintiffs’ expanding theories of liability, the risks inherent in major litigation, and inconsistent emerging legal

doctrines. Furthermore, over time, insurers, including the Company, have experienced significant changes in the rate at which asbestos

claims are brought, the claims experience of particular insureds, and the value of claims, making predictions of future exposure from

past experience uncertain. Plaintiffs and insureds also have sought to use bankruptcy proceedings, including “pre-packaged”

bankruptcies, to accelerate and increase loss payments by insurers. In addition, some policyholders have asserted new classes of claims

for coverages to which an aggregate limit of liability may not apply. Further uncertainties include insolvencies of other carriers and

unanticipated developments pertaining to the Company’s ability to recover reinsurance for asbestos and environmental claims.

Management believes these issues are not likely to be resolved in the near future.

In the case of the reserves for environmental exposures, factors contributing to the high degree of uncertainty include expanding theories

of liability and damages, the risks inherent in major litigation, inconsistent decisions concerning the existence and scope of coverage for

environmental claims, and uncertainty as to the monetary amount being sought by the claimant from the insured.

The reporting pattern for assumed reinsurance claims, including those related to asbestos and environmental claims, is much longer than

for direct claims. In many instances, it takes months or years to determine that the policyholder’s own obligations have been met and

how the reinsurance in question may apply to such claims. The delay in reporting reinsurance claims and exposures adds to the

uncertainty of estimating the related reserves.

It is also not possible to predict changes in the legal and legislative environment and their effect on the future development of asbestos

and environmental claims.

Given the factors described above, the Company believes the actuarial tools and other techniques it employs to estimate the ultimate cost

of claims for more traditional kinds of insurance exposure are less precise in estimating reserves for asbestos and environmental

exposures. For this reason, the Company principally relies on exposure-based analysis to estimate the ultimate costs of these claims and

regularly evaluates new account information in assessing its potential asbestos and environmental exposures. The Company supplements

this exposure-based analysis with evaluations of the Company’s historical direct net loss and expense paid and reported experience, and

net loss and expense paid and reported experience by calendar and/or report year, to assess any emerging trends, fluctuations or

characteristics suggested by the aggregate paid and reported activity.

As of December 31, 2015 and 2014, the Company reported $1.7 billion of net asbestos reserves and $256 and $247 of net environmental

reserves, respectively. The Company believes that its current asbestos and environmental reserves are appropriate. However, analyses of

future developments could cause The Hartford to change its estimates and ranges of its asbestos and environmental reserves, and the

effect of these changes could be material to the Company’s consolidated operating results and liquidity.

Lease Commitments

The total rental expense on operating leases was $60, $62, and $79 in 2015, 2014, and 2013, respectively, which excludes sublease rental

income of $3, $4, and $8 in 2015, 2014 and 2013, respectively.