The Hartford 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

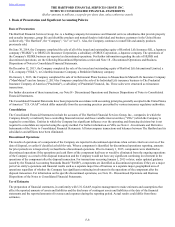

1. Basis of Presentation and Significant Accounting Policies (continued)

F-12

Interest rate, volatility, dividend, credit default and index swaps involve the periodic exchange of cash flows with other parties, at

specified intervals, calculated using agreed upon rates or other financial variables and notional principal amounts. Generally, little to no

cash or principal payments are exchanged at the inception of the contract. Typically, at the time a swap is entered into, the cash flow

streams exchanged by the counterparties are equal in value.

Interest rate cap and floor contracts entitle the purchaser to receive from the issuer at specified dates, the amount, if any, by which a

specified market rate exceeds the cap strike interest rate or falls below the floor strike interest rate, applied to a notional principal

amount. A premium payment is made by the purchaser of the contract at its inception and no principal payments are exchanged.

Forward contracts are customized commitments that specify a rate of interest or currency exchange rate to be paid or received on an

obligation beginning on a future start date and are typically settled in cash.

Financial futures are standardized commitments to either purchase or sell designated financial instruments, at a future date, for a

specified price and may be settled in cash or through delivery of the underlying instrument. Futures contracts trade on organized

exchanges. Margin requirements for futures are met by pledging securities or cash, and changes in the futures’ contract values are settled

daily in cash.

Option contracts grant the purchaser, for a premium payment, the right to either purchase from or sell to the issuer a financial instrument

at a specified price, within a specified period or on a stated date. The contracts may reference commodities, which grant the purchaser

the right to either purchase from or sell to the issuer commodities at a specified price, within a specified period or on a stated date.

Option contracts are typically settled in cash.

Foreign currency swaps exchange an initial principal amount in two currencies, agreeing to re-exchange the currencies at a future date,

at an agreed upon exchange rate. There may also be a periodic exchange of payments at specified intervals calculated using the agreed

upon rates and exchanged principal amounts.

The Company’s derivative transactions conducted in insurance company subsidiaries are used in strategies permitted under the

derivative use plans required by the State of Connecticut, the State of Illinois and the State of New York insurance departments.

Accounting and Financial Statement Presentation of Derivative Instruments and Hedging Activities

Derivative instruments are recognized on the Consolidated Balance Sheets at fair value and are reported in Other Investments and Other

Liabilities. For balance sheet presentation purposes, the Company has elected to offset the fair value amounts, income accruals, and

related cash collateral receivables and payables of OTC derivative instruments executed in a legal entity and with the same counterparty

or under a master netting agreement, which provides the Company with the legal right of offset.

The Company also clears interest rate swap and certain credit default swap derivative transactions through central clearing houses. OTC-

cleared derivatives require initial collateral at the inception of the trade in the form of cash or highly liquid collateral, such as U.S.

Treasuries and government agency investments. Central clearing houses also require additional cash collateral as variation margin based

on daily market value movements. For information on collateral, see the derivative collateral arrangements section in Note 6 -

Investments and Derivative Instruments of Notes to Consolidated Financial Statement. In addition, OTC-cleared transactions include

price alignment interest either received or paid on the variation margin, which is reflected in net investment income. The Company has

also elected to offset the fair value amounts, income accruals and related cash collateral receivables and payables of OTC-cleared

derivative instruments based on clearing house agreements.

On the date the derivative contract is entered into, the Company designates the derivative as (1) a hedge of the fair value of a recognized

asset or liability (“fair value” hedge), (2) a hedge of the variability in cash flows of a forecasted transaction or of amounts to be received

or paid related to a recognized asset or liability (“cash flow” hedge), (3) a hedge of a net investment in a foreign operation (“net

investment” hedge) or (4) held for other investment and/or risk management purposes, which primarily involve managing asset or

liability related risks and do not qualify for hedge accounting.

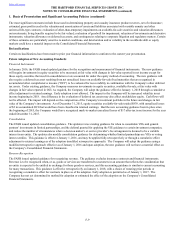

Fair Value Hedges

Changes in the fair value of a derivative that is designated and qualifies as a fair value hedge, including foreign-currency fair value

hedges, along with the changes in the fair value of the hedged asset or liability that is attributable to the hedged risk, are recorded in

current period earnings as net realized capital gains and losses with any differences between the net change in fair value of the derivative

and the hedged item representing the hedge ineffectiveness. Periodic cash flows and accruals of income/expense (“periodic derivative

net coupon settlements”) are recorded in the line item of the Consolidated Statements of Operations in which the cash flows of the

hedged item are recorded.