The Hartford 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

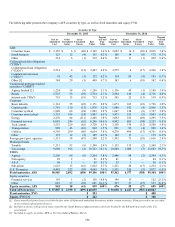

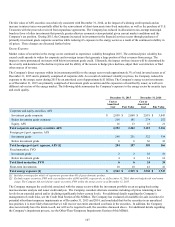

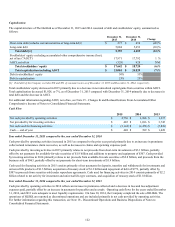

Municipal Bonds

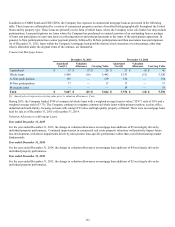

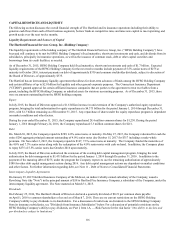

The following table summarizes the amortized cost, fair value, and weighted average credit quality of the Company's available-for-sale

investments in municipal bonds.

December 31, 2015 December 31, 2014

Amortized

Cost Fair Value

Weighted

Average

Credit Quality Amortized

Cost Fair Value

Weighted

Average

Credit Quality

General Obligation $ 2,069 $ 2,243 AA $ 2,259 $ 2,480 AA

Pre-Refunded [1] 850 903 AAA 716 748 AAA

Revenue

Transportation 1,566 1,744 A+ 1,599 1,781 A+

Health Care 1,371 1,499 AA- 1,412 1,560 AA-

Water & Sewer 1,228 1,324 AA 1,204 1,308 AA

Education 1,109 1,205 AA 1,115 1,232 AA

Sales Tax 692 779 AA- 916 1,020 AA-

Leasing [2] 728 803 AA- 772 858 AA-

Power 658 709 A+ 739 814 A+

Housing 91 94 AA 148 153 AA

Other 762 818 AA- 855 917 AA-

Total Revenue 8,205 8,975 AA- 8,760 9,643 AA-

Total Municipal $ 11,124 $ 12,121 AA- $ 11,735 $ 12,871 AA-

[1] Pre-Refunded bonds are bonds for which an irrevocable trust containing sufficient U.S. treasury, agency, or other securities has been established

to fund the remaining payments of principal and interest.

[2] Leasing revenue bonds are generally the obligations of a financing authority established by the municipality that leases facilities back to a

municipality. The notes are typically secured by lease payments made by the municipality that is leasing the facilities financed by the issue. Lease

payments may be subject to annual appropriation by the municipality or the municipality may be obligated to appropriate general tax revenues to

make lease payments.

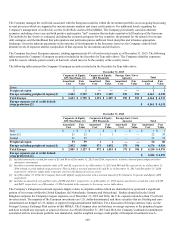

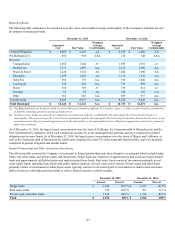

As of December 31, 2015, the largest issuer concentrations were the state of California, the Commonwealth of Massachusetts, and the

New York Dormitory Authority, which each comprised less than 3% of the municipal bond portfolio and were comprised of general

obligation and revenue bonds. As of December 31, 2014, the largest issuer concentrations were the states of Illinois and California, as

well as the Commonwealth of Massachusetts, which each comprised less than 3% of the municipal bond portfolio, and were primarily

comprised of general obligation and taxable bonds.

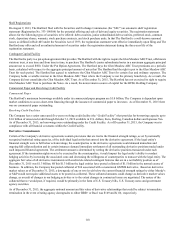

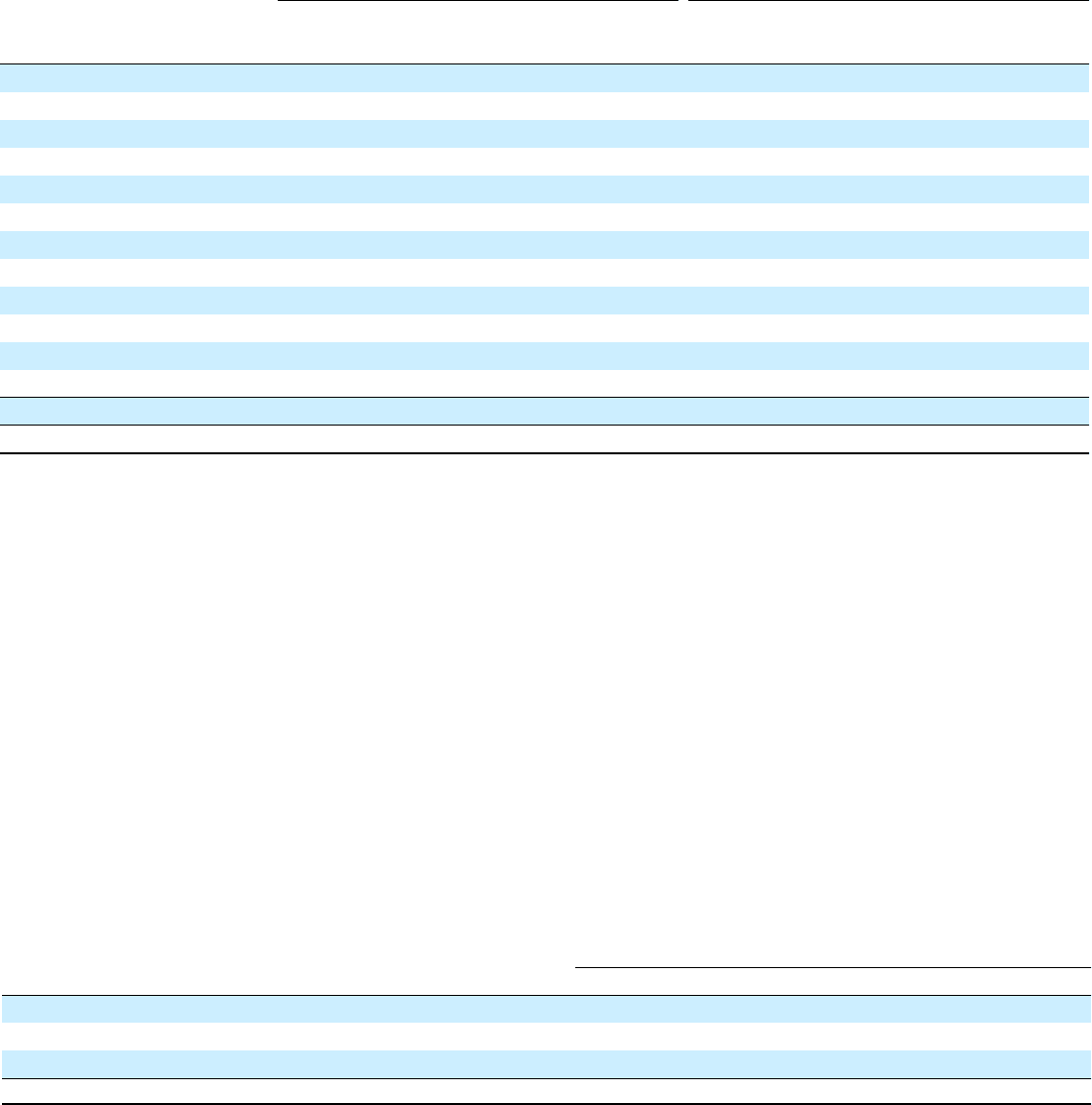

Limited Partnerships and Other Alternative Investments

The following table presents the Company’s investments in limited partnerships and other alternative investments which include hedge

funds, real estate funds, and private equity and other funds. Hedge funds are comprised of approximately half credit and equity-related

funds and approximately half global macro and market neutral focus funds. Real estate funds consist of investments primarily in real

estate equity funds, including some funds with public market exposure, and real estate joint ventures. Private equity and other funds

primarily consist of investments in funds whose assets typically consist of a diversified pool of investments in small to mid-sized non-

public businesses with high growth potential as well as limited exposure to public markets.

December 31, 2015 December 31, 2014

Amount Percent Amount Percent

Hedge funds $ 1,034 36.0 % $ 1,187 40.3 %

Real estate funds 576 20.0 % 561 19.1 %

Private equity and other funds 1,264 44.0 % 1,194 40.6 %

Total $ 2,874 100% $ 2,942 100%