The Hartford 2015 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

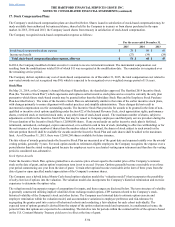

16. Employee Benefit Plans (continued)

F-88

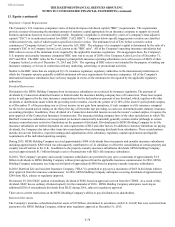

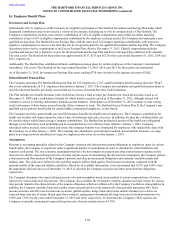

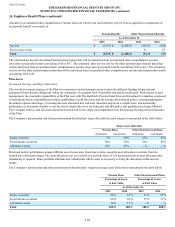

Amounts in accumulated other comprehensive income (loss) on a before tax basis that have not yet been recognized as components of

net periodic benefit cost consist of:

Pension Benefits Other Postretirement Benefits

As of December 31,

2015 2014 2015 2014

Net loss $ (2,553) $ (2,428) $ (123) $ (124)

Prior service credit — — 91 97

Total $ (2,553) $ (2,428) $ (32) $ (27)

The estimated net loss for the defined benefit pension plans that will be amortized from accumulated other comprehensive income

(loss) into net periodic benefit cost during 2016 is $55. The estimated prior service cost for the other postretirement benefit plans that

will be amortized from accumulated other comprehensive income (loss) into net periodic benefit cost during 2016 is $(7). The estimated

net loss for the other postretirement plans that will be amortized from accumulated other comprehensive income into net periodic benefit

cost during 2016 is $5.

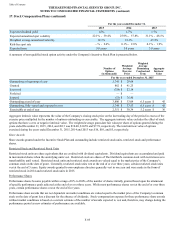

Plan Assets

Investment Strategy and Target Allocation

The overall investment strategy of the Plan is to maximize total investment returns to provide sufficient funding for present and

anticipated future benefit obligations within the constraints of a prudent level of portfolio risk and diversification. With respect to asset

management, the oversight responsibility of the Plan rests with The Hartford’s Pension Fund Trust and Investment Committee composed

of individuals whose responsibilities include establishing overall objectives and the setting of investment policy; selecting appropriate

investment options and ranges; reviewing the asset allocation mix and asset allocation targets on a regular basis; and monitoring

performance to determine whether or not the rate of return objectives are being met and that policy and guidelines are being followed.

The Company believes that the asset allocation decision will be the single most important factor determining the long-term performance

of the Plan.

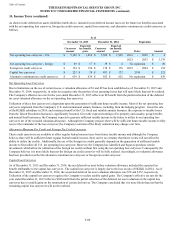

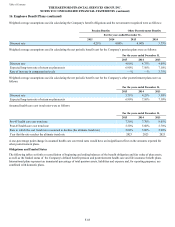

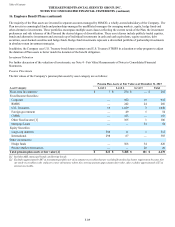

The Company’s pension plan and other postretirement benefit plans’ target allocation by asset category is presented in the table below.

Target Asset Allocation

Pension Plans Other Postretirement Plans

(minimum) (maximum) (minimum) (maximum)

Equity securities 5% 20% 15% 45%

Fixed income securities 50% 70% 55% 85%

Alternative assets 10% 45% —% —%

Divergent market performance among different asset classes may, from time to time, cause the asset allocation to deviate from the

desired asset allocation ranges. The asset allocation mix is reviewed on a periodic basis. If it is determined that an asset allocation mix

rebalancing is required, future portfolio additions and withdrawals will be used, as necessary, to bring the allocation within tactical

ranges.

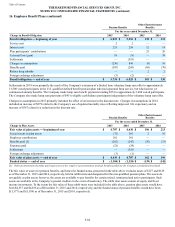

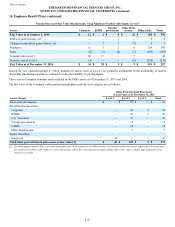

The Company’s pension plan and other postretirement benefit plans’ weighted average asset allocation is presented in the table below.

Pension Plans Other Postretirement Plans

Percentage of Assets Percentage of Assets

at Fair Value at Fair Value

As of December 31,

2015 2014 2015 2014

Equity securities 20 % 21 % 25 % 25 %

Fixed income securities 66 % 62 % 75 % 75 %

Alternative assets 14 % 17 % — % — %

Total 100% 100% 100% 100%