The Hartford 2015 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

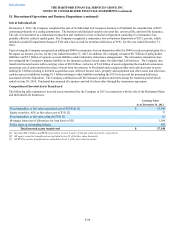

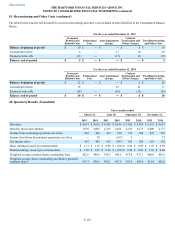

18. Discontinued Operations and Business Dispositions (continued)

F-99

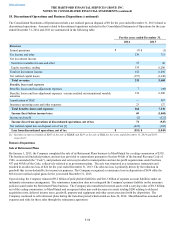

Sale of Individual Life

On January 2, 2013, the Company completed the sale of its Individual Life insurance business to Prudential for consideration of $615

consisting primarily of a ceding commission. The business sold included variable universal life, universal life, and term life insurance.

The sale was structured as a reinsurance transaction and resulted in a loss on business disposition consisting of a reinsurance loss

partially offset by realized capital gains. The Company recognized a reinsurance loss on business disposition of $533, pre-tax, which

included a goodwill impairment charge of $342 and a loss accrual for premium deficiency of $191, for the year ended December 31,

2012.

Upon closing the Company recognized an additional $940 in reinsurance loss on disposition offset by $940 in realized capital gains for a

$0 impact on income, pre-tax, for the year ended December 31, 2013. In addition, the Company reinsured $8.7 billion of policyholder

liabilities and $5.3 billion of separate account liabilities under indemnity reinsurance arrangements. The reinsurance transaction does

not extinguish the Company's primary liability on the insurance policies issued under the Individual Life business. The Company also

transferred invested assets with a carrying value of $8.0 billion, exclusive of $1.4 billion of assets supporting the modified coinsurance

agreement, net of cash transferred in place of short-term investments, to Prudential and recognized other non-cash decreases in assets

totaling $1.8 billion relating to deferred acquisition costs, deferred income taxes, property and equipment and other assets and other non-

cash decreases in liabilities totaling $1.5 billion relating to other liabilities including the $191 loss accrual for premium deficiency,

associated with the disposition. The Company continued to sell life insurance products and riders during the transition period which

ended on June 30, 2014. Prudential has assumed all expenses and risk for these sales through the reinsurance agreement.

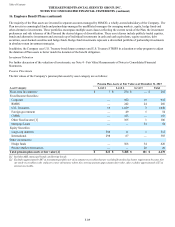

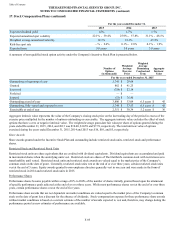

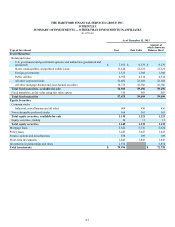

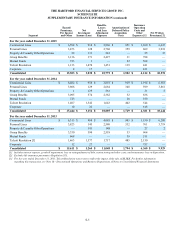

Composition of Invested Assets Transferred

The following table summarizes invested assets transferred by the Company in 2013 in connection with the sale of the Retirement Plans

and Individual Life businesses.

Carrying Value

As of December 31, 2012

Fixed maturities, at fair value (amortized cost of $13,916) [1] $ 15,349

Equity securities, AFS, at fair value (cost of $35) [2] 37

Fixed maturities, at fair value using the FVO [3] 16

Mortgage loans (net of allowances for loan losses of $1) 1,364

Policy loans, at outstanding balance 582

Total invested assets transferred $ 17,348

[1] Includes $14.7 billion and $670 of securities in level 2 and 3 of the fair value hierarchy, respectively.

[2] All equity securities transferred are included in level 2 of the fair value hierarchy.

[3] All FVO securities transferred are included in level 3 of the fair value hierarchy.