The Hartford 2015 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255

|

|

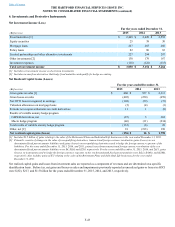

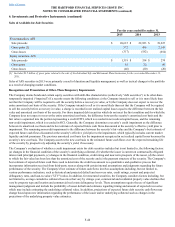

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Investments and Derivative Instruments (continued)

F-50

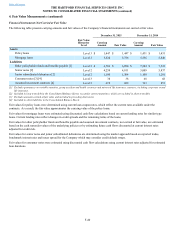

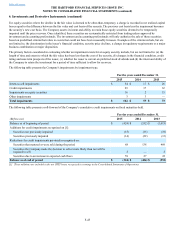

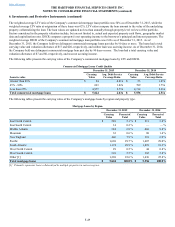

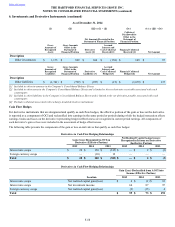

Mortgage Loans by Property Type

December 31, 2015 December 31, 2014

Carrying

Value Percent of

Total Carrying

Value Percent of

Total

Commercial

Agricultural $ 26 0.5 % $ 46 0.8 %

Industrial 1,422 25.3 % 1,476 26.6 %

Lodging 26 0.5 % 26 0.5 %

Multifamily 1,345 23.9 % 1,190 21.4 %

Office 1,547 27.5 % 1,517 27.3 %

Retail 1,109 19.7 % 1,147 20.6 %

Other 149 2.6 % 154 2.8 %

Total mortgage loans $ 5,624 100.0% $ 5,556 100.0%

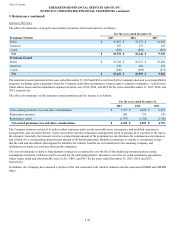

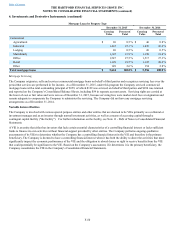

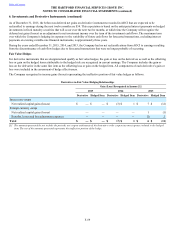

Mortgage Servicing

The Company originates, sells and services commercial mortgage loans on behalf of third parties and recognizes servicing fees over the

period that services are performed in fee income. As of December 31, 2015, under this program the Company serviced commercial

mortgage loans with a total outstanding principal of $359, of which $129 was serviced on behalf of third parties and $230 was retained

and reported on the Company’s Consolidated Balance Sheets, including $54 in separate account assets. Servicing rights are carried at

the lower of cost or fair value and were zero as of December 31, 2015, because servicing fees were market-level fees at origination and

remain adequate to compensate the Company to administer the servicing. The Company did not have any mortgage servicing

arrangements as of December 31, 2014.

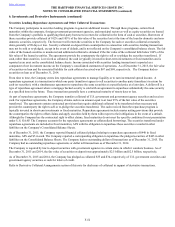

Variable Interest Entities

The Company is involved with various special purpose entities and other entities that are deemed to be VIEs primarily as a collateral or

investment manager and as an investor through normal investment activities, as well as a means of accessing capital through a

contingent capital facility ("the facility"). For further information on the facility, see Note 11 - Debt of Notes to Consolidated Financial

Statements.

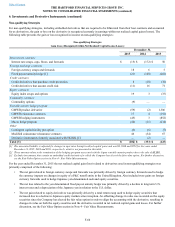

A VIE is an entity that either has investors that lack certain essential characteristics of a controlling financial interest or lacks sufficient

funds to finance its own activities without financial support provided by other entities. The Company performs ongoing qualitative

assessments of its VIEs to determine whether the Company has a controlling financial interest in the VIE and therefore is the primary

beneficiary. The Company is deemed to have a controlling financial interest when it has both the ability to direct the activities that most

significantly impact the economic performance of the VIE and the obligation to absorb losses or right to receive benefits from the VIE

that could potentially be significant to the VIE. Based on the Company’s assessment, if it determines it is the primary beneficiary, the

Company consolidates the VIE in the Company’s Consolidated Financial Statements.