The Hartford 2015 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

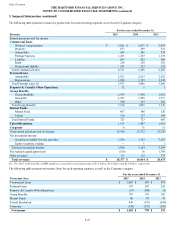

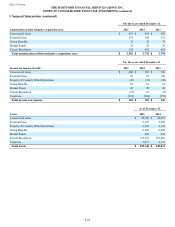

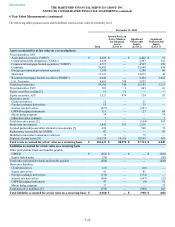

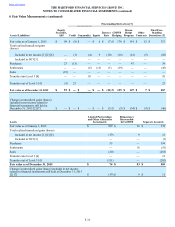

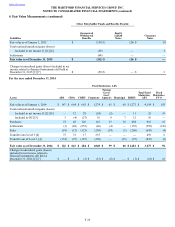

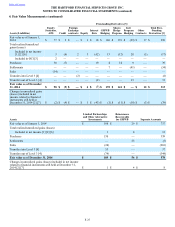

4. Fair Value Measurements (continued)

F-31

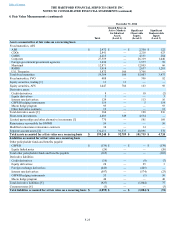

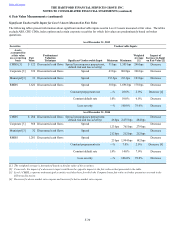

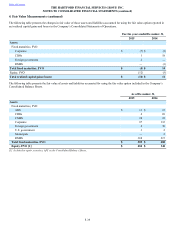

As of December 31, 2015

Freestanding Derivatives Unobservable Inputs

Fair

Value Predominant Valuation

Technique Significant

Unobservable Input Minimum Maximum

Impact of

Increase in In

put on Fair

Value [1]

Interest rate derivative

Interest rate swaps (30) Discounted cash flows Swap curve beyond 30 years 3% 3% Decrease

Interest rate swaptions [2] 8 Option model Interest rate volatility 1% 2% Increase

GMWB hedging instruments

Equity variance swaps (31) Option model Equity volatility 19% 21% Increase

Equity options 35 Option model Equity volatility 27% 29% Increase

Customized swaps 131 Discounted cash flows Equity volatility 10% 40% Increase

Macro hedge program [3]

Equity options 179 Option model Equity volatility 14% 28% Increase

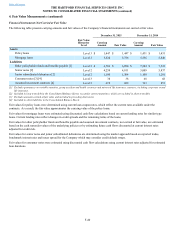

As of December 31, 2014

Interest rate derivative

Interest rate swaps (29) Discounted cash flows Swap curve beyond 30 years 3% 3% Decrease

Interest rate swaptions 22 Option model Interest rate volatility 1% 1% Increase

GMWB hedging instruments

Equity options 46 Option model Equity volatility 22% 34% Increase

Customized swaps 124 Discounted cash flows Equity volatility 10% 40% Increase

Macro hedge program

Equity options 141 Option model Equity volatility 27% 28% Increase

[1] Conversely, the impact of a decrease in input would have the opposite impact to the fair value as that presented in the table. Changes are based on

long positions, unless otherwise noted. Changes in fair value will be inversely impacted for short positions.

[2] The swaptions presented are purchased options that have the right to enter into a pay-fixed swap.

[3] Level 3 macro hedge derivatives excludes those for which the Company bases fair value on broker quotations as noted in the following discussion.

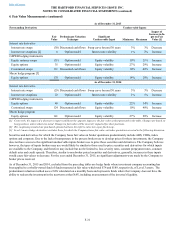

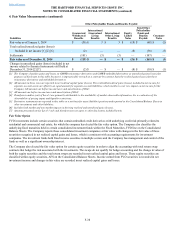

Securities and derivatives for which the Company bases fair value on broker quotations predominately include ABS, CDOs, index

options and corporate. Due to the lack of transparency in the process brokers use to develop prices for these investments, the Company

does not have access to the significant unobservable inputs brokers use to price these securities and derivatives. The Company believes

however, the types of inputs brokers may use would likely be similar to those used to price securities and derivatives for which inputs

are available to the Company, and therefore may include but not be limited to, loss severity rates, constant prepayment rates, constant

default rates and credit spreads. Therefore, similar to non broker priced securities and derivatives, generally, increases in these inputs

would cause fair values to decrease. For the year ended December 31, 2015, no significant adjustments were made by the Company to

broker prices received.

As of December 31, 2015 and 2014, excluded from the preceding tables are hedge funds where investment company accounting has

been applied to a wholly-owned fund of funds measured at fair value which total $74 and $189, respectively, of Level 3 assets. The

predominant valuation method uses a NAV calculated on a monthly basis and represents funds where the Company does not have the

ability to redeem the investment in the near-term at that NAV, including an assessment of the investee's liquidity.