The Hartford 2015 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

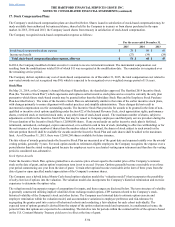

17. Stock Compensation Plans (continued)

F-95

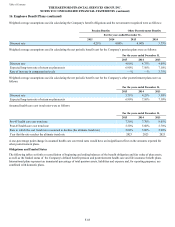

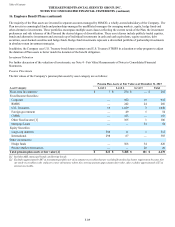

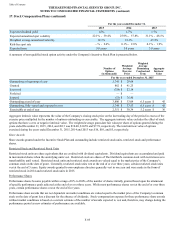

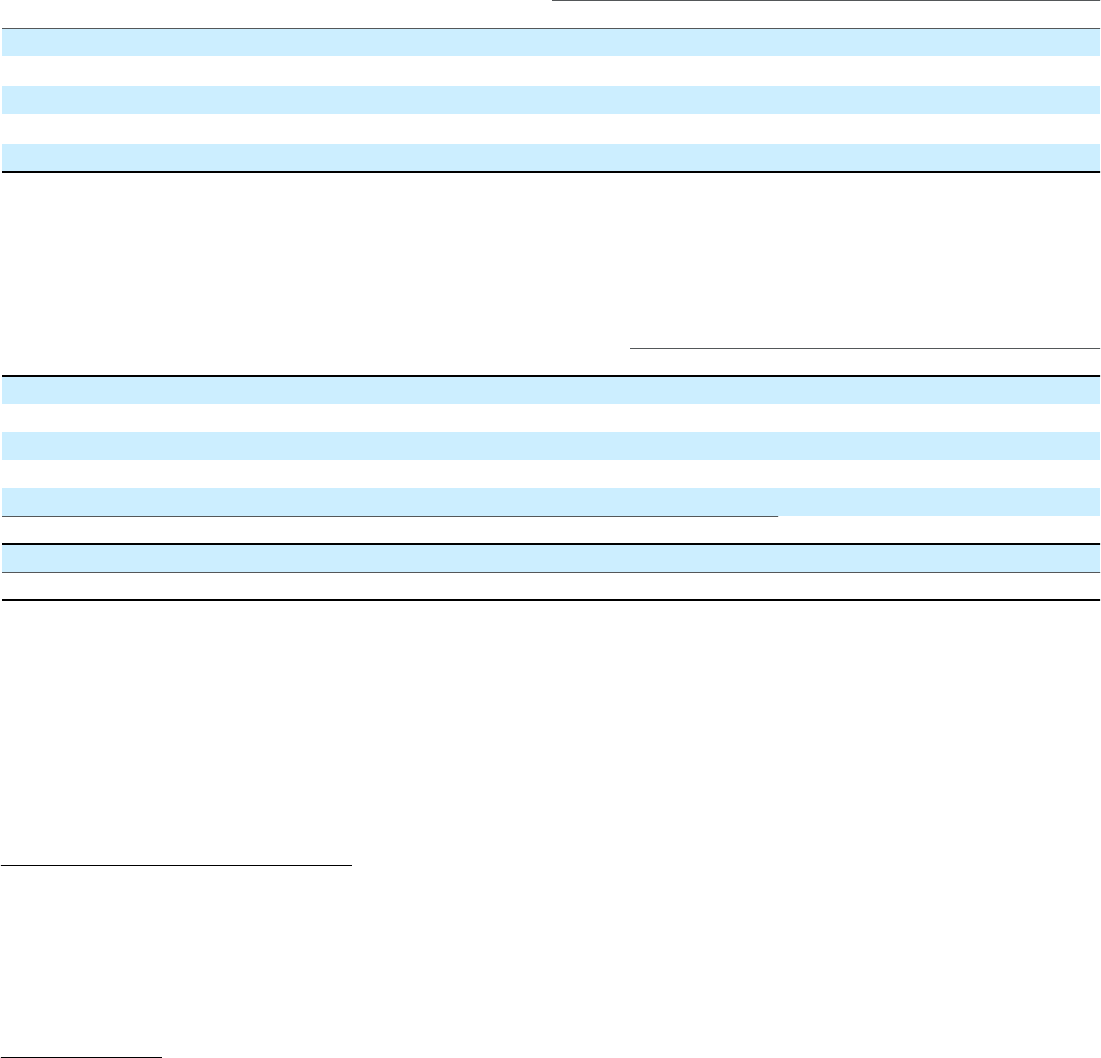

For the years ended December 31,

2015 2014 2013

Expected dividend yield 1.8% 1.7% 1.7%

Expected annualized spot volatility 22.1% - 39.4% 25.9% - 57.8% 31.1% - 48.1%

Weighted average annualized volatility 32.7% 35.1% 47.3%

Risk-free spot rate —% - 2.6% 0.1% - 2.8% 0.1% - 1.9%

Expected term 5.0 years 5.0 years 5.0 years

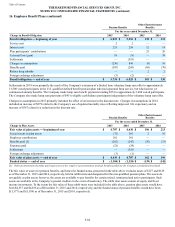

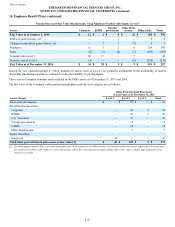

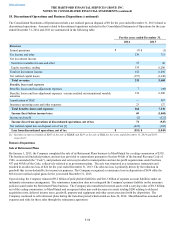

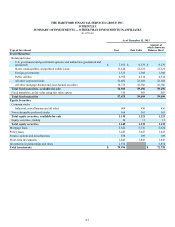

A summary of non-qualified stock option activity under the Company’s Incentive Stock Plan is presented below.

Number of

Options

(in thousands)

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

For the year ended December 31, 2015

Outstanding at beginning of year 3,745 $ 29.64

Granted 862 $ 41.25

Exercised (754) $ 22.18

Forfeited — $ —

Expired (53) $ 76.80

Outstanding at end of year 3,800 $ 33.09 6.5 years $ 45

Outstanding, fully vested and expected to vest 3,749 $ 33.53 6.5 years $ 42

Exercisable at end of year 2,351 $ 30.34 5.2 years $ 36

Aggregate intrinsic value represents the value of the Company's closing stock price on the last trading day of the period in excess of the

exercise price multiplied by the number of options outstanding or exercisable. The aggregate intrinsic value excludes the effect of stock

options that have a zero or negative intrinsic value. The weighted average grant-date fair value per share of options granted during the

years ended December 31, 2015, 2014, and 2013 was $10.60, $10.59 and $7.78, respectively. The total intrinsic value of options

exercised during the years ended December 31, 2015, 2014 and 2013 was $16, $10, and $5, respectively.

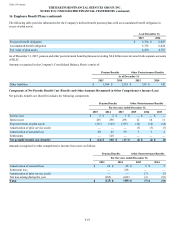

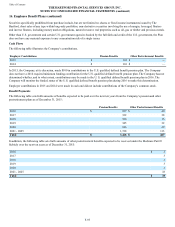

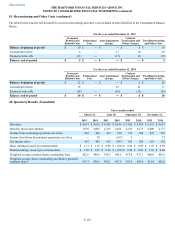

Share Awards

Share awards granted under the Incentive Stock Plan and outstanding include restricted stock units, restricted stock and performance

shares.

Restricted Stock and Restricted Stock Units

Restricted stock units are share equivalents that are credited with dividend equivalents. Dividend equivalents are accumulated and paid

in incremental shares when the underlying units vest. Restricted stock are shares of The Hartford's common stock with restrictions as to

transferability until vested. Restricted stock units and restricted stock awards are valued equal to the market price of the Company’s

common stock on the date of grant. Generally, restricted stock units vest at the end of or over three years; certain restricted stock units

vest at the end of 5 years. Equity awards granted to non-employee directors generally vest in one year and were made in the form of

restricted stock in 2014 and restricted stock units in 2015.

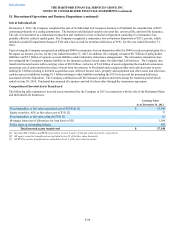

Performance Shares

Performance shares become payable within a range of 0% to 200% of the number of shares initially granted based upon the attainment

of specific performance goals achieved at the end of or over three years. While most performance shares vest at the end of or over three

years, certain performance shares vest at the end of five years.

Performance share awards that are not dependent on market conditions are valued equal to the market price of the Company's common

stock on the date of grant less a discount for the absence of dividends. Stock-compensation expense for these performance share awards

without market conditions is based on a current estimate of the number of awards expected to vest and, therefore, may change during the

performance period as new estimates of performance are available.