Starwood 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

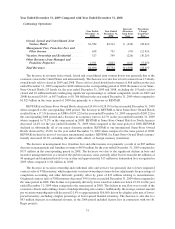

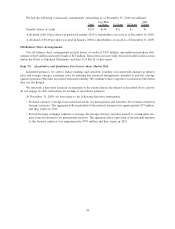

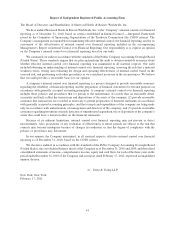

Year Ended December 31, 2009 Compared with Year Ended December 31, 2008

Continuing Operations

Year Ended

December 31,

2009

Year Ended

December 31,

2008

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Owned, Leased and Consolidated Joint

Venture Hotels...................... $1,584 $2,212 $ (628) (28.4)%

Management Fees, Franchise Fees and

Other Income ...................... 658 751 (93) (12.4)%

Vacation Ownership and Residential ....... 523 749 (226) (30.2)%

Other Revenues from Managed and

Franchise Properties ................. 1,931 2,042 (111) (5.4)%

Total Revenues ....................... $4,696 $5,754 $(1,058) (18.4)%

The decrease in revenues from owned, leased and consolidated joint venture hotels was primarily due to the

economic crisis in the United States and internationally. The decrease was also due to lost revenues from 15 wholly

owned hotels sold or closed in 2009 and 2008. These sold or closed hotels had revenues of $68 million in the year

ended December 31, 2009 compared to $248 million in the corresponding period of 2008. Revenues at our Same-

Store Owned Hotels (53 hotels for the year ended December 31, 2009 and 2008, excluding the 15 hotels sold or

closed and 10 additional hotels undergoing significant repositionings or without comparable results in 2009 and

2008) decreased 24.0%, or $437 million, to $1.386 billion for the year ended December 31, 2009 when compared to

$1.823 billion in the same period of 2008 due primarily to a decrease in REVPAR.

REVPAR at our Same-Store Owned Hotels decreased 24.6% to $128.95 for the year ended December 31, 2009

when compared to the corresponding 2008 period. The decrease in REVPAR at these Same-Store Owned Hotels

resulted from a 17.1% decrease in ADR to $199.22 for the year ended December 31, 2009 compared to $240.23 for

the corresponding 2008 period and a decrease in occupancy rates to 64.7% in the year ended December 31, 2009

when compared to 71.2% in the same period in 2008. REVPAR at Same-Store Owned Hotels in North America

decreased 24.4% for the year ended December 31, 2009 when compared to the same period of 2008. REVPAR

declined in substantially all of our major domestic markets. REVPAR at our international Same-Store Owned

Hotels decreased by 25.0% for the year ended December 31, 2009 when compared to the same period of 2008.

REVPAR declined in most of our major international markets. REVPAR for Same-Store Owned Hotels interna-

tionally decreased 20.3% excluding the unfavorable effects of foreign currency translation.

The decrease in management fees, franchise fees and other income was primarily a result of an $87 million

decrease in management and franchise revenue to $630 million for the year ended December 31, 2009 compared to

$717 million in the corresponding period in 2008. The decrease was due to the significant decline in base and

incentive management fees as a result of the global economic crisis, partially offset by fees from the net addition of

40 managed and franchised hotels to our system and approximately $15 million in termination fees recognized in

2009 when compared to $4 million in 2008.

The decrease in vacation ownership and residential sales and services was primarily due to lower originated

contract sales of VOI inventory, which represents vacation ownership revenues before adjustments for percentage of

completion accounting and other deferrals, partially offset by gains of $23 million relating to securitizations.

Originated contract sales of VOI inventory decreased 39% for the year ended December 31, 2009 when compared to

the same period in 2008. This decline was primarily driven by lower tour flow which was down 19.2% for the year

ended December 31, 2009 when compared to the same period in 2008. The decline in tour flow was a result of the

economic climate and resulting closure of underperforming sales centers. Additionally, the average contract amount

per vacation ownership unit sold decreased 21.4% to approximately $16,000, driven by a higher sales mix of lower-

priced inventory, including a higher percentage of lower-priced biennial inventory. The decrease is also due to a

$43 million decrease in residential revenue, as the 2008 period included license fees in connection with two St.

Regis projects.

31