Starwood 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

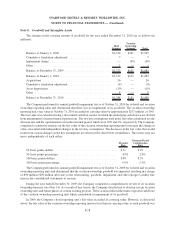

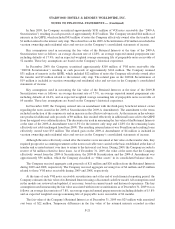

Note 8. Goodwill and Intangible Assets

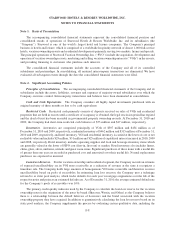

The changes in the carrying amount of goodwill for the year ended December 31, 2010 are as follows (in

millions):

Hotel

Segment

Vacation

Ownership

Segment Total

Balance at January 1, 2009 ............................... $1,324 $241 $1,565

Cumulative translation adjustment .......................... 7 — 7

Impairment charge ..................................... — (90) (90)

Other ............................................... 1 — 1

Balance at December 31, 2009 ............................ $1,332 $151 $1,483

Balance at January 1, 2010 ............................... $1,332 $151 $1,483

Acquisitions .......................................... 26 — 26

Cumulative translation adjustment .......................... (8) — (8)

Asset dispositions ...................................... (10) — (10)

Other ............................................... 8 — 8

Balance at December 31, 2010 ............................ $1,348 $151 $1,499

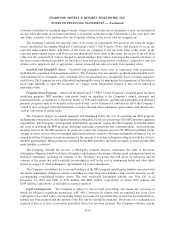

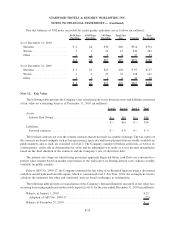

The Company performed its annual goodwill impairment test as of October 31, 2010 for its hotel and vacation

ownership reporting units and determined that there was no impairment of its goodwill. The vacation ownership

reporting unit’s fair value at October 31, 2010 exceeded its carrying value by approximately $237 million, or 30%.

The fair value was calculated using a discounted cash flow model, in which the underlying cash flows were derived

from management’s current financial projections. The two key assumptions used in the fair value calculation are the

discount rate and the capitalization rate in the terminal period, which were 10% and 2%, respectively. The Company

completed a sensitivity analysis on the fair value of the vacation ownership reporting unit to measure the change in

value associated with independent changes in the two key assumptions. The decreases in the fair value that would

result from various changes in the key assumptions are shown in the chart below (in millions). The factors may not

move independently of each either.

Discount

Rate

Terminal Period

Capitalization

Rate

50 basis points-dollars ....................................... $51 $29

50 basis points-percentage .................................... 4.9% 2.8%

100 basis points-dollars ...................................... $98 $55

100 basis points-percentage ................................... 9.5% 5.3%

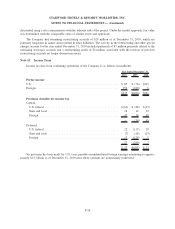

The Company performed its annual goodwill impairment test as of October 31, 2009 for its hotel and vacation

ownership reporting units and determined that the vacation ownership goodwill was impaired, resulting in a charge

of $90 million ($90 million after-tax) to the restructuring, goodwill, impairment and other charges (credits) line

item in the consolidated statements of income.

During the year ended December 31, 2009, the Company completed a comprehensive review of its vacation

ownership business (see Note 14). As a result of this review, the Company decided not to develop certain vacation

ownership sites and future phases of certain existing projects. These actions reduced the future expected cash flows

of the vacation ownership reporting unit which contributed to impairment of its goodwill.

In 2009, the Company’s hotel reporting unit’s fair value exceeded its carrying value. However, as discussed

above, the fair value of the vacation ownership reporting unit was less than its carrying value, as such goodwill was

F-18

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)