Starwood 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

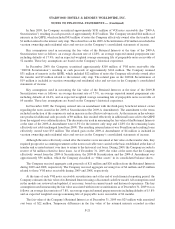

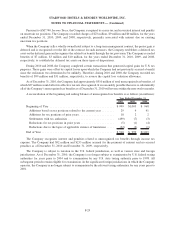

deemed to be impaired, and step two of goodwill impairment test was performed. This step resulted in an implied

goodwill fair value of $151 million compared to an actual goodwill balance of $241 million, with the difference of

$90 million representing the impairment charge. In determining fair values associated with the goodwill impair-

ment steps, the Company primarily used the income and the market approaches. Under the income approach, fair

value was determined based on the estimated future cash flows of the reporting units taking into account

assumptions such as REVPAR, operating margins and sales pace of vacation ownership units and discounting

these cash flows using a discount rate commensurate with the risk inherent in the calculations. Under the market

approach, the fair value of the reporting units were determined based on market valuation techniques such as

comparable revenue and EBITDA multiples of similar companies in the hospitality industry. The vacation

ownership goodwill had not been previously impaired.

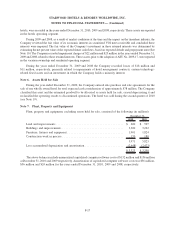

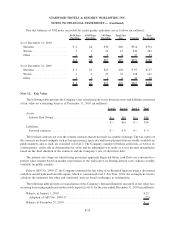

Intangible assets consisted of the following (in millions):

2010 2009

December 31,

Trademarks and trade names ......................................... $309 $309

Management and franchise agreements .................................. 377 376

Other . . . ....................................................... 78 76

764 761

Accumulated amortization ........................................... (196) (181)

$ 568 $ 580

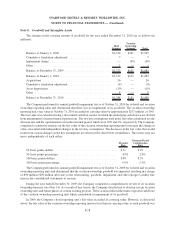

The intangible assets related to management and franchise agreements have finite lives, and accordingly, the

Company recorded amortization expense of $33 million, $35 million, and $32 million, respectively, during the

years ended December 31, 2010, 2009 and 2008. The other intangible assets noted above have indefinite lives.

Amortization expense relating to intangible assets with finite lives for each of the years ended December 31, is

expected to be as follows (in millions):

2011 . .................................................................. $32

2012 . .................................................................. $30

2013 . .................................................................. $30

2014 . .................................................................. $30

2015 . .................................................................. $29

Note 9. Other Assets

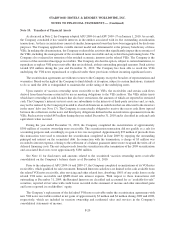

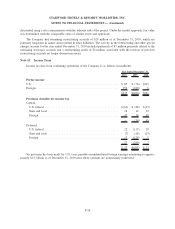

Other assets include the following (in millions):

2010 2009

December 31,

VOI notes receivable, net of allowance of $69 and $84 ....................... $132 $222

Prepaid taxes ...................................................... 88 103

Deposits and other .................................................. 161 113

Total ............................................................ $381 $438

See Note 11 for discussion relating to VOI notes receivable.

F-19

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)