Starwood 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

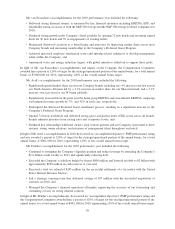

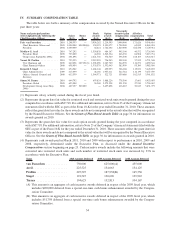

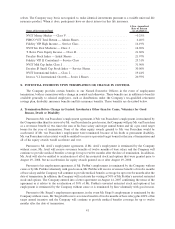

V. GRANTS OF PLAN-BASED AWARDS

The table below sets forth a summary of the grants of plan-based incentive awards to the Named Executive

Officers made during 2010:

Name

(listed alphabetically

by name following the

Chief Executive

Officer) (a)

Grant

date (or

year with

respect to

non-equity

incentive plan

award) (b)(1)

Compensation

Committee

Approval

date

(c)(1)

Threshold

($)(d)

Target

($)(e)

Maximum

($)(f)

All Other

Stock

Awards:

Number of

Shares of

Stock or

Units

(#)(g)

All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#)(h)(3)

Exercise

or Base

Price of

Option

Awards

($/Sh)(i)(4)

Grant Date

Fair Value

of Stock

and Option

Awards

($)(j)(5)

Estimated Future Payouts Under

Non-Equity Incentive Plan Awards(2)

van Paasschen. . . . . . 2/26/2010 2/11/2010 81,731 38.24 1,210,395

2/26/2010 2/11/2010 98,078(7) 3,750,012

3/01/2010 (6) 21,468(6) 831,241

2010 — 2,500,000 3,750,000

Avril . . . . . . . . . . . . 2/26/2010 2/11/2010 32,693 38.24 484,167

2/26/2010 2/11/2010 39,231(7) 1,499,997

3/01/2010 (6) 5,292(6) 204,906

2010 150,350 751,750 2,067,312

Prabhu . . . . . . . . . . 2/26/2010 2/11/2010 49,039 38.24 726,243

2/26/2010 2/11/2010 58,847(7) 2,250,015

3/01/2010 (6) 6,456(6) 249,976

2010 150,350 751,750 2,067,312

Siegel . . . . . . . . . . . 2/26/2010 2/11/2010 31,058 38.24 459,953

2/26/2010 2/11/2010 37,270(7) 1,425,018

3/01/2010 (6) 4,489(6) 173,814

2010 127,698 638,490 1,755,848

Turner . . . . . . . . . . 2/26/2010 2/11/2010 127,501 38.24 1,888,226

2/26/2010 2/11/2010 17,000(7) 649,995

3/01/2010 (6) 4,562(6) 176,641

2010 129,750 648,750 1,784,062

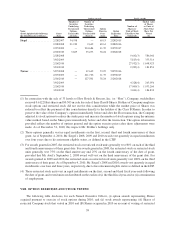

(1) Grant date differs from Compensation Committee approval date in accordance with the procedure outlined in

the discussion on page 32 under the heading Equity Grant Practices.

(2) Represents the potential values of the awards granted to the Named Executive Officers under the Executive Plan

if the threshold, target and maximum goals are satisfied for all applicable performance measures. See detailed

discussion of these awards in section VI. below.

(3) The options generally vest in equal installments on the first, second, third and fourth anniversary of their grant.

As of September 4, 2010, Mr. Siegel’s awards vest quarterly in equal installments over four years due to his

retirement eligible status, as defined in the LTIP.

(4) The exercise price was determined by using the average of the high and low price of Shares on the grant date.

(5) Represents the fair value of the awards disclosed in columns (g) and (h) on their respective grant dates. For

restricted stock and restricted stock units, fair value is calculated in accordance with ASC 718 using the average

of the high and low price of Shares on the grant date. For stock options, fair value is calculated in accordance

with ASC 718 using a lattice valuation model. For additional information, refer to Note 23 of the Company’s

financial statements filed with the SEC as part of the Form 10-K for the year ended December 31, 2010. There

can be no assurance that these amounts will correspond to the actual value that will be recognized by the Named

Executive Officers.

(6) On March 1, 2010, in accordance with the Executive Plan, 25% of Messrs. van Paasschen, Avril, Prabhu, Siegel

and Turner’s annual bonus with respect to 2009 performance was converted into restricted stock units and the

number of units was increased by 33%. The amount included in stock awards in the summary compensation

table only includes the 33% increase, as the deferral of the bonus amount is disclosed separately. These

restricted stock units vest in equal installments on the first, second and third fiscal year-ends following the date

of grant, and vested units are distributed on the earlier of (i) the third fiscal year-end or (ii) a termination of

employment. Dividends are paid to the Named Executive Officers in amounts equal to those paid to holders of

36