Starwood 2010 Annual Report Download - page 136

Download and view the complete annual report

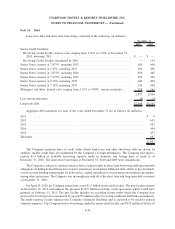

Please find page 136 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 10. Transfers of Financial Assets

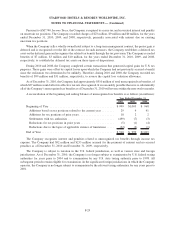

As discussed in Note 2, the Company adopted ASU 2009-16 and ASU 2009 -17 on January 1, 2010. As a result,

the Company concluded it has variable interests in the entities associated with its five outstanding securitization

transactions. As these securitizations consist of similar, homogenous loans they have been aggregated for disclosure

purposes. The Company applied the variable interest model and determined it is the primary beneficiary of these

VIEs. In making this determination, the Company evaluated the activities that significantly impact the economics of

the VIEs, including the management of the securitized notes receivable and any related non-performing loans. The

Company also evaluated its retention of the residual economic interests in the related VIEs. The Company is the

servicer of the securitized mortgage receivables. The Company also has the option, subject to certain limitations, to

repurchase or replace VOI notes receivable, that are in default, at their outstanding principal amounts. Such activity

totaled $38 million during the year end December 31, 2010. The Company has been able to resell the VOIs

underlying the VOI notes repurchased or replaced under these provisions without incurring significant losses.

The securitization agreements are without recourse to the Company, except for breaches of representations and

warranties. Based on the right of the Company to fund defaults at its option, subject to certain limitations, it intends

to do so until the debt is extinguished to maintain the credit rating of the underlying notes.

Upon transfer of vacation ownership notes receivable to the VIEs, the receivables and certain cash flows

derived from them become restricted for use in meeting obligations to the VIE creditors. The VIEs utilize trusts

which have ownership of cash balances that also have restrictions, the amounts of which are reported in restricted

cash. The Company’s interests in trust assets are subordinate to the interests of third-party investors and, as such,

may not be realized by the Company if needed to absorb deficiencies in cash flows that are allocated to the investors

in the trusts’ debt (see Note 17). The Company is contractually obligated to receive the excess cash flows (spread

between the collections on the notes and third party obligations defined in the securitization agreements) from the

VIEs. Such activity totaled $43 million during the year ended December 31, 2010 and is classified in cash and cash

equivalents when received.

During the year ended December 31, 2010, the Company completed the securitization of approximately

$300 million of vacation ownership notes receivable. The securitization transaction did not qualify as a sale for

accounting purposes and, accordingly, no gain or loss was recognized. Approximately $93 million of proceeds from

this transaction were used to terminate the securitization completed in June 2009 by repaying the outstanding

principal and interest on the securitized debt. In connection with the termination, a charge of $5 million was

recorded to interest expense, relating to the settlement of a balance guarantee interest rate swap and the write-off of

deferred financing costs. The net cash proceeds from the securitization after termination of the 2009 securitization

and associated deal costs were approximately $180 million.

See Note 11 for disclosures and amounts related to the securitized vacation ownership notes receivable

consolidated on the Company’s balance sheets as of December 31, 2010.

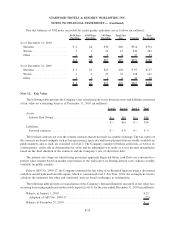

Prior to the adoption of ASU 2009-16 and 2009-17, the Company completed securitizations of its VOI notes

receivables, which qualified for sales treatment. Retained Interests cash flows are limited to the cash available from

the related VOI notes receivable, after servicing and other related fees, absorbing 100% of any credit losses on the

related VOI notes receivable and QSPE fixed rate interest expense. With respect to those transactions still

outstanding at December 31, 2009, the Retained Interests are classified and accounted for as “available-for-sale”

securities, reported at fair value with credit losses recorded in the statement of income and other unrealized gains

and losses reported in stockholders’ equity.

The Company’s replacement of the defaulted VOI notes receivable under the securitization agreements with

new VOI notes receivable resulted in net gains of approximately $3 million and $4 million during 2009 and 2008,

respectively, which are included in vacation ownership and residential sales and services in the Company’s

consolidated statements of income.

F-20

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)